Fundamental view:

Gold is holding the lower ground against the American dollar just above $1,850 maintaining its consolidative mode. For this week, the pair had rose more than 2%. With data from the US showing that consumer inflation reached its highest level since 1990, XAU/USD rallied and touched its highest level since June – $1,868 on Wednesday. Eventhough gold retreated from that level, it somehow managed to close in the positive territory on Wednesday and Thursday before going into a consolidation phase. Whereas the improving market mood appears to be weighing down on gold price.

Moving on to macroeconomic data, The US Bureau of Labor Statistics reported on Wednesday that annual inflation, as measured by the Consumer Price Index (CPI) had jumped to its highest level since 1990 at 6.2% in October. The Core CPI, which excludes volatile food and energy prices, also climbed to its strongest level in more than three decades at 4.6%. On Friday, the University of Michigan announced that the Consumer Sentiment Index fell to its lowest level since November 2011 at 66.8.

The major economic events deciding the movement of the pair in the next week are Retail Sales monthly report, Fed Industrial Production monthly report at Nov 16, EIA Crude Oil Stocks Change at Nov 17, Initial Jobless Claims at Nov 18 and Fed Governor Waller Speech at Nov 19 for US.

XAU/USD Weekly outlook:

Technical View:

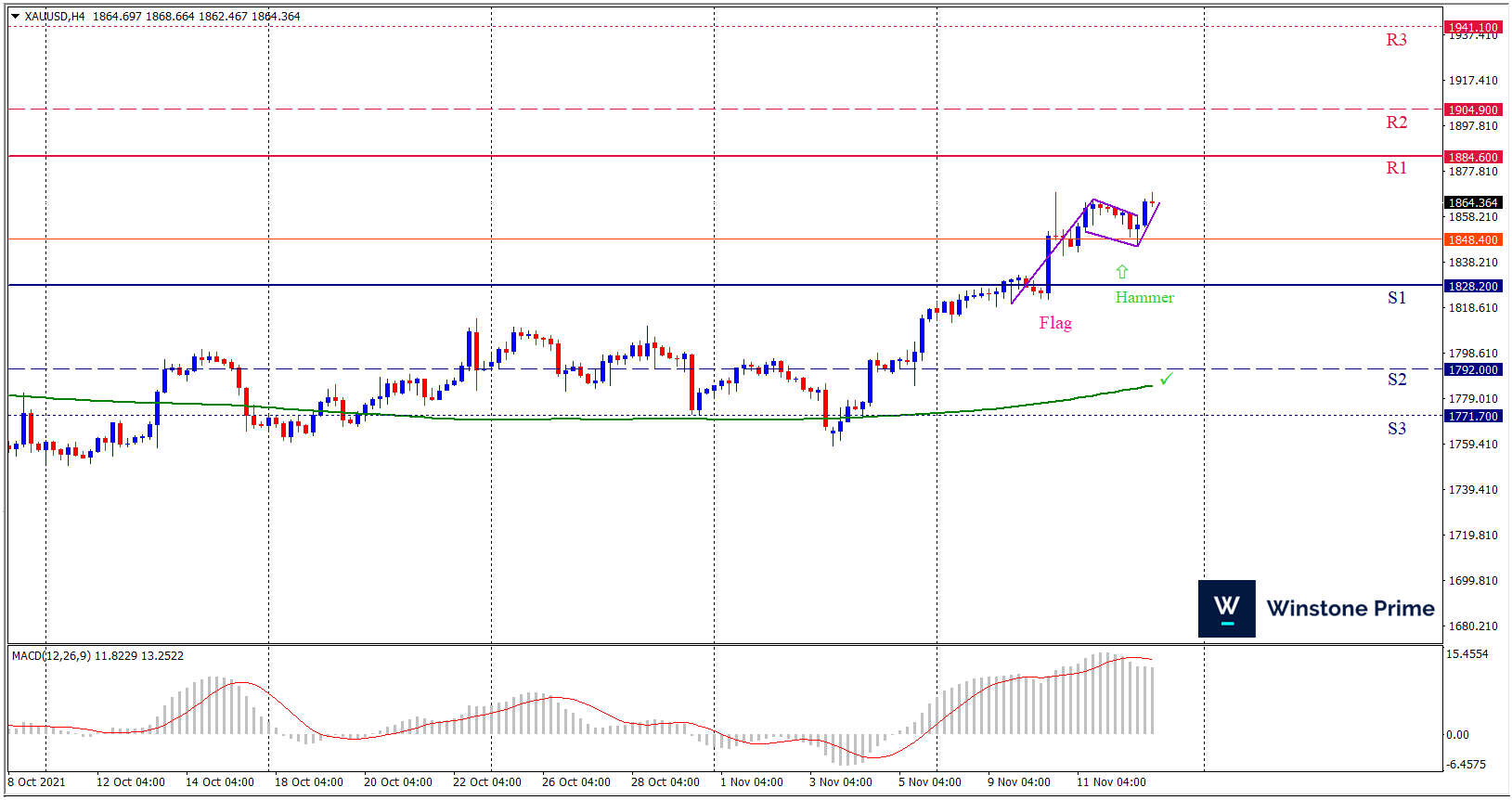

Last week’s high was 2.70% higher than the previous week. Maintaining high at 1868.7 and low at 1812.2 showed a movement of 565 pips.

In the upcoming week we expect XAU/USD to show a bullish trend. The Instrument is trading above the 200 Simple Moving Average and the MACD trades to the upside. A solid breakout above 1884.6 may open a clean path towards 1904.9 and may take a way up to 1941.1. Should 1828.2 prove to be unreliable support, the XAUUSD may sink downwards 1792.0 and 1771.7 respectively. In H4 chart bullish flag pattern formation favors prospects of a bullish trend. Also to be noted hammer formation exerts the expectation of uptrend for the pair.

| Preference |

| Buy: 1864.3 target at 1915.8 and stop loss at 1823.7 |

| Alternate Scenario |

| Sell: 1823.7 target at 1772.5 and stop loss at 1864.3 |