The support and resistance level breakout trading system is a price action trading system; it is one of the simplest and easiest trading setups to spot and trade.

This support and resistance level breakout trading strategy is different from the horizontal support and resistance trading strategy in which you trade the bounce of the price on the support and resistance levels.

Support Level Breakout

A support level breakout is when a price breaks a support level and continues to head down, in a downtrend.

Hence when a support level is broken, it means the market is in a downtrend.

Resistance Level Breakout

A resistance level breakout is a price breaks a resistance level and continues to head up, in a uptrend.

Hence when a resistance level is broken, it means the market is said to be in an uptrend.

Timeframes : Preferable to use 1 Hr, but you can use small time frame also.

Instrument : you can trade any instrument

Trading Rules for the Support and Resistance Breakout :

Trading breakout is really simple. Remember Support breakout is for sell trades and Resistance breakout is for buy trades.

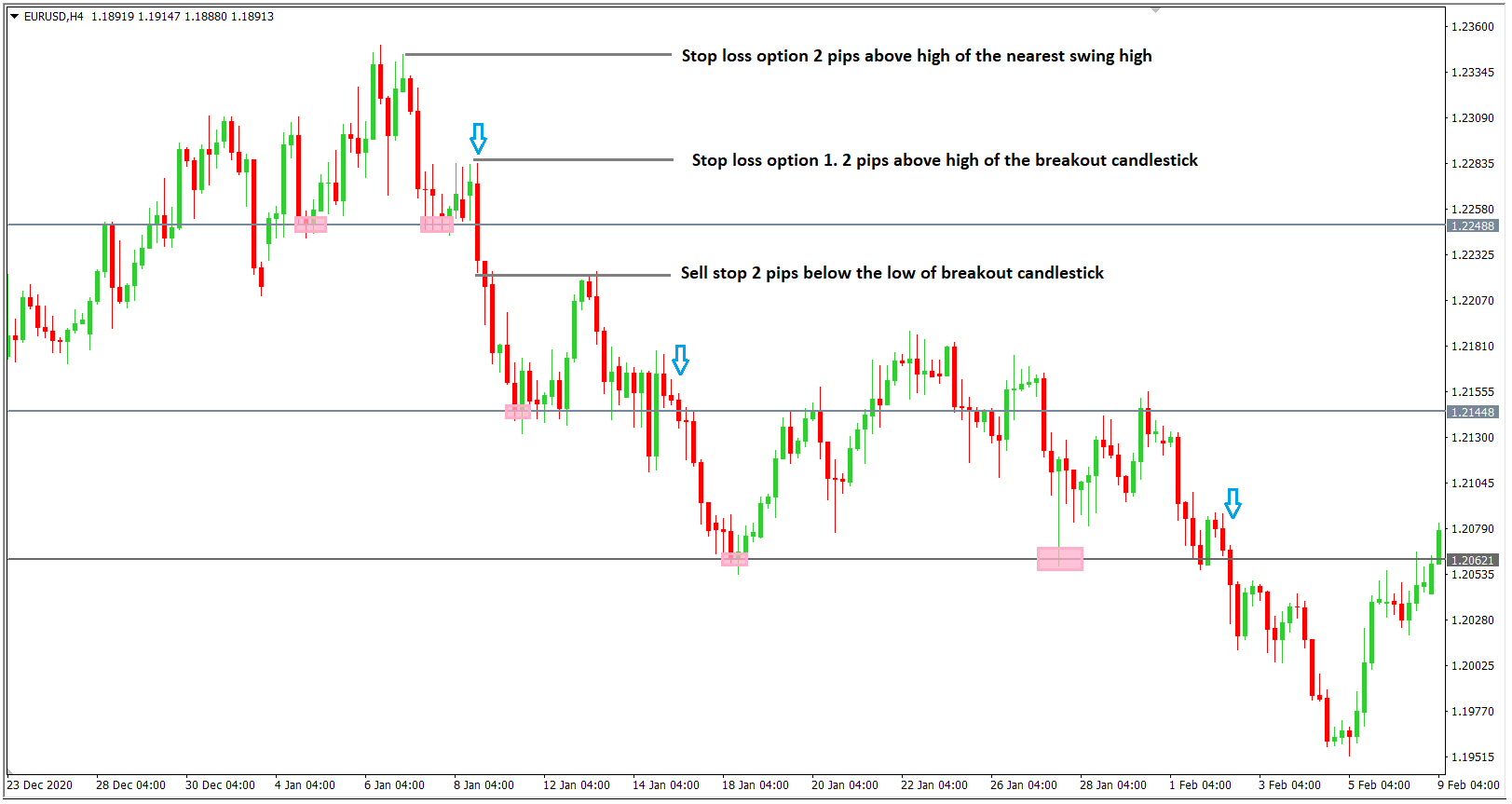

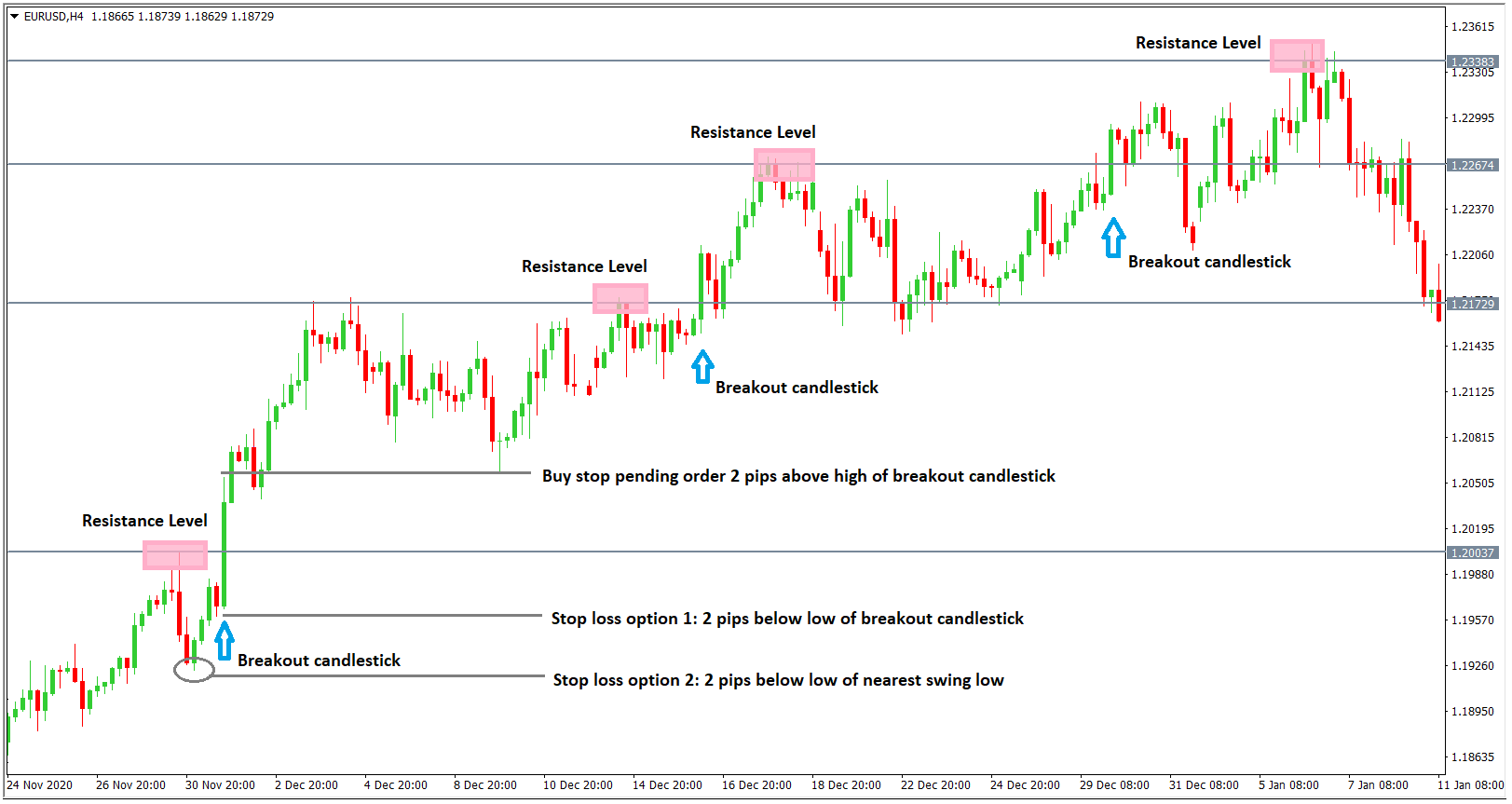

- The pink boxes represent support levels (image 1) and resistance levels (image 2).

- And the blue arrow indicates the candlestick that broke the support level (image 1) and resistance level (image2) and closed below/above it.

- Identify the support level /resistance level and you can draw a horizontal line if you wish to.

- For Support breakout, take note of the breakout candlestick when price comes down and touches that support level. The breakout candlestick is that closes below the support line after intersecting it.

- For resistance breakout, take note of the breakout candlestick when price head up and touches that resistance level. The breakout candle stick is that close above the resistance level after intersecting it.

- Then place a sell stop order 2 pips below the low of the breakout candlestick for support breakout or place a buy stop order 2 pips above the high of the breakout candlestick for resistance breakout.

