Fundamental view:

The Euro edged higher this week, reaching a high of 1.1927. The unfavorable US employment report released yesterday was the main reason behind the broad dollar weakness. In the past week, Wall Street rallied to unexplored territory, while government bond yields remained subdued throughout the week, with the yield on the 10-year Treasury note losing the 1.70% level.

“We are not really looking at forecasts for this purpose, we are looking at actual progress” – Jerome Powell, Chair of the Federal Reserve, has said on the bank’s commitment to act only when the economy fully recovers. For the dollar, that has meant additional.

US EIA Crude Oil Stocks Change on 7th April and Europe Trade Balance & Europe Industrial Production yearly report on 9th April favored bearish trend for the pair whereas US ISM-NY Business Conditions Index & US Factory Orders monthly report on 5th April and Europe Consumer Confidence on 6th April favored bullish trend for the pair.

The major economic events deciding the movement of the pair in the next week are Europe Retail Sales monthly report at April 12, Europe ZEW Economic Sentiment Indicator, US CPI monthly report at April 13, US EIA Crude Oil Stocks Change, Fed Chair Powell Speech at April 14, US Retail Sales monthly report, US Initial Jobless Claims at April 15, Eurogroup Meeting and US Building Permits at April 16.

EUR/USD Weekly outlook:

Technical View:

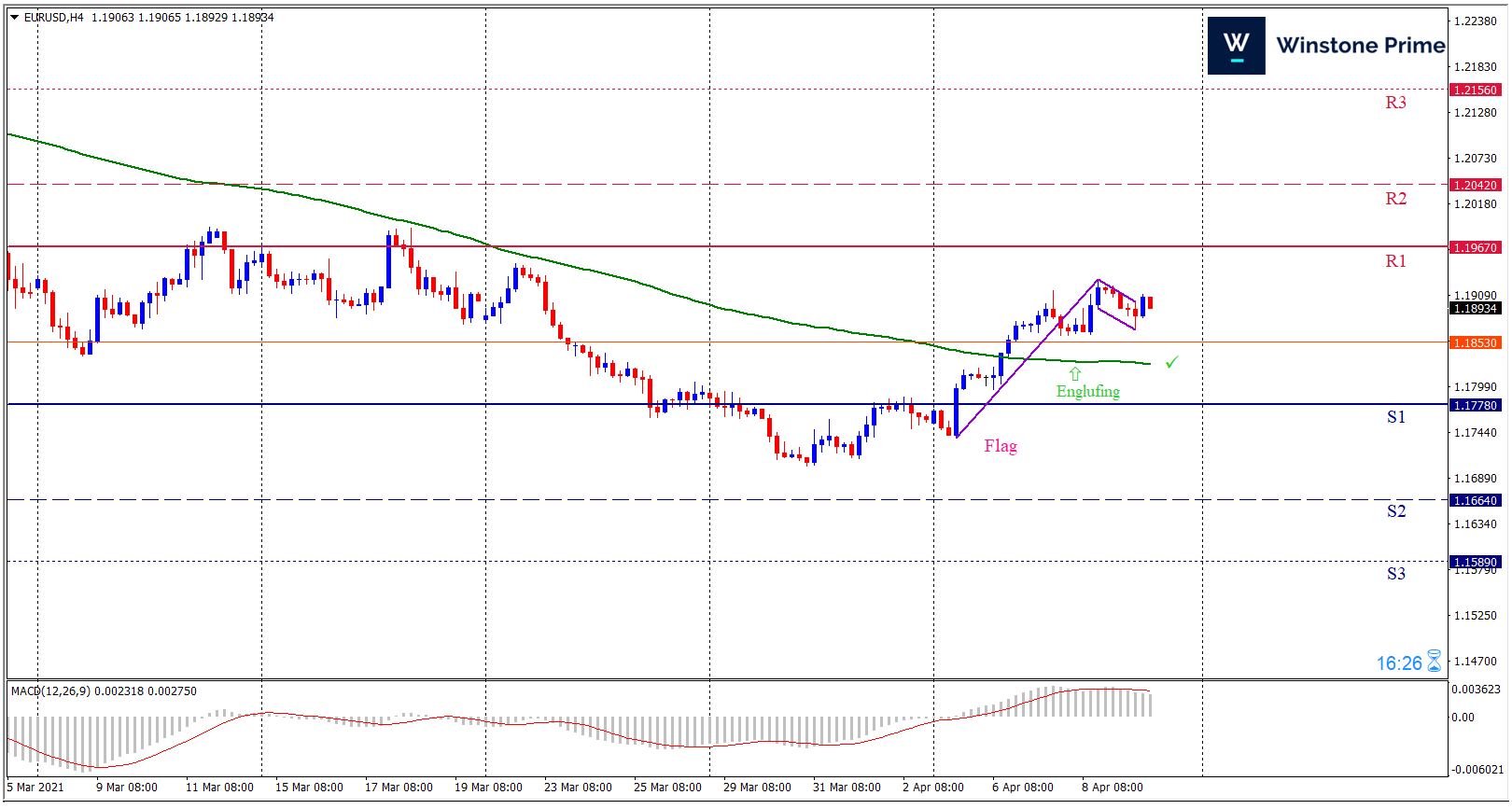

Last week’s high was 1.12% higher than the previous week. Maintaining high at 1.1927 and low at 1.1738 showed a movement of 189 pips.

In the upcoming week we expect EUR/USD to show a bullish trend. The currency pair is trading above the 100 Simple Moving Average and the MACD trades to the upside. A solid breakout above 1.1967 may open a clean path towards 1.2042 and may take a way up to 1.2156. Should 1.1778 prove to be unreliable support, the EURUSD may sink downwards 1.1664 and 1.1589 respectively. Chart formation of a bullish flag pattern in H4 chart sets prospects for a bullish trend. Engulfing formation in H4 chart escalates the expectation for a bullish trend.

| Preference |

| Buy: 1.1890 target at 1.2041 and stop loss at 1.1773 |

| Alternate Scenario |

| Sell: 1.1773 target at 1.1590 and stop loss at 1.1890 |