Fundamental view:

Aussie managed to gain against the greenback during this week. Initially in the week, sentiment led the way for the greenback changing course on relief-related news. The week started with the traders worried about supply chain issues which weighed on growth and it pushed inflation up, a situation that continues as it comes to an end. The US dollar got under more pressure on Friday, following the release of the Nonfarm Payrolls report, which showed that the country added only 194K new jobs in September. US Federal Reserve Chair Jerome Powell has said that it would take one good employment report to convince him about tapering. On the other hand, The Reserve Bank of Australia had a monetary policy meeting on Tuesday, and as widely anticipated, the central bank left its cash rate at a record low of 0.1%. Amidst all these, AUD showed a uptrend.

US ISM Non-Manufacturing PMI on 5th Oct and US EIA Natural Gas Storage Change on 7th Oct created bullish trend whereas Australia ANZ Job Advertisements monthly report on 5th Oct and US EIA Heating Oil Stocks Change on 6th Oct created bearish trend for the pair.

The major economic events deciding the movement of the pair in the next week are Australia NAB Business Confidence US JOLTS Job Openings at Oct 12, FOMC Minutes at Oct 13, Australia Employment Change, US Initial Jobless Claims, US EIA Crude Oil Stocks Change at Oct 14 and US Retail Sales monthly report at Oct 15.

AUD/USD Weekly outlook:

Technical View:

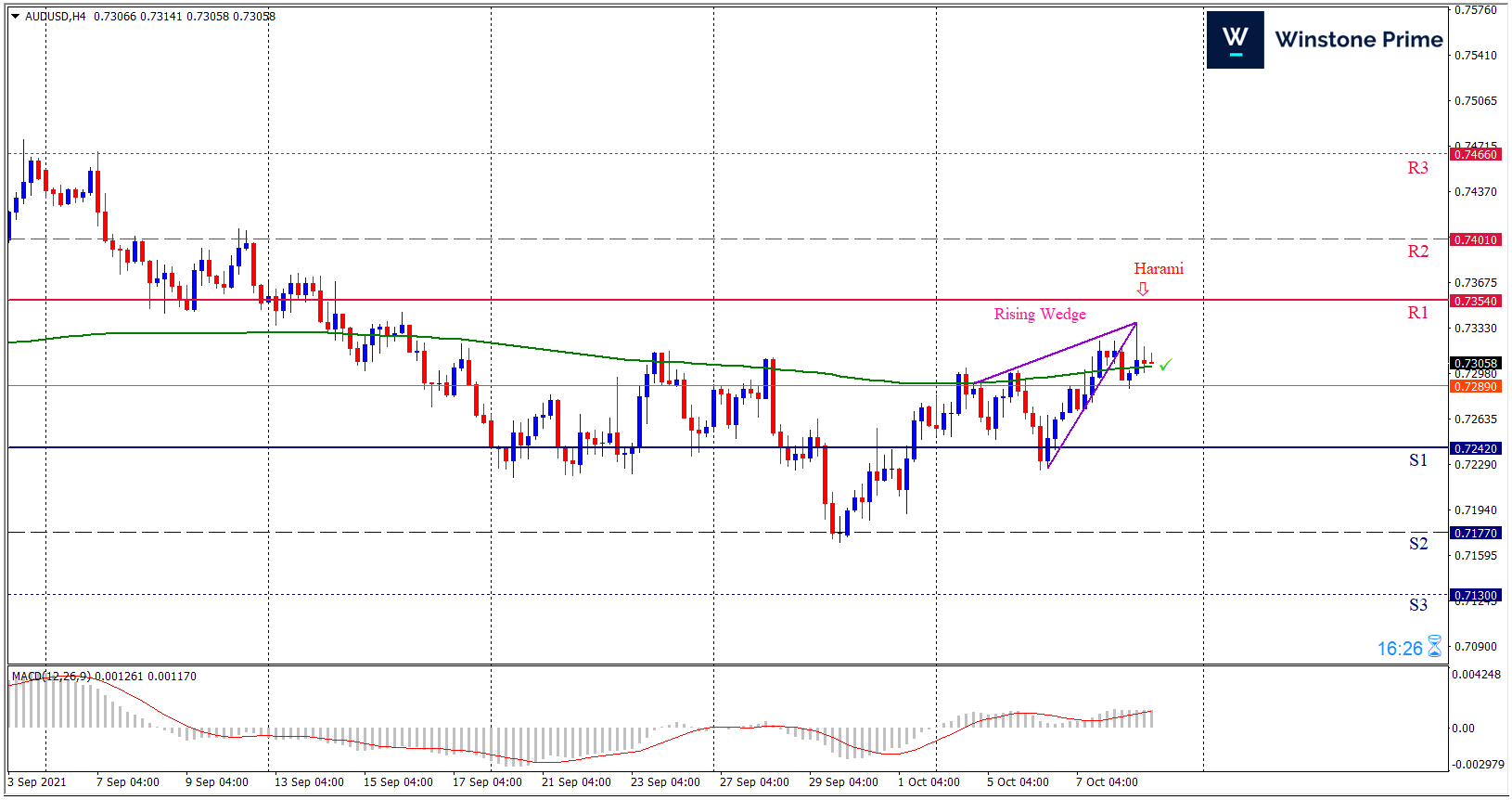

Last week’s high was 0.37% higher than the previous week. Maintaining high at 0.7337 and low at 0.7225 showed a movement of 112 pips.

In the upcoming week we expect AUD/USD to show a bearish trend. The currency pair is trading above the 200 Simple Moving Average and the MACD trades to the upside. A firm breakout below 0.7242 may fall at 0.7177 and may take a way down to 0.7130. Should 0.7354 prove to be unreliable resistance, the AUDUSD may raise upwards at 0.7401 and 0.7466 respectively. In H4 chart rising wedge pattern breakout favors prospects of a bearish trend. Also to be noted bearish harami formation exerts the expectation of downtrend for the pair.

| Preference |

| Sell: 0.7304 target at 0.7197 and stop loss at 0.7359 |

| Alternate Scenario |

| Buy: 0.7359 target at 0.7465 and stop loss at 0.7304 |