Fundamental view:

The Euro initially fell in the week but then turned around and closed the week with a bullish candle. In the last week, European Central Bank Governing Council member Klaas Knot noted that the ECB could end its bond-buying program earlier than planned if inflation continues to surprise to the upside. Knot further argued that it was appropriate for the ECB to prepare for gradual monetary policy normalization. On the other hand, There seems a certain amount of mistrust as to whether or not the Federal Reserve is actually going to be able to tighten monetary policy for very long. Market also seems to move towards riskier assets in hope of fewer hospitalizations due to the new variant of Covid, dubbed as Omicron.

In this week, CFTC EUR Non-Commercial Net Positions on 27th December favored bearish outlook whereas Eurozone retail sales yearly report on 28th December, US EIA Crude Oil Stocks Change on 29th December and Eurozone CPI monthly report on 30th December favored bullish outlook.

The major economic events deciding the movement of the pair in the next week are OPEC Meeting, Eurozone Unemployment Change, US ISM Manufacturing PMI at Jan 04, US ADP Nonfarm Employment Change, EIA Crude Oil Stocks Change, FOMC Minutes at Jan 05, Initial Jobless Claims at Jan 06, Eurozone Retail Sales monthly report and US Nonfarm Payrolls at Jan 07.

EUR/USD Weekly outlook:

Technical View:

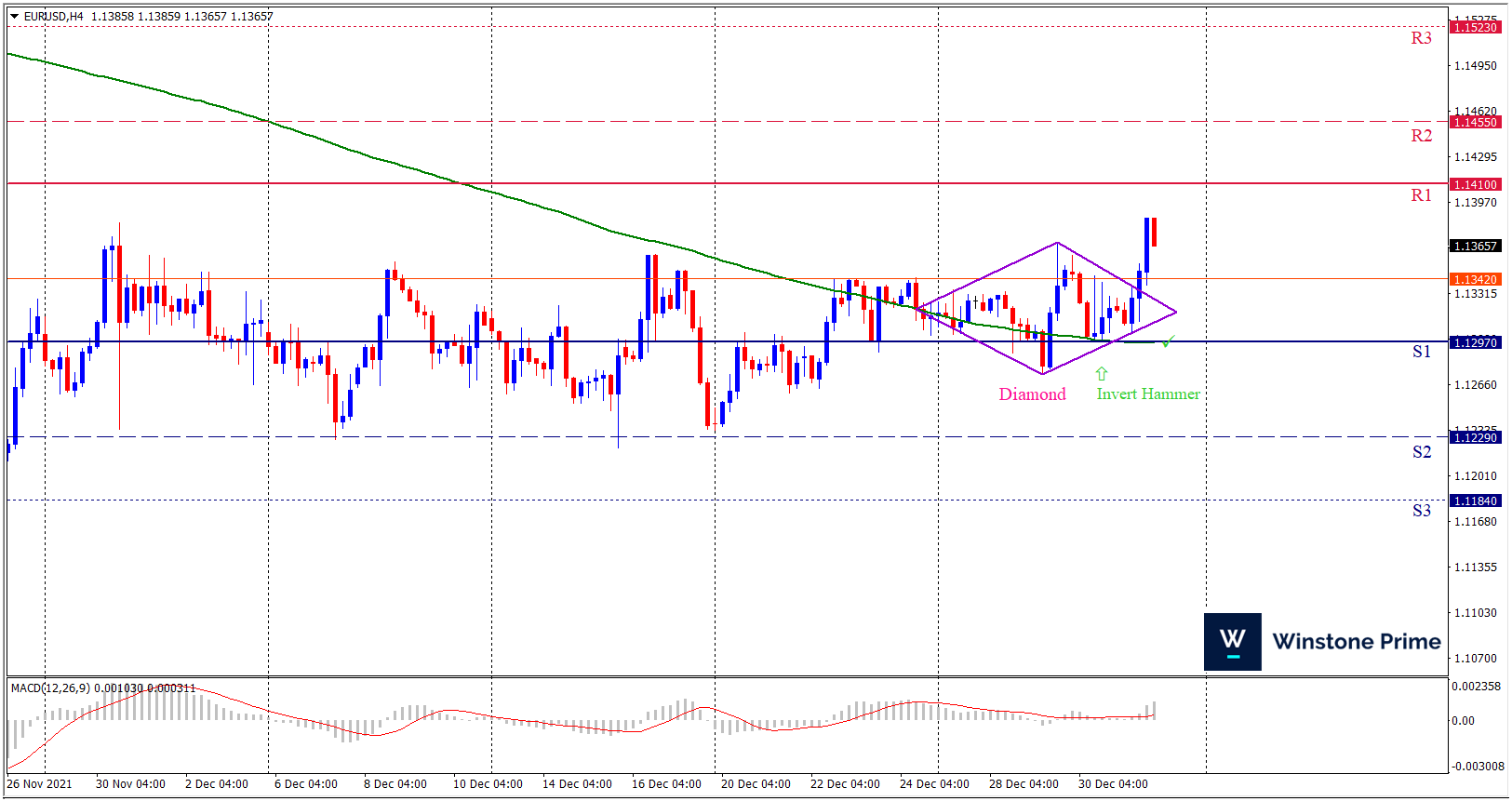

Last week’s high was 0.38% higher than the previous week. Maintaining high at 1.1386 and low at 1.1273 showed a movement of 113 pips.

In the upcoming week we expect EUR/USD to show a bullish trend. The currency pair is trading above the 200 Simple Moving Average and the MACD trades to the upside. A solid breakout above 1.1410 may open a clean path towards 1.1455 and may take a way up to 1.1523. Should 1.1297 prove to be unreliable support, the EURUSD may sink downwards 1.1229 and 1.1184 respectively. Chart formation of a diamond pattern breakout upside in H4 chart sets prospects for a bullish trend. Invert hammer formation in H4 chart escalates the expectation for a bullish trend.

| Preference |

| Buy: 1.1365 target at 1.1454 and stop loss at 1.1292 |

| Alternate Scenario |

| Sell: 1.1292 target at 1.1185 and stop loss at 1.1365 |