Fundamental view:

The US dollar has rallied quite a bit against the Japanese yen during the trading week but it has given back about half of the gains. Dollar strength has been largely a function of rising US interest rates, the yield on the 10-year Treasury has gained about 40 basis points this year to 1.336% most of that in February. Anticipation of an additional consumer push for the US economy from a new stimulus package has also helped in the dollar strength though continuing difficulties in the labor market have been a restraint.

Japan Core Machinery Orders yearly report on 17th Feb and Japan CPI yearly report & CPI excl. Food and Energy yearly report on 19th Feb created downtrend atmosphere for the pair whereas Japan GDP quarterly report & GDP yearly report on 15th Feb and Japan Tertiary Industry Activity Index on 16th Feb created uptrend atmosphere for the pair.

The major economic events deciding the movement of the pair in the next week are Fed Chair Powell Testimony, US CB Consumer Confidence Index at Feb 23, BoJ Trimmed Mean Core CPI yearly report, Fed Chair Powell Testimony at Feb 24, Japan Retail Sales monthly report, US GDP quarterly report, US Core Durable Goods Orders monthly report, and US Initial Jobless Claims at Feb 25.

USD/JPY Weekly outlook:

Technical View:

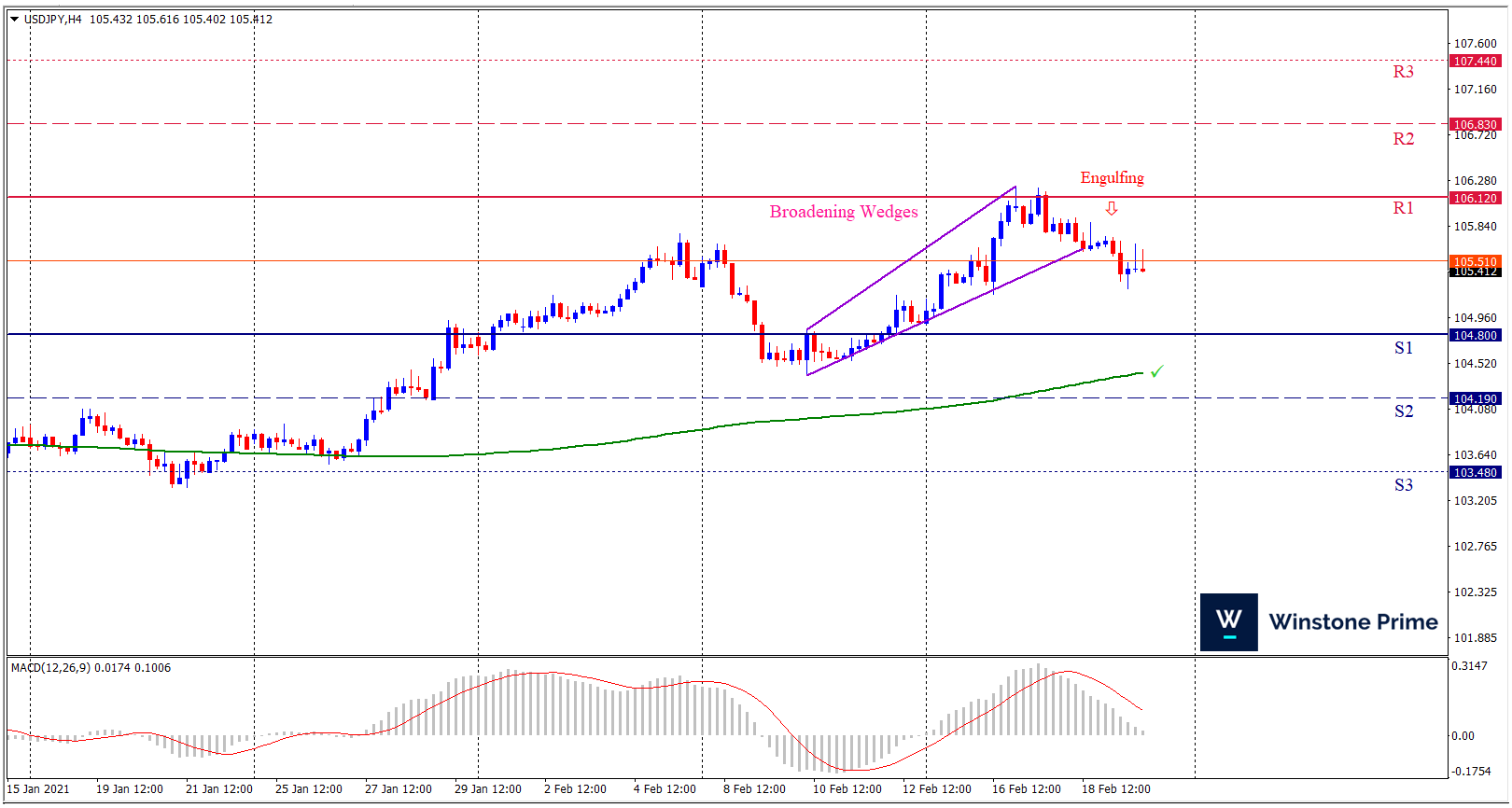

Last week’s high was 0.52% higher than the previous week. Maintaining high at 106.22 and low at 104.90 showed a movement of 132 pips.

In the upcoming week we expect USD/JPY to show a bearish trend. The currency pair is trading above the 200 Simple Moving Average and the MACD trades to the downside. A solid breakout below 104.80 may open a clean path towards 104.19 and may take a way down to 103.48. Should 106.12 prove to be unreliable resistance, the USDJPY may raise upwards 106.83 and 107.44 respectively. In H4 chart, Formation of broadening wedge pattern breakout downside indicates reversal of the trend creating prospects of a bearish trend Along with a bearish engulfing formation braces our expectation.

| Preference |

| Sell: 105.50 target at 104.25 and stop loss at 106.17 |

| Alternate Scenario |

| Buy: 106.17 target at 107.43 and stop loss at 105.50 |