- After that, place your stop loss 2 pips above/below the high/low of the breakout candlestick or just 2 pips above the high of the nearest swing high.

- Take profit should be atleast 2-3 times what you risked or you can make use of trailing stop technique to ride out the trend if you want.

Image 1: Support Breakout

Image 2 : Resistance Breakout

Additional Notes on stop loss placement:

- When you place stop loss 2 pips above/below the high/low of the breakout candlestick. The advantages will be tight stop loss and this may increase your risk:reward greatly when your trade goes well. But problem with this is that it may be close to the entry price level and you may get stopped out prematurely.

- Or when you place stop loss 2 pips above/below the high/low of the nearest swing high. The advantage is that you have less chance of getting stopped out from a trade prematurely. The big problem here is that sometimes, the stop loss distance to the nearest swing high will be large and this reduces your risk:reward ratio as well because price has to move a lot of distance in the direction of your trade before you even reach a 1:1 risk:reward ratio.

Pros :

- When a breakout trade is successful, there is a possibility of large gains. Getting in on a strong trend early can be a profitable situation.

- Usually Breakout trades present themselves during consolidating market phases. Initial stop losses may be relatively small according to the compressional pattern or price range being used for market entry. In addition, confirmation of a trade’s failure may come rapidly, offering an opportunity for a quick exit.

Cons :

- Optimal trade setups may not occur frequently. Searching for setups can often leave a trader on the sidelines instead of pursuing other opportunities.

- False breakouts are a considerable part of this approach. No matter how sound the methodology used in identifying a breakout is, quantifying market follow-through is largely subjective. In few instances, a signal may appear to be solid but end up lacking the increased participation needed to succeed.