Kiwi trades low against the greenback during Friday early session. This move can be related to the release of China’s Caixin PMI data. The kiwi also shows the sour market sentiment, as well as reacts to the softer data and the Nonfarm payroll data.

China’s Caixin Services PMI for the month of November came below 53.8 to 52.1 Along with that the Composite PMI also had a drop from 51.5 to 51.2 during November.

On the other hand, The Labor Department’s report showed that nonfarm job growth rose less than expected in November, the unemployment rate dropped to 4.2%, its lowest since February 2020, and wages increased.

Separately, a measure of U.S. services industry activity hit a record high in November. Both sets of data appeared to influence investor expectations for the Fed’s next move towards tightening its policy. Fed Chair Jerome Powell said this week that the central bank will consider a faster wind-down of its bond-buying program, prompting speculation that interest rate hikes would also be brought forward.

Omicron concerns also creates sour market sentiment. Omicron variant appeared to be spreading faster than Delta, the last most prevalent version of COVID-19. The number of countries reporting Omicron cases kept rising on Friday but there was still little clarity on the severity of the disease or the level of protection provided by existing COVID-19 vaccines.

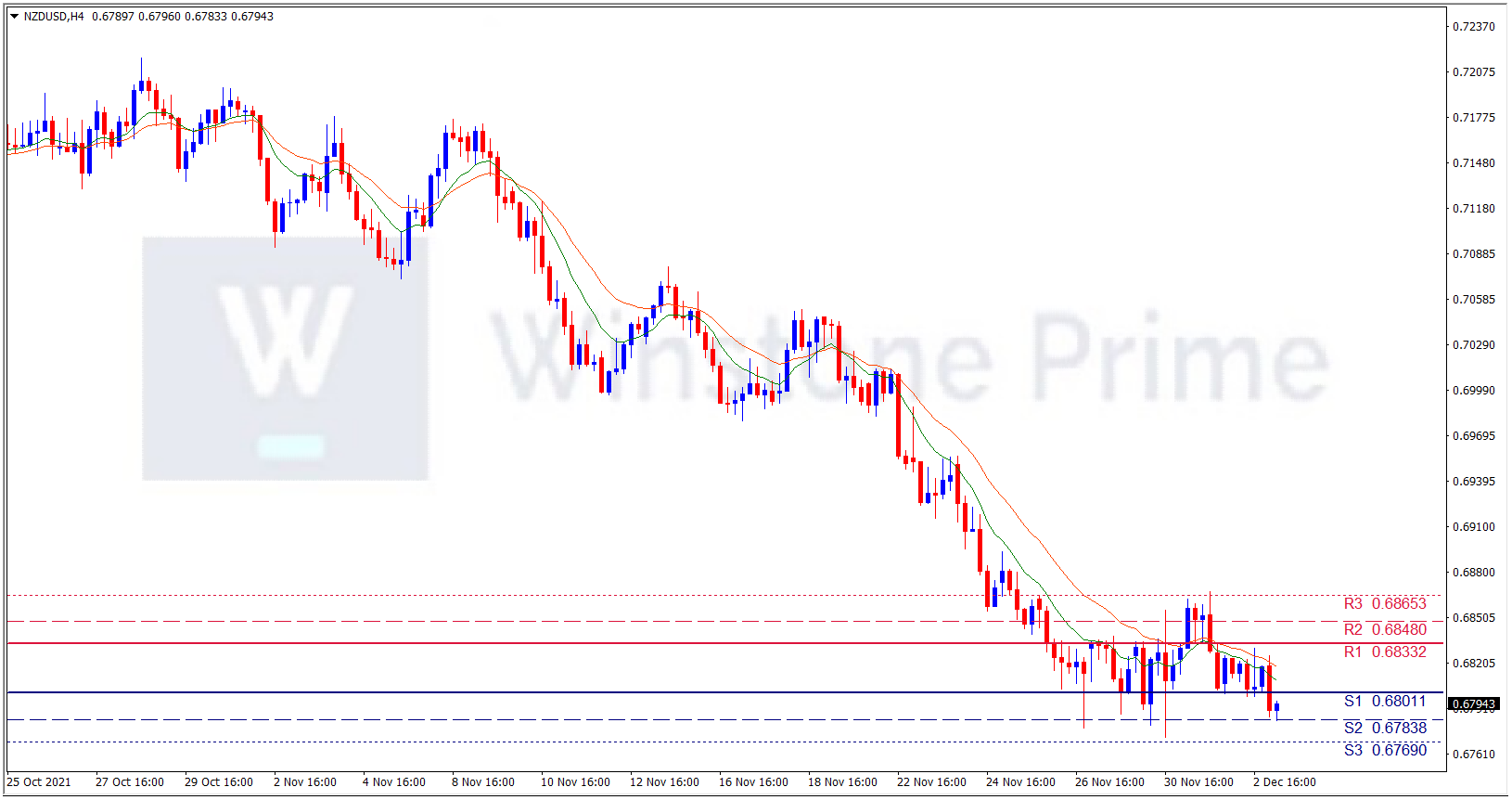

NZD/USD 4 Hour Chart:

Support: 0.6801 (S1), 0.6784 (S2), 0.6769 (S3).

Resistance: 0.6833 (R1), 0.6848 (R2), 0.6865 (R3).

Amidst the prevailing catalysts favoring the safe haven US dollar against the Kiwi, we expect a bearish trend for NZD/USD.