Fundamental view:

Gold struggled to build on the previous week’s inflation-fueled rally and ended with a weekly bearish candle. The Rising US Treasury bond yields favored the greenback and pressurized the Dollar in the beginning of the week. Later the upbeat US data favored the US dollar and underpinned the bearish trend of the pair. The US Department of Labor’s weekly publication portrayed that there were 268,000 initial claims for unemployment benefits in the week ending November 13 which was better than the expectation. Additionally, The Federal Reserve Bank of Philadelphia reported that business activity in the Third Federal Reserve District expanded at a strong pace in November.

On the other hand, Fed officials delivered mixed comments on the policy outlook which turned to be negative for the dollar. Further Factors like rising COVID-19 cases in Eastern Europe like Austria is in a lockdown for 20 days, and Increase in Germany’s covid cases above March 2020 high, dented investors mood. Adding to it, the health minister said he could not rule out another lockdown in Germany as infections surge aggressively in the largest Eurozone economy. This also leads to the downbeat market sentiments.

The major economic events deciding the movement of the pair in the next week are US Markit Manufacturing PMI at Nov 23, US GDP quarterly report, US Core Durable Goods Orders monthly report, US Initial Jobless Claims, EIA Crude Oil Stocks Change, Michigan Consumer Sentiment and FOMC Minutes at Nov 24 for US.

XAU/USD Weekly outlook:

Technical View:

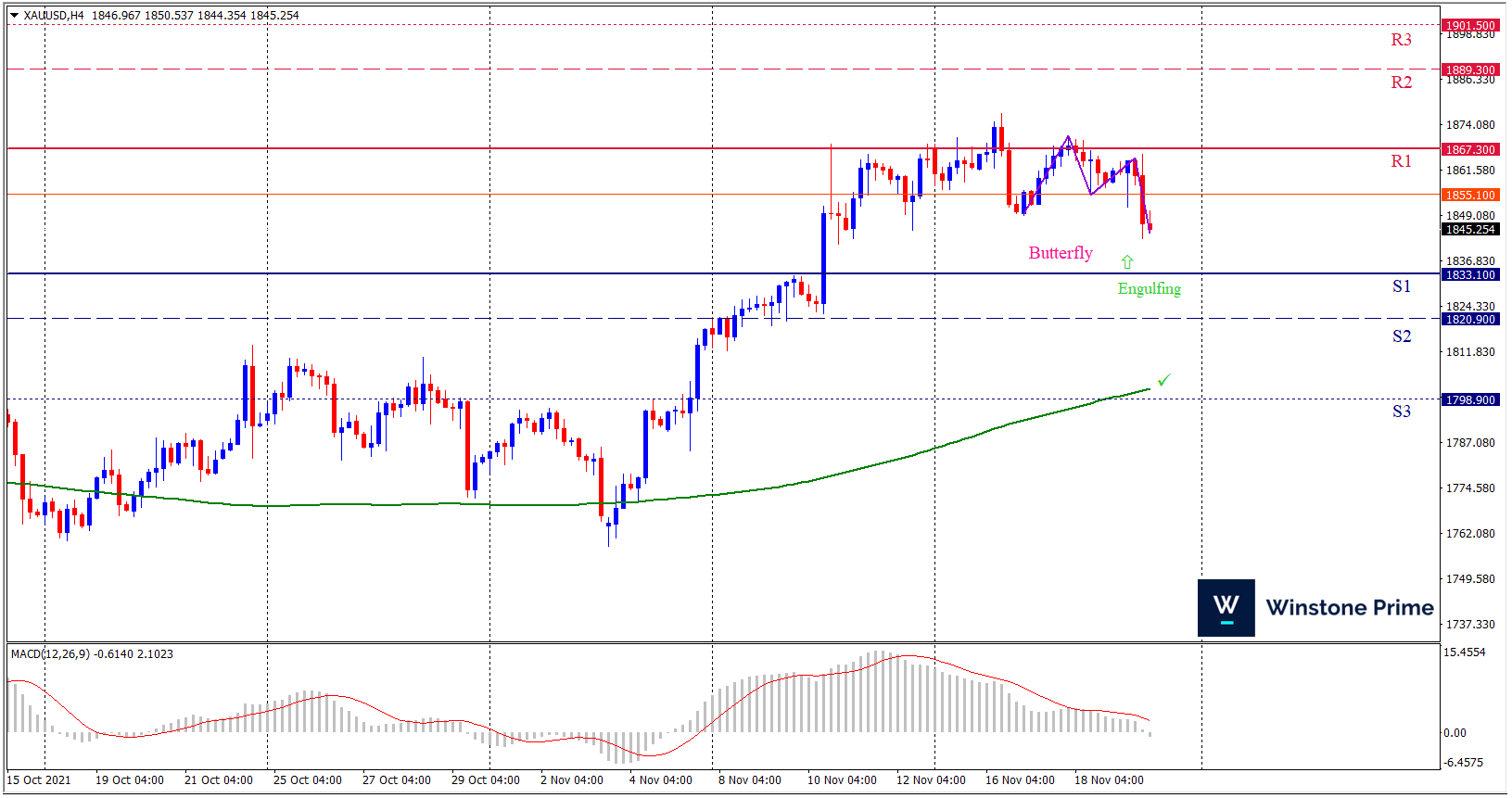

Last week’s high was 0.45% higher than the previous week. Maintaining high at 1877.1 and low at 1842.9 showed a movement of 342 pips.

In the upcoming week we expect XAU/USD to show a bullish trend. The Instrument is trading above the 200 Simple Moving Average and the MACD trades to the downside. A solid breakout above 1867.3 may open a clean path towards 1889.3 and may take a way up to 1901.5. Should 1833.1 prove to be unreliable support, the XAUUSD may sink downwards 1820.9 and 1798.9 respectively. In H4 chart bullish butterfly pattern favors prospects of a bullish trend. Also to be noted Bullish engulfing formation exerts the expectation of uptrend for the pair.

| Preference |

| Buy: 1847.5 target at 1880.3 and stop loss at 1828.7 |

| Alternate Scenario |

| Sell: 1828.7 target at 1799.9 and stop loss at 1847.5 |