Fundamental view:

The selling pressure around greenback lead to the rise of the yellow metal in the last week. Gold saw immediate gains following Powell’s speech at the Jackson Hole Economic Policy Symposium. Powell sounded more cautious than other Fed officials when talking about tapering, stating that the central bank could start reducing its $120 billion in monthly bond purchases this year. According to analysts, Powell’s comments were more on the dovish side, creating some selling pressure in the U.S. dollar, which has been positive for gold.

US Bureau of Economic Analysis (BEA) announced that it revised the annualized real GDP growth in the second quarter to 6.6% from 6.5%. And the US Department of Labor said the Initial Jobless Claims increased by 4,000 to 353,000 in the week ending August 20. But it did not effect the market trend. Overall the gold enjoyed the US dollar weakness in the last week.

The major economic events deciding the movement of the pair in the next week are CB Consumer Confidence Index at Aug 31, ADP Nonfarm Employment Change, ISM Manufacturing PMI, EIA Crude Oil Stocks Change at Sep 01, Initial Jobless Claims at Sep 02, Nonfarm Payrolls and ISM Non-Manufacturing PMI at Sep 03 for US.

XAU/USD Weekly outlook:

Technical View:

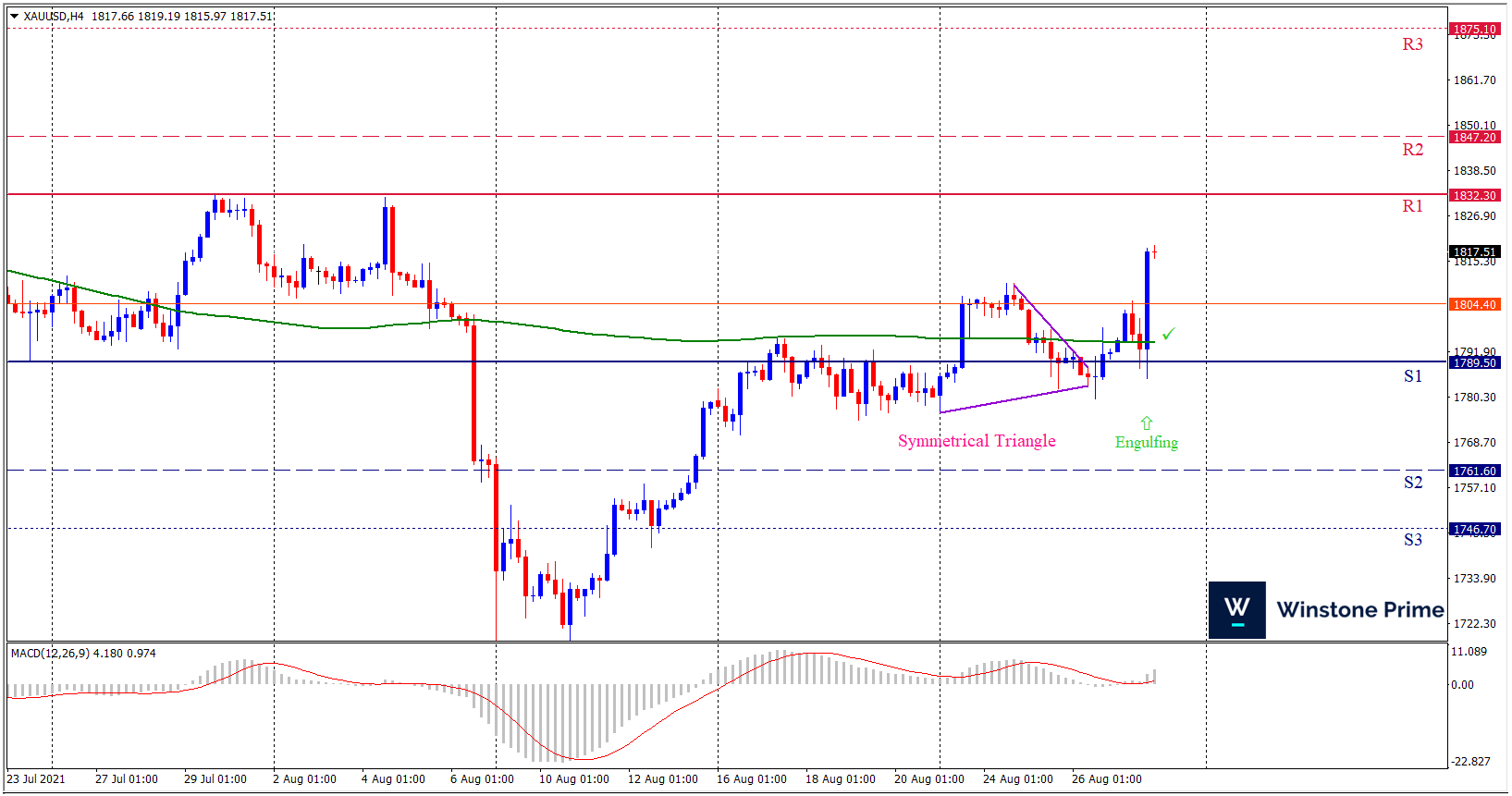

Last week’s high was 1.33% higher than the previous week. Maintaining high at 1819.2 and low at 1776.4 showed a movement of 428 pips.

In the upcoming week we expect XAU/USD to show a bullish trend. The Instrument is trading above the 200 Simple Moving Average and the MACD trades to the upside. A solid breakout above 1832.3 may open a clean path towards 1847.2 and may take a way up to 1875.1. Should 1789.5 prove to be unreliable support, the XAUUSD may sink downwards 1761.6 and 1746.7 respectively. In H4 chart symmetrical triangle breakout favors prospects of a bullish trend. Also to be noted Bullish engulfing formation exerts the expectation of uptrend for the pair.

| Preference |

| Buy: 1817.5 target at 1846.2 and stop loss at 1800.4 |

| Alternate Scenario |

| Sell: 1800.4 target at 1762.6 and stop loss at 1817.5 |