Fundamental view:

The dollar traded higher against the Japanese yen this week because of the recent dollar strength as of its July 28 meeting. The rise in Covid-19 Delta cases in many of the states in US and across countries were the reason behind the dollar’s gains. The Fed begin its annual three-day Jackson Hole symposium on Thursday August 26. Though the pending taper has been a much conjectured topic, in view of the recent economic data. Whereas Japanese information was largely as expected without any signal of any change in the economy.

Japan GDP quarterly report on 16th August and Japan Adjusted Trade Balance on 18th August created downtrend whereas US Fed Manufacturing Production monthly report on 17th August and US Initial Jobless Claims on 19th August created uptrend for the pair.

The major economic events deciding the movement of the pair in the next week are Japan Markit Manufacturing PMI at Aug 23, BoJ Board Member Nakamura Speech, US Core Durable Goods Orders monthly report, US EIA Crude Oil Stocks Change at Aug 25, US GDP quarterly report, Us Initial Jobless Claims at Aug 26 and Fed Chair Powell Speech at Aug 27.

USD/JPY Weekly outlook:

Technical View:

Last week’s high was 0.51% lower than the previous week. Maintaining high at 110.23 and low at 109.11 showed a movement of 112 pips.

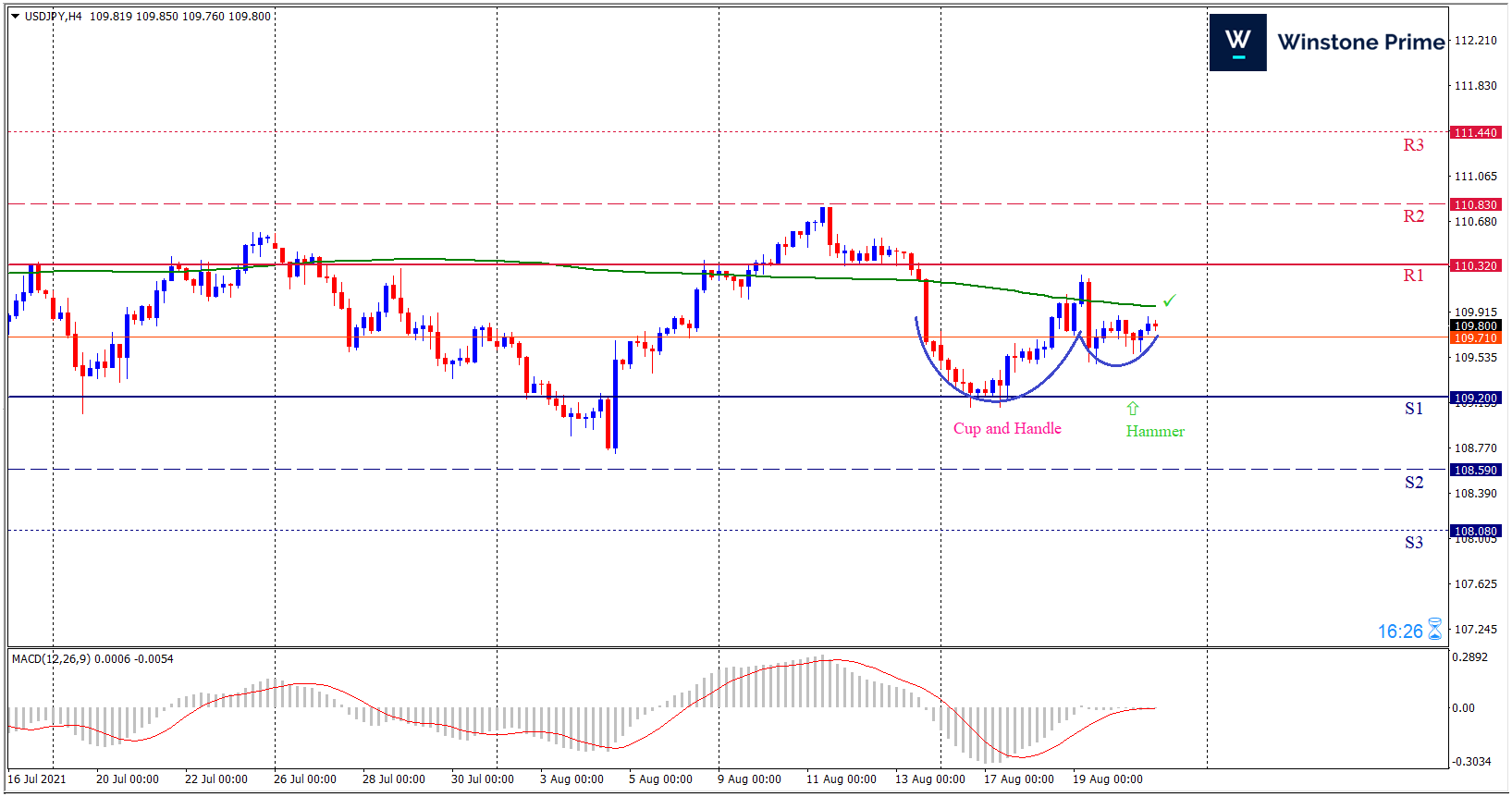

In the upcoming week we expect USD/JPY to show a bullish trend. The currency pair is trading below the 200 Simple Moving Average and the MACD trades to the nearly neutral. A solid breakout above 110.32 may open a clean path towards 110.83 and may take a way up to 111.44. Should 109.20 prove to be unreliable support, the USDJPY may sink downwards 108.59 and 108.08 respectively. In H4 chart, Formation of cup and handle patterns create the prospects of a bullish trend. Along with a bullish hammer formation braces our expectation.

| Preference |

| Buy: 109.81 target at 110.82 and stop loss at 109.15 |

| Alternate Scenario |

| Sell: 109.15 target at 108.09 and stop loss at 109.81 |