Fundamental view:

The Australian dollar initially tried to rally during the week but it gave up gains to form bear candle in the end. Risk appetite has offset demand for the American dollar, despite the US economy is among those improving the most. Australia is not more behind behind, as the Q1 Gross Domestic Product was up 1.8% which is officially above pre-pandemic levels. The imbalance between the two economies comes from inflation. In Australia, the Consumer Price Index rose 1.1% in the first quarter of the year, from 0.9% in the previous one, way below the Reserve Bank of Australia desired 2-3%. In the US, inflation skyrocketed to 5% YoY in May, although there is a general sense that such a jump is temporal, in line with what Federal Reserve officials have said in the last couple of months.

However, inflationary pressures, employment recovery, and how they could affect central banks’ decision is the main theme.

Australia NAB Business Confidence on 8th June and Westpac-MI Consumer Sentiment monthly report on 9th June favored bearish trend for the pair whereas ANZ Job Advertisements monthly report on 7th June and Australia MI Inflation Expectations on 10th June favored bullish trend for the pair.

The major economic events deciding the movement of the pair in the next week are RBA Meeting Minutes, US Retail Sales monthly report, Fed Industrial Production yearly report at Jun 15, US EIA Crude Oil Stocks Change, Fed Interest Rate Decision at Jun 16, RBA Governor Lowe Speech, Australia Employment Change, US Philadelphia Fed Manufacturing Index and US Initial Jobless Claims at Jun 17.

AUD/USD Weekly outlook:

Technical View:

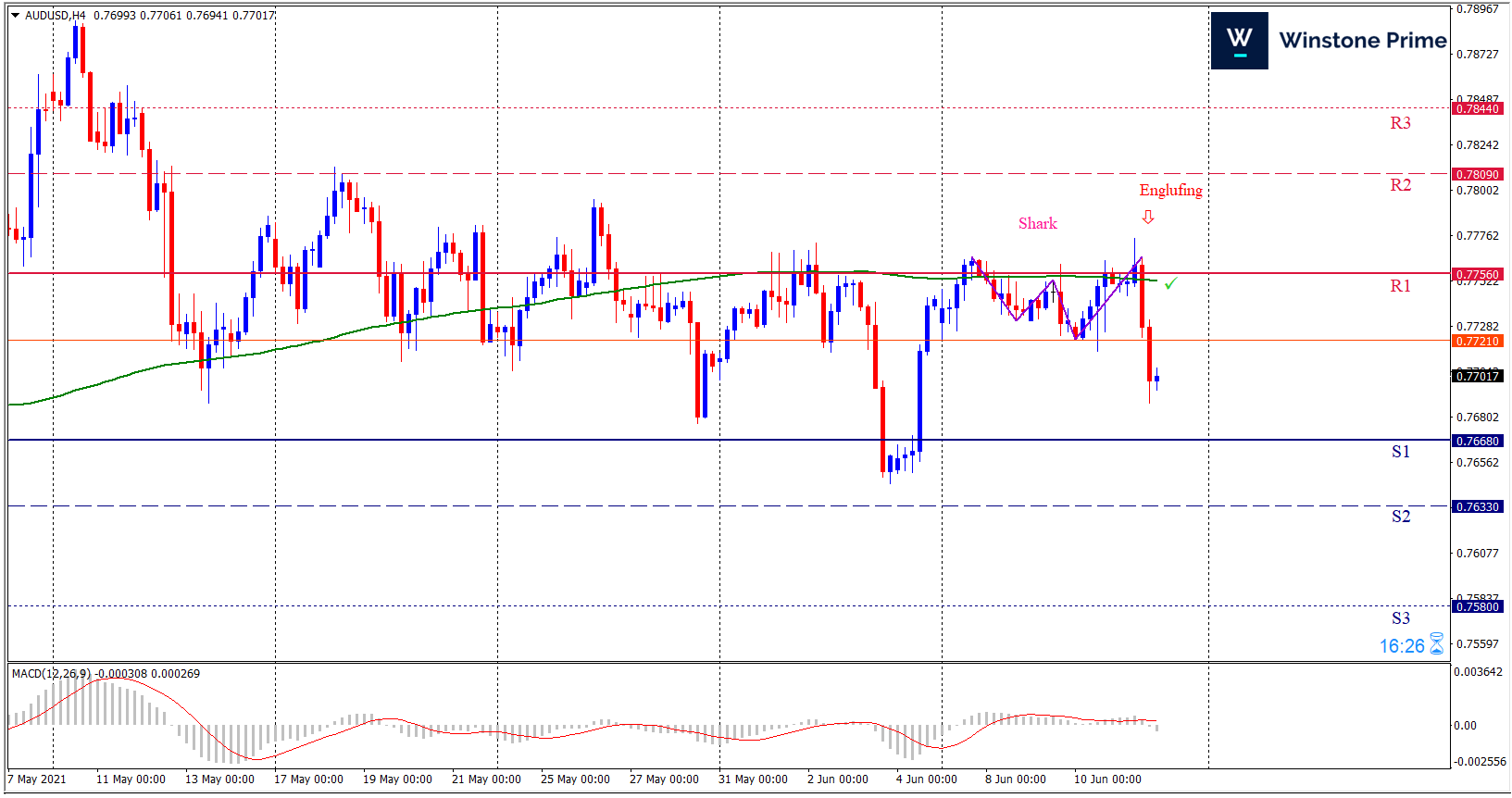

Last week’s high was 0.04% higher than the previous week. Maintaining high at 0.7775 and low at 0.7687 showed a movement of 88 pips.

In the upcoming week we expect AUD/USD to show a bearish trend. The currency pair is trading below the 200 Simple Moving Average and the MACD trades to the downside. A solid breakout below 0.7668 may open a clean path towards 0.7633 and may take a way down to 0.7580. Should 0.7756 prove to be unreliable resistance, the AUDUSD may raise upwards 0.7809 and 0.7844 respectively. In H4 chart bearish shark pattern formation favors prospects of a bearish trend. Also to be noted bearish engulfing formation exerts the expectation of downtrend for the pair.

| Preference |

| Sell: 0.7702 target at 0.7634 and stop loss at 0.7761 |

| Alternate Scenario |

| Buy: 0.7761 target at 0.7843 and stop loss at 0.7702 |