Fundamental view:

Australian dollar fell against the US dollar in this week. The Reserve Bank of Australia published the Minutes of its latest meeting, which portrayed that policymakers are compromised to maintain supportive monetary conditions, and repeated rates will remain at record lows until employment and inflation make a reach of the desired levels. Australian policymakers remained optimistic about the latest economic developments but are conscious that the latest lockdowns will delay monetary policy’s normalization. Elsewhere, The US Federal Reserve is having a monetary policy meeting on Wednesday, July 28, and it will focus will be on hints related to the future reduction of the current financial support which is the first step toward normalization.

US Building Permits monthly report on 20th July and Australia Retail Sales monthly report on 21st July created downtrend whereas US EIA Heating Oil Stocks Change on 21st July and US Initial Jobless Claims 4-Week Average on 22nd July created uptrend for the Pair.

The major economic events deciding the movement of the pair in the next week are RBA Deputy Governor Debelle Speech, US Core Durable Goods Orders monthly report, US CB Consumer Confidence Index at July 27, Fed Interest Rate Decision at July 28, US GDP quarterly report, US Initial Jobless Claims at July 29, Australia PPI quarterly report and US Michigan Consumer Sentiment at July 30.

AUD/USD Weekly outlook:

Technical View:

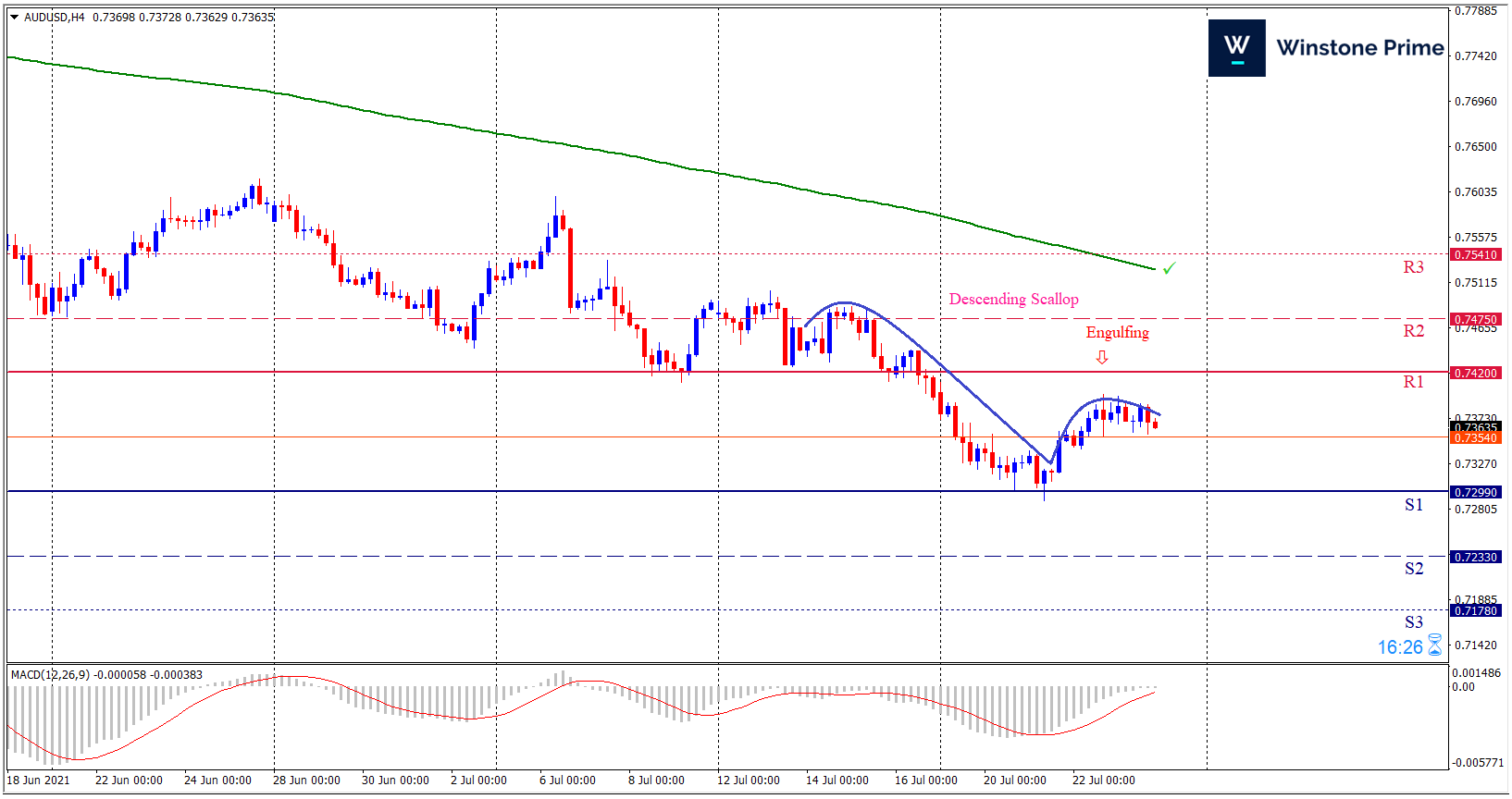

Last week’s high was 1.24% lower than the previous week. Maintaining high at 0.7410 and low at 0.7289 showed a movement of 121 pips.

In the upcoming week we expect AUD/USD to show a bearish trend. The currency pair is trading below the 200 Simple Moving Average and the MACD trades to the downside. A solid breakout below 0.7299 may open a clean path towards 0.7233 and may take a way down to 0.7178. Should 0.7420 prove to be unreliable resistance, the AUDUSD may raise upwards 0.7475 and 0.7541 respectively. In H4 chart descending scallop pattern favors prospects of a bearish trend. Also to be noted bearish engulfing formation exerts the expectation of downtrend for the pair.

| Preference |

| Sell: 0.7351 target at 0.7235 and stop loss at 0.7425 |

| Alternate Scenario |

| Buy: 0.7425 target at 0.7539 and stop loss at 0.7351 |