Fundamental view:

The British pound seesawed against the US dollar during the trading course of the week. The Fed Hawkishness and the Omicron woes were the major catalysts behind the movement. Central bank had released the Minutes of its December meeting, that showed policymakers began discussing the reduction of their bonds holding in the upcoming months. And the Fed also judged that conditions for a rate hike could be met soon suppose if the recent pace of labor market improvements continued.

Covid cases are surging in UK. And the increasing pressure on the hospitals might force the Prime Minister Boris Johnson to take some action. The Covid woes in UK and the Hawkish Fed could pressure the sterling in the upcoming week.

In this week, BoE Housing Equity Withdrawal quarterly report, UK Markit/CIPS Construction PMI and JOLTS Job Openings on 4th January favored downtrend whereas UK Markit/CIPS Services PMI on 6th January and US Nonfarm Payrolls on 7th January favored uptrend.

The major economic events deciding the movement of the pair in the next week are Fed Chair Powell Testimony at Jan 11, EIA Crude Oil Stocks Change, US Federal Budget Balance at Jan 12, US Initial Jobless Claims at Jan 13, UK Manufacturing Production monthly report, UK GDP monthly report, US Retail Sales monthly report and Fed Industrial Production yearly report at Jan 14.

GBP/USD Weekly outlook:

Technical View:

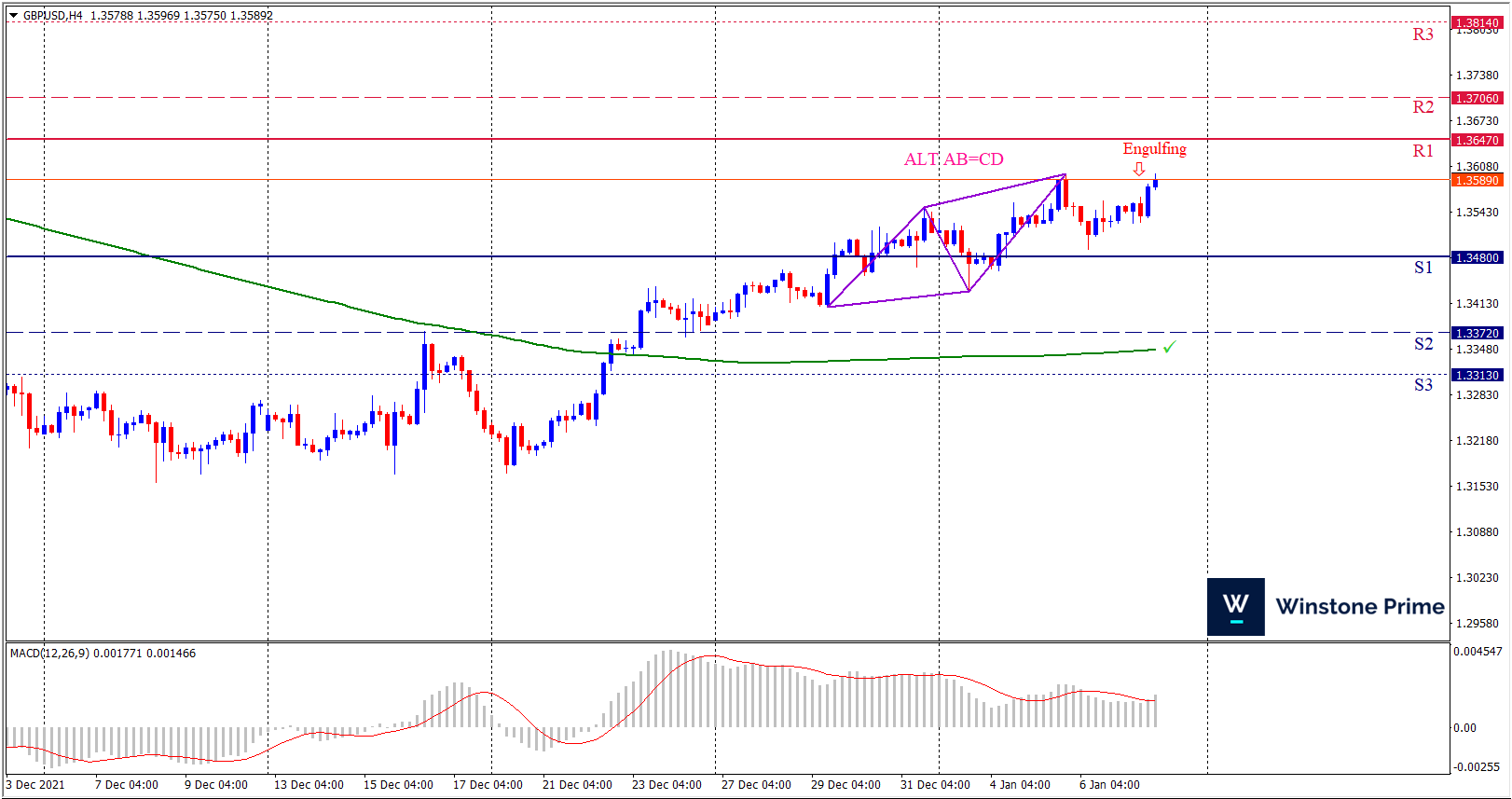

Last week’s high was 0.35% higher than the previous week. Maintaining high at 1.3597 and low at 1.3430 showed a movement of 167 pips.

In the upcoming week we expect GBP/USD to show a bearish trend. The currency pair is trading above the 200 Simple Moving Average and the MACD trades to the upside. Should 1.3480 proves to be unreliable support then the pair may fall further to 1.3372 and 1.3313 respectively whereas a solid breakout above 1.3647 will open a clear path upward to 1.3706 and then will further raise up to 1.3814. Chart formation of Alt AB=CD pattern in H4 chart favors prospects of a bearish trend. Bearish engulfing pattern formation escalates the expectation for a bearish trend.

| Preference |

| Sell: 1.3585 target at 1.3421 and stop loss at 1.3652 |

| Alternate Scenario |

| Buy: 1.3652 target at 1.3813 and stop loss at 1.3585 |