Fundamental view:

The US dollar has skyrocketed against the Japanese yen during the trading course of the week. The widening spread between US and Japanese sovereign yields over the past three weeks has kept the USD/JPY moving sharply higher despite the weaker view on the dollar. The yen was hampered by the prospect of another huge stimulus package from Tokyo when the national elections on October 31 are completed. Inflation in Japan and the United States continued to dominate economic news. Markets are now waiting for an announcement from the Federal Reserve on the start date and amount of its bond purchase program reduction at its November 3 meeting.

US JOLTS Job Openings on 12th Oct and US Michigan Current Conditions on 15th Oct created bearish trend whereas US CB Employment Trends Index on 11th Oct and US EIA Cushing Crude Oil Stocks Change on 14th Oct created bullish trend for the pair.

The major economic events deciding the movement of the pair in the next week are Fed Industrial Production yearly report at Oct 18, , Japan Trade Balance at Oct 19, EIA Crude Oil Stocks Change at Oct 20, Japan CPI yearly report, Philadelphia Fed Manufacturing Index, Initial Jobless Claims at Oct 21 and Markit Manufacturing PMI at Oct 22.

USD/JPY Weekly outlook:

Technical View:

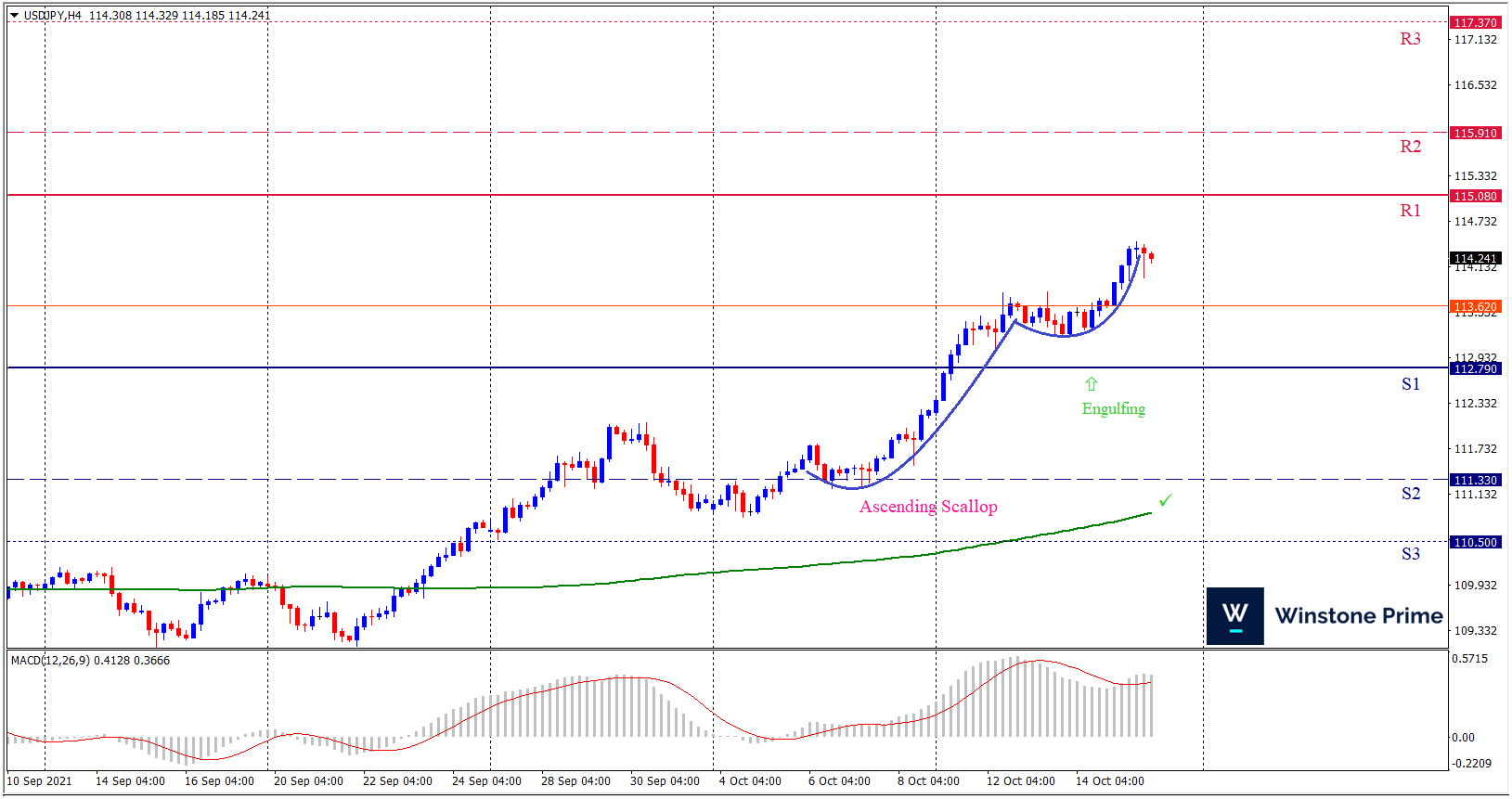

Last week’s high was 2.00% higher than the previous week. Maintaining high at 114.46 and low at 112.17 showed a movement of 229 pips.

In the upcoming week we expect USD/JPY to show a bullish trend. The currency pair is trading above the 200 Simple Moving Average and the MACD trades to the upside. A solid breakout above 115.08 may open a clean path towards 115.91 and may take a way up to 117.37. Should 112.79 prove to be unreliable support, the USDJPY may sink downwards 111.33 and 110.50 respectively. In H4 chart, Formation of ascending scallop pattern indicates reversal of the trend creating prospects of a bullish trend Along with a bullish engulfing formation braces our expectation.

| Preference |

| Buy: 114.24 target at 116.32 and stop loss at 112.74 |

| Alternate Scenario |

| Sell: 112.74 target at 110.51 and stop loss at 114.24 |