Fundamental view:

The Australian dollar has rallied significantly during the course of the week. The strength of Aussie is mainly due to the broad US dollar weakness and moderate recovery of Australian economy. US Federal Reserve chief Jerome Powell repeated that the central bank will maintain its ultra-loose monetary policy until actual data confirms an economic comeback. Australia will reopen its borders with New Zealand next week but will likely maintain the closure of other international borders, as coronavirus cases are on the rise outside the country. Prime Minister Scott Morrison said that it is not safe to reopen international borders, adding that even vaccinating the local population is not enough to grant lifting travel restrictions.

US Natural Gas Storage on 15th April and US Housing Starts on 16th April favored downtrend for the pair whereas US Federal Budget Balance on 12th April and Australia Employment Change & Unemployment Rate on 15th April favored uptrend for the pair.

The major economic events deciding the movement of the pair in the next week are RBA Meeting Minutes at April 20, Australia Retail Sales monthly report, US EIA Crude Oil Stocks Change at April 21, NAB Quarterly Business Confidence, US Initial Jobless Claims at April 22 and US Markit Manufacturing PMI at April 23.

AUD/USD Weekly outlook:

Technical View:

Last week’s high was 1.08% higher than the previous week. Maintaining high at 0.7761 and low at 0.7585 showed a movement of 176 pips.

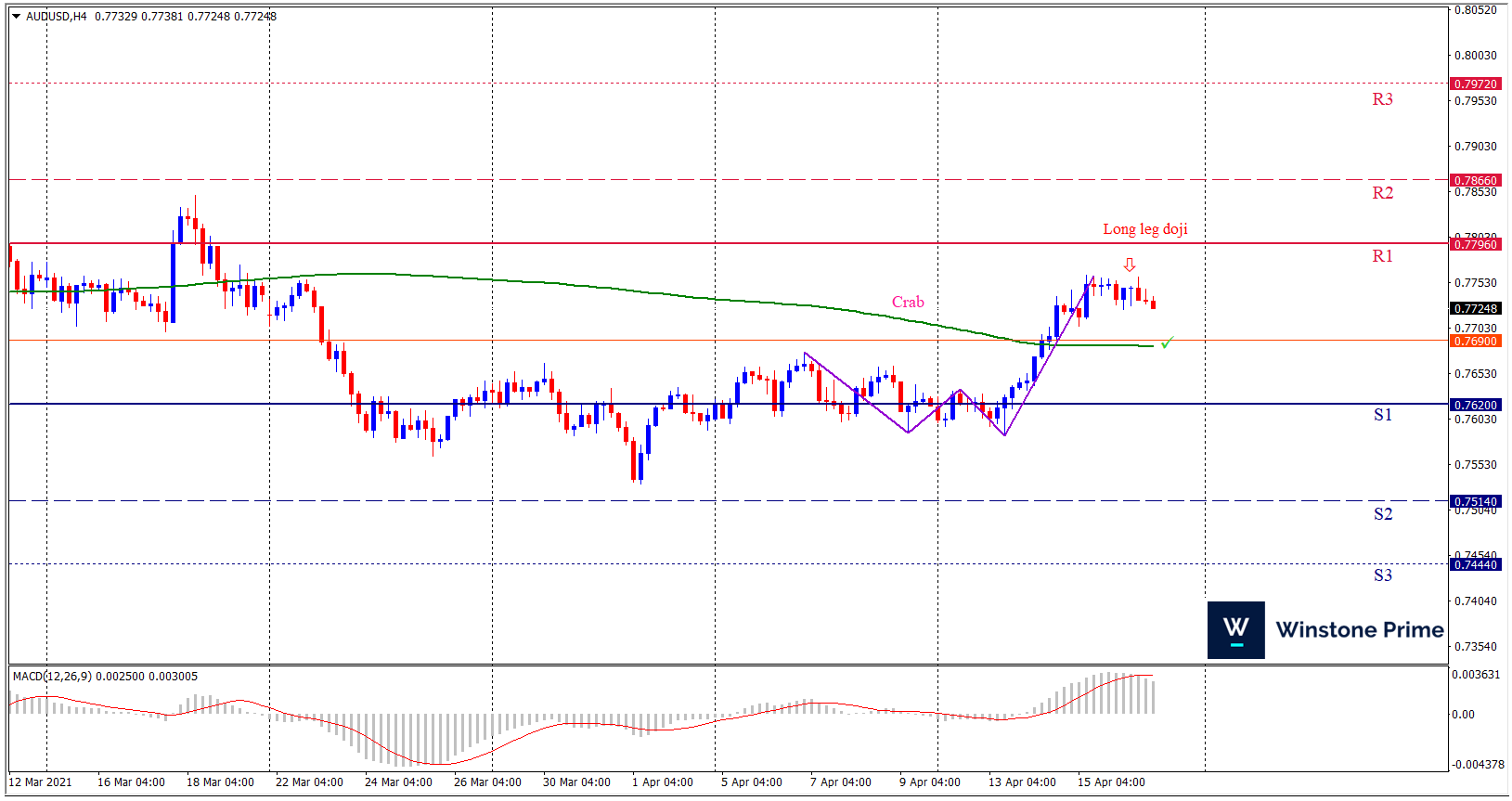

In the upcoming week we expect AUD/USD to show a bearish trend. The currency pair is trading above the 200 Simple Moving Average and the MACD trades to the upside. A solid breakout below 0.7620 may open a clean path towards 0.7514 and may take a way down to 0.7444. Should 0.7796 prove to be unreliable resistance, the AUDUSD may raise upwards 0.7866 and 0.7972 respectively. In H4 chart bearish crab breakout favors prospects of a bearish trend. Also to be noted long leg doji formation exerts the expectation of downtrend for the pair.

| Preference |

| Sell: 0.7725 target at 0.7538 and stop loss at 0.7802 |

| Alternate Scenario |

| Buy: 0.7802 target at 0.7971 and stop loss at 0.7725 |