Fundamental view:

The Australian dollar traded up and down against the greenback and ended the week at the 0.7120 level. The upbeat employment data was the major catalysts favoring the pair this week. The Fed announced the monetary policy this week which was same as market expectation. The Fed made an increment in the reduction in bond-buying on a monthly basis to $30 billion, from $15 billion as announced in November, starting from January 2022. Which means that the central bank will stop buying $20 billion Treasuries and $10 billion Mortgage-Backed Securities per month, and also means sooner rate hikes. Elsewhere, The Fed’s dot-plot now implies three rate hikes in 2022 and three more in 2023. Additionally, the central bank upwardly revised its inflation forecasts to 5.6% for 2021 and 2.6% for 2022, up from 4.2% and 2.2% previously.

On the other hand, Australia reported that it managed to create 366.1K job positions in November, which is far better than the 200K expected. The unemployment rate contracted to 4.6%, while the Participation Rate rose to 66.1%, both beating expectations and hinted at a hinting at a stronger economic recovery.

EIA Cushing Crude Oil Stocks Change on 15th December and Australia Employment Change and on 16th December framed uptrend whereas NAB Business Confidence on 14th December and US Building Permits on 16th December framed downtrend for the pair in this week.

The major economic events deciding the movement of the pair in the next week are RBA Meeting Minutes at Dec 21, US GDP quarterly report, US CB Consumer Confidence Index, EIA Crude Oil Stocks Change at Dec 22, US Core Durable Goods Orders monthly report, US Initial Jobless Claims and Michigan Consumer Sentiment at Dec 23.

AUD/USD Weekly outlook:

Technical View:

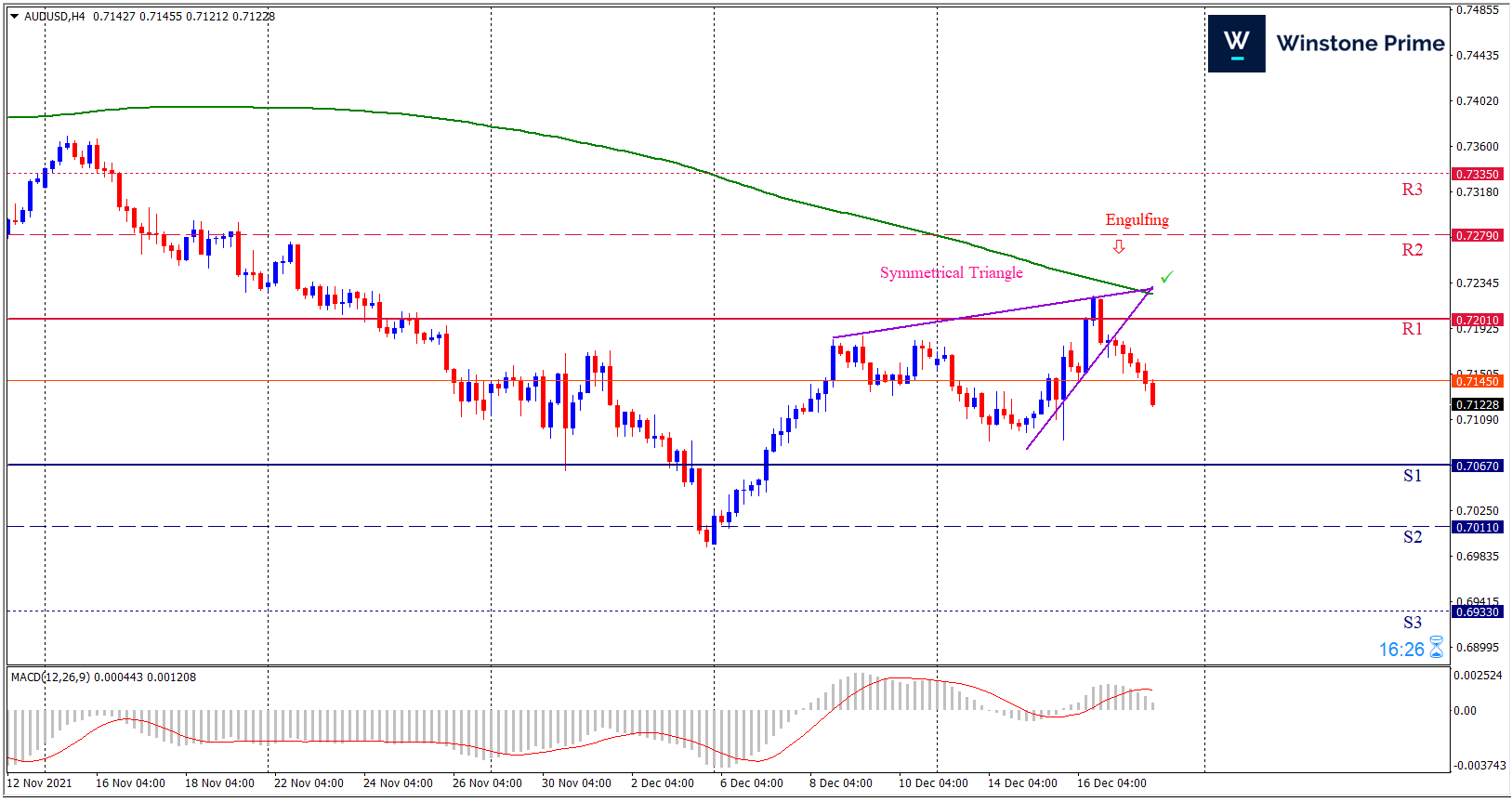

Last week’s high was 0.52% higher than the previous week. Maintaining high at 0.7223 and low at 0.7089 showed a movement of 134 pips.

In the upcoming week we expect AUD/USD to show a bearish trend. The currency pair is trading below the 200 Simple Moving Average and the MACD trades to the upside. Should 0.7067 proves to be unreliable support then the pair may fall further to 0.7011 and 0.6933 respectively whereas a solid breakout above 0.7201 will open a clear path upward to 0.7279 and then will further raise up to 0.7335. In H4 chart Symmetrical triangle breakout downside favors prospects of a bearish trend. Also to be noted bearish engulfing formation exerts the expectation of downtrend for the pair.

| Preference |

| Sell: 0.7122 target at 0.6994 and stop loss at 0.7206 |

| Alternate Scenario |

| Buy: 0.7206 target at 0.7334 and stop loss at 0.7122 |