Fundamental view:

The US dollar moved higher against the Japanese yen and reached December high of 114.49 on Friday. The reason for this can be linked to the diminishing fear of Omicron and the Hawkish fed. The reports that the Omicron variant might be less severe than feared helped in easing the worries about the continuous surge in new COVID-19 cases around the world and in turn, improved the market sentiment. US inflation scored another dismal record in November thus increasing the possibility that the Federal Reserve could act on interest rates in the first quarter.

Federal Reserve Chair Jerome Powell reassured that it is about to to end its bond program before hiking the fed funds rate after the meeting on December 15. Bond purchases are slated to end in March. On Friday after the December FOMC meeting, Fed governor Christopher Waller said in an appearance in New York, that the purpose of increasing the taper from $15 billion to $30 billion was to end the program in time for the FOMC meeting on March 15-16.

US Existing Home Sales on 22nd December and Japan Core CPI yearly report on 24th December favored downtrend Whereas US CB Leading Economic Index monthly report on 20th December and US Core Durable Goods Orders monthly report on 23rd December favored uptrend for the pair.

The major economic events deciding the movement of the pair in the next week are Japan Unemployment Rate and Japan Industrial Production monthly at Dec 27, US S&P/CS HPI Composite-20 yearly report at Dec 28, EIA Crude Oil Stocks Change, US Pending Home Sales monthly report at Dec 29, Initial Jobless Claims and MNI Chicago Business Barometer at Dec 30.

USD/JPY Weekly outlook:

Technical View:

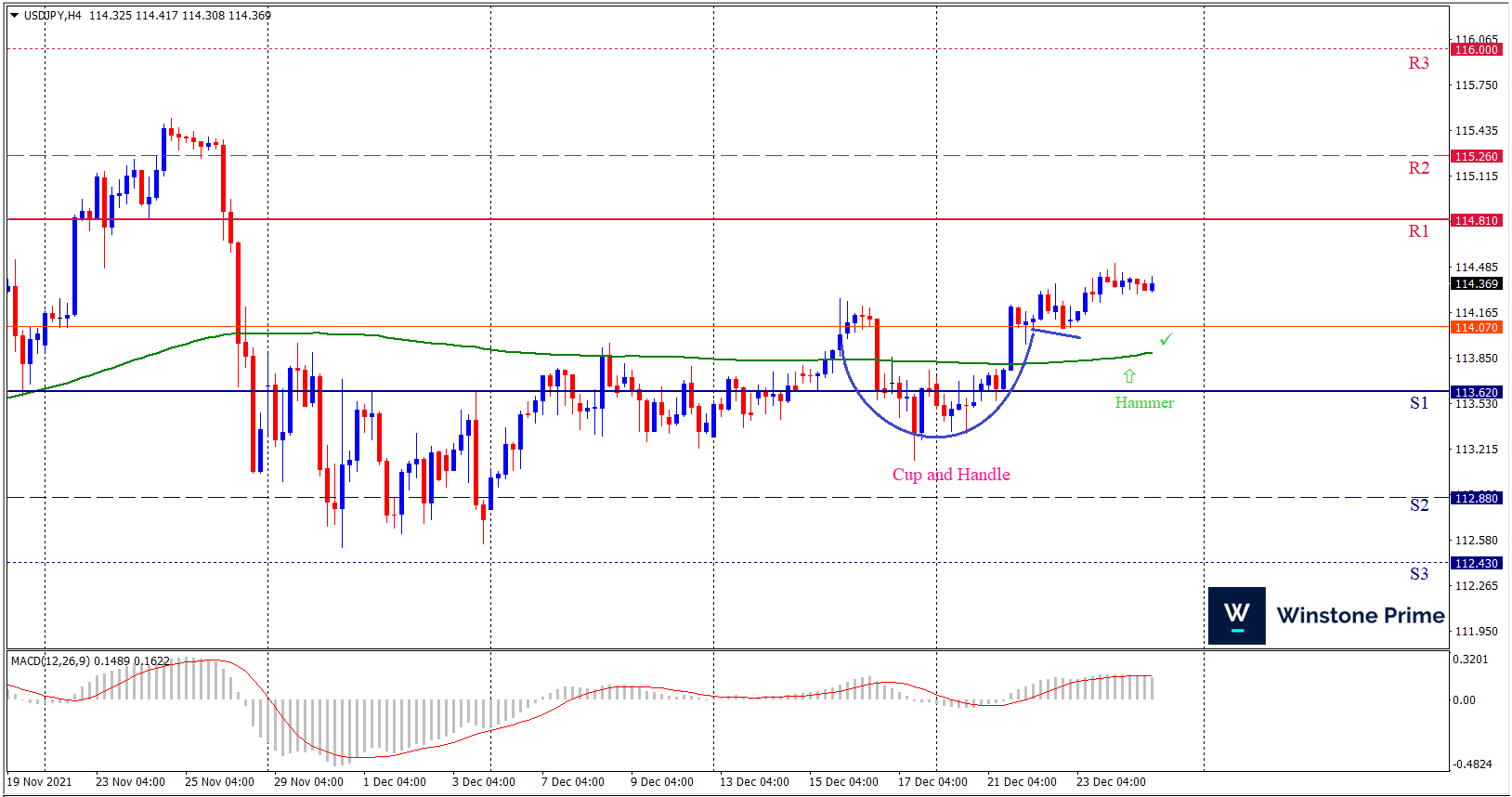

Last week’s high was 0.21% higher than the previous week. Maintaining high at 114.51 and low at 113.32 showed a movement of 119 pips.

In the upcoming week we expect USD/JPY to show a bullish trend. The currency pair is trading above the 200 Simple Moving Average and the MACD trades to the upside. A solid breakout above 114.81 may open a clean path towards 115.26 and may take a way up to 116.00. Should 113.62 prove to be unreliable support, the USDJPY may sink downwards 112.88 and 112.43 respectively. In H4 chart, Formation of cup and handle pattern indicates reversal of the trend creating prospects of a bullish trend Along with a hammer formation braces our expectation.

| Preference |

| Buy: 114.36 target at 115.45 and stop loss at 113.58 |

| Alternate Scenario |

| Sell: 113.58 target at 112.44 and stop loss at 114.36 |