Fundamental view:

The Euro initially tried to rally during the course of the week but then fell at the end of the week. The greenback took a hit in the previous week from the US Federal Reserve, as chief Jerome Powell spoke. However, it does seem like the central bank is paving the way to announce the first stage toward normal. On Wednesday, Fed Vice Chairman Richard Clarida said that the central bank is likely to hit its economic targets by the end of 2021 and start raising rates again in 2023. The country added 943K new jobs in July, while the Unemployment rate contracted to 5.4%, the both data beat the market’s expectations.

Europe Retail Sales monthly report on 2nd August and Europe Unemployment Change on 3rd August created uptrend whereas Europe Markit Composite PMI on 4th August and US Nonfarm Payrolls on 6th August created downtrend for the pair.

The major economic events deciding the movement of the pair in the next week are US JOLTS Job Openings at Aug 09, Europe ZEW Economic Sentiment Indicator, US Nonfarm Productivity at Aug 10, Federal Budget Balance at Aug 11, Europe Industrial Production monthly report, US Initial Jobless Claims, US WASDE Report at Aug 12 and US Michigan Consumer Sentiment at Aug 13.

EUR/USD Weekly outlook:

Technical View:

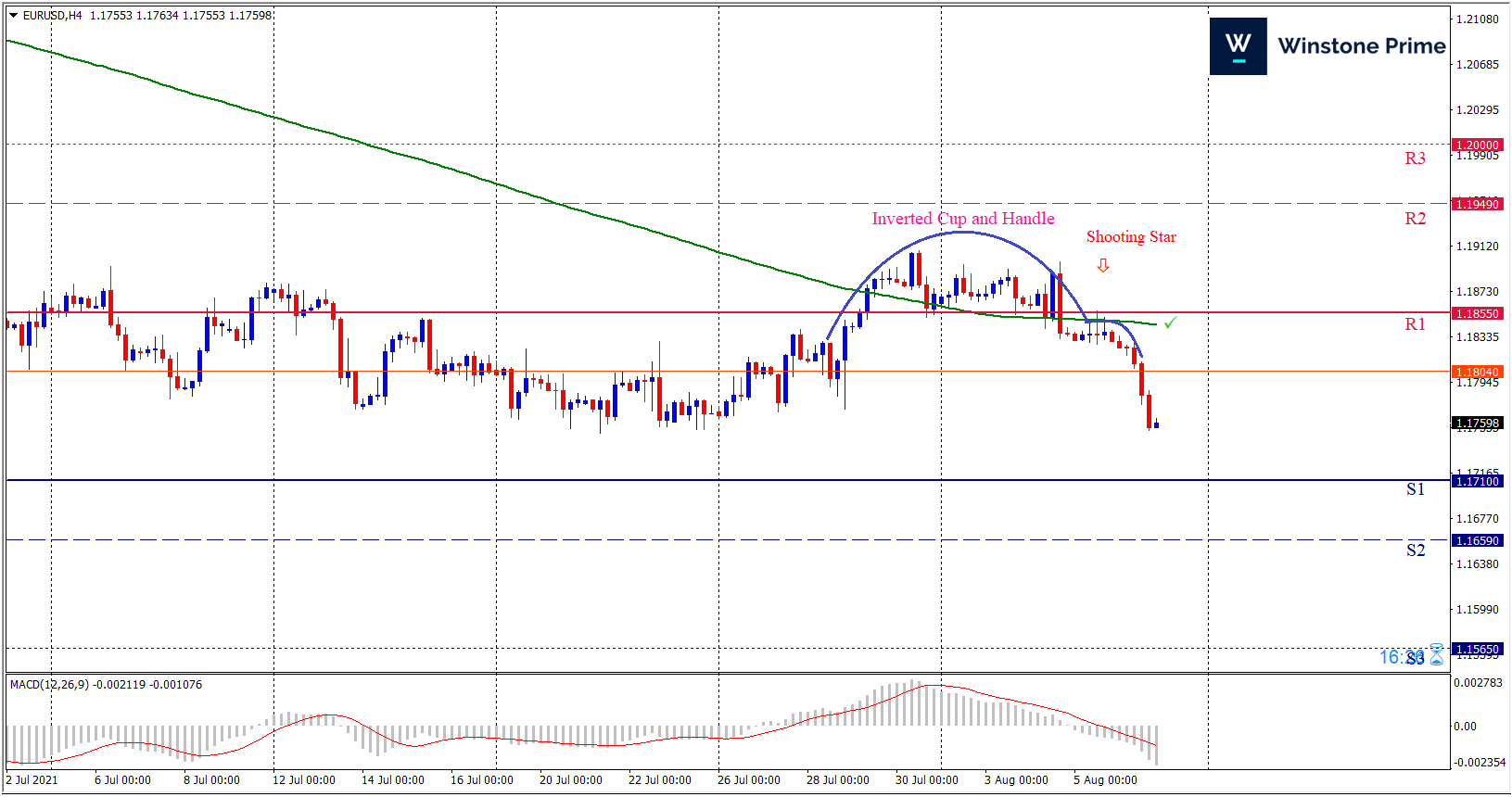

Last week’s high was 0.08% lower than the previous week. Maintaining high at 1.1899 and low at 1.1754 showed a movement of 145 pips.

In the upcoming week we expect EUR/USD to show a bearish trend. The currency pair is trading below the 200 Simple Moving Average and the MACD trades to the downside. A solid breakout below 1.1710 may open a clean path towards 1.1659 and may take a way down to 1.1565. Should 1.1855 prove to be unreliable resistance, the EURUSD may raise upwards 1.1949 and 1.2000 respectively. Chart formation of an inverted cup and handle pattern in H4 chart sets prospects for a bearish trend. Shooting star formation in H4 chart escalates the expectation for a bearish trend.

| Preference |

| Sell: 1.1761 target at 1.1660 and stop loss at 1.1809 |

| Alternate Scenario |

| Buy: 1.1809 target at 1.1948 and stop loss at 1.1761 |