Fundamental view:

The US dollar has rallied significantly during the course of the week and broke the ¥115 level. The Good US Retail Sales report along with a Consumer Price Index (CPI) at its highest level since 1990 favored the US dollar and in turn may allow the Fed to end its $120 billion bond buying program as targeted by June 2022. Proof of a strengthening recovery might be enough for the Federal Open Market Committee (FOMC) to advance its taper timetable at the December 15 meeting. The US economy outperformed the Japanese economy this week and seem to continue to do so in the upcoming week.

In this week, Japan GDP quarterly report on 15th November and US Building permits on 17th November favored bearish trend whereas US Retail Sales monthly report on 16th November and Japan CPI yearly report on 19th November favored bullish trend for the pair.

The major economic events deciding the movement of the pair in the next week are US Markit Manufacturing PMI at Nov 23, Japan Markit Manufacturing PMI, US GDP quarterly report, US Core Durable Goods Orders monthly report, US Initial Jobless Claims, Michigan Consumer Sentiment, FOMC Minutes at Nov 24 and Japan Coincident Index at Nov 25.

USD/JPY Weekly outlook:

Technical View:

Last week’s high was 0.58% higher than the previous week. Maintaining high at 114.97 and low at 113.58 showed a movement of 139 pips.

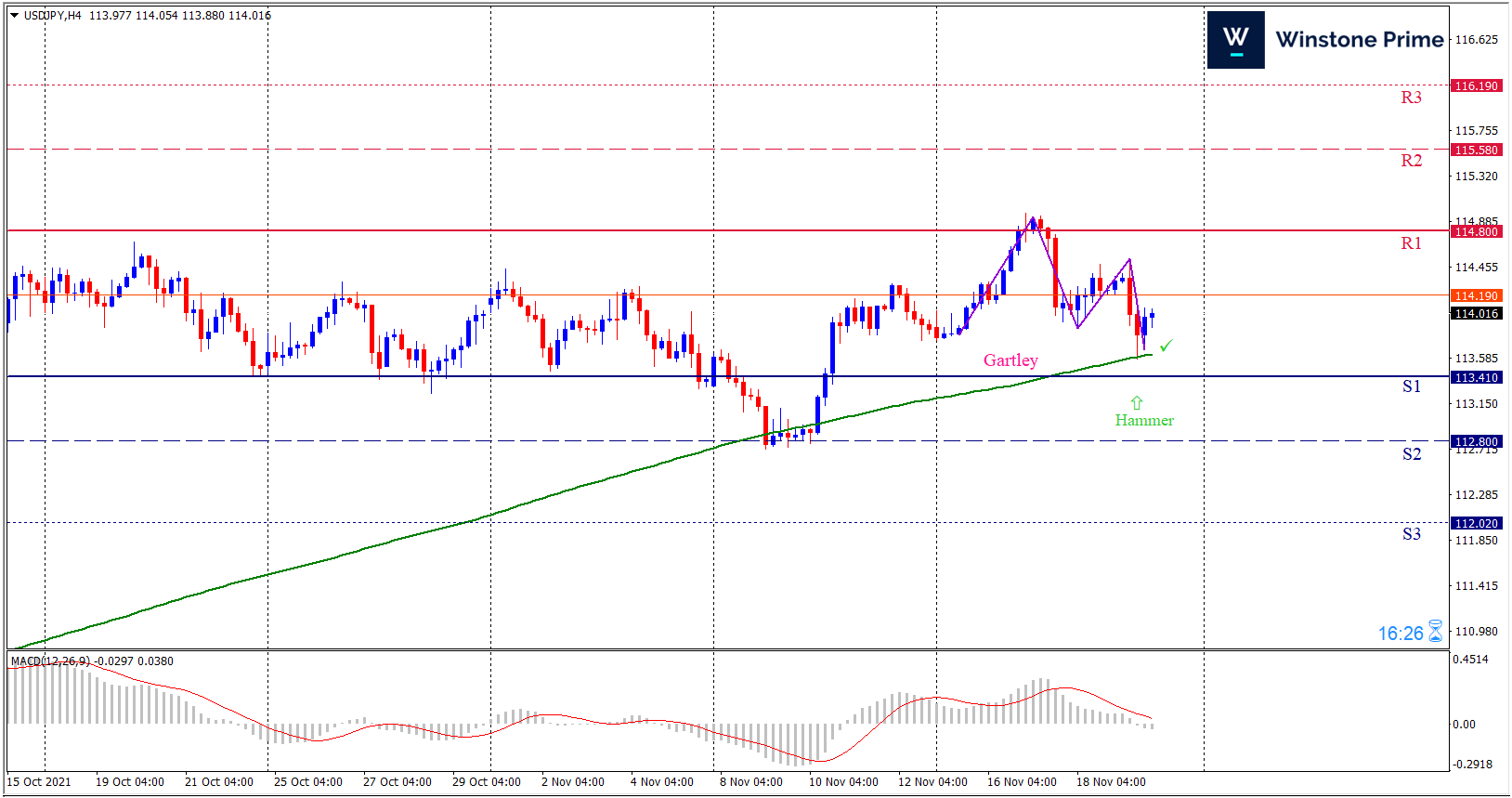

In the upcoming week we expect USD/JPY to show a bullish trend. The currency pair is trading above the 200 Simple Moving Average and the MACD trades to the downside. A solid breakout above 114.80 may open a clean path towards 115.58 and may take a way up to 116.19. Should 113.41 prove to be unreliable support, the USDJPY may sink downwards 112.80 and 112.02 respectively. In H4 chart, Formation of bullish gartley pattern indicates reversal of the trend creating prospects of a bullish trend additionally hammer formation braces our expectation.

| Preference |

| Buy: 114.21 target at 115.57 and stop loss at 113.36 |

| Alternate Scenario |

| Sell: 113.36 target at 112.03 and stop loss at 114.21 |