Fundamental view:

The Euro fell hard during this week. The quote EUR/USD lost the most on Tuesday when government bond yields raised to levels last seen in February 2020. The benchmark 10-year US Treasury bond yield surged to its highest level at 1.89% which helped the greenback preserve its strength mid-week. Amidst Yields surge, other catalysts like inflation, aggressive policy from the Fed, China’s slowing economy and Russia’s potential military action also favored the greenback. The US central bank is about to have a monetary policy meeting next week and will announce the monetary policy decision on January 26. Traders are expecting for clearer hints about upcoming rate hikes. Investors are pricing in a first rate hike for March 2022 and at least three hikes through the year.

On the other hand, The European Central Bank policymakers keep acknowledging that persistently high inflation might last longer than anticipated and even move above their comfort zone, Additionally, they are not about to retrieve financial support and they are maintaining a cautious stance.

In this week, Eurozone PPI monthly report and US initial Jobless claims on 20th January favored uptrend whereas Eurozone Trade Balance on 18th January and US Building permits on 19th January favored downtrend for the pair

The major economic events deciding the movement of the pair in the next week are Eurozone group Ifo Business Climate, US CB Consumer Confidence Index at Jan 25, Fed Interest Rate Decision, FOMC Press Conference at Jan 26, US GDP quarterly report, US Core Durable Goods Orders monthly report, Initial Jobless Claims at Jan 27, Eurozone group GDP quarterly report and Michigan Consumer Sentiment at Jan 28.

EUR/USD Weekly outlook:

Technical View:

