Fundamental view:

Greenback fell against the Japanese yen in the past week. The main reason behind the dollar fell are the renewed USD weakness following the Dovish Fed Officials comments and the dismal US August jobs report. Nonfarm Payrolls in US increased by only 235,000 in August which fell well short of already-lowered projections. Fed Powell expressed concerns about the potential effects of the spread of the coronavirus Delta variant in the economic recovery. He noted that tapering may still happen this year, conditioned on progress in the economy towards the Fed’s goals. About inflation, he said “At these levels, it is, of course, a cause for concern,” but added, “that concern is tempered by a number of factors that suggest that these elevated readings are likely to prove temporary.” Amidst all these catalyst, greenback showed a downtrend.

US S&P/CS HPI Composite-20 s.a. monthly report on 31st August and Japan Markit Services PMI on 3rd September created uptrend whereas Japan Retail Sales monthly report on 30th August and US ADP Nonfarm Employment Change on 1st September created downtrend for the pair.

The major economic events deciding the movement of the pair in the next week are Japan GDP quarterly report at Sep 07, Japan Economy Watchers Index for Current Conditions, US JOLTS Job Openings, FOMC Member Williams Speech at Sep 08, US Initial Jobless Claims, US EIA Crude Oil Stocks Change at Sep 09 and US WASDE Report at Sep 10.

USD/JPY Weekly outlook:

Technical View:

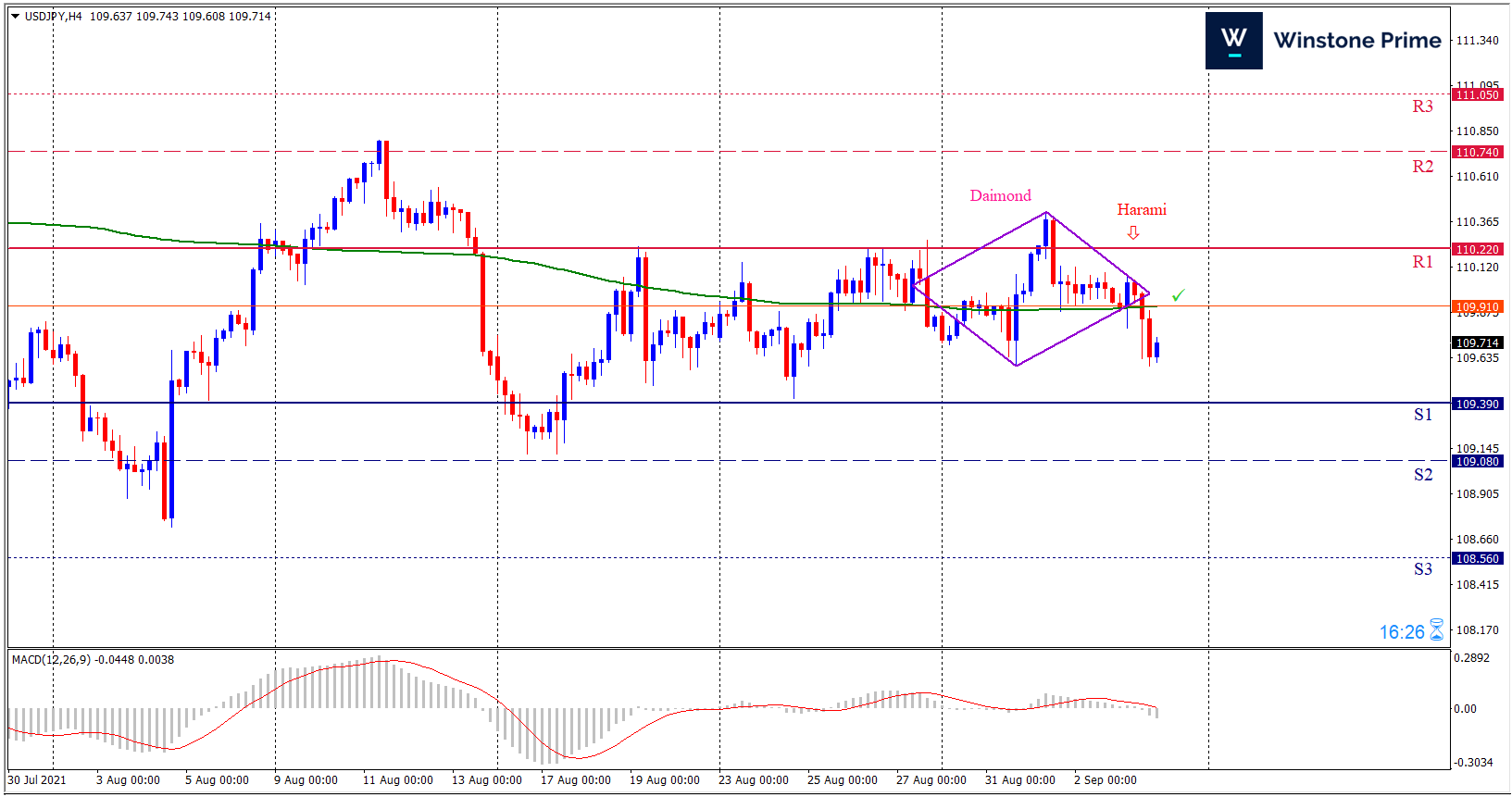

Last week’s high was 0.14% higher than the previous week. Maintaining high at 110.42 and low at 109.59 showed a movement of 83 pips.

In the upcoming week we expect USD/JPY to show a bearish trend. The currency pair is trading below the 200 Simple Moving Average and the MACD trades to the downside. A solid breakout below 109.39 may open a clean path towards 109.08 and may take a way down to 108.56. Should 110.22 prove to be unreliable resistance, the USDJPY may raise upwards 110.74 and 111.05 respectively. In H4 chart, Formation of diamond pattern breakout indicates reversal of the trend creating prospects of a bearish trend Along with a bearish harami formation braces our expectation.

| Preference |

| Sell: 109.72 target at 109.09 and stop loss at 110.25 |

| Alternate Scenario |

| Buy: 110.25 target at 111.04 and stop loss at 109.72 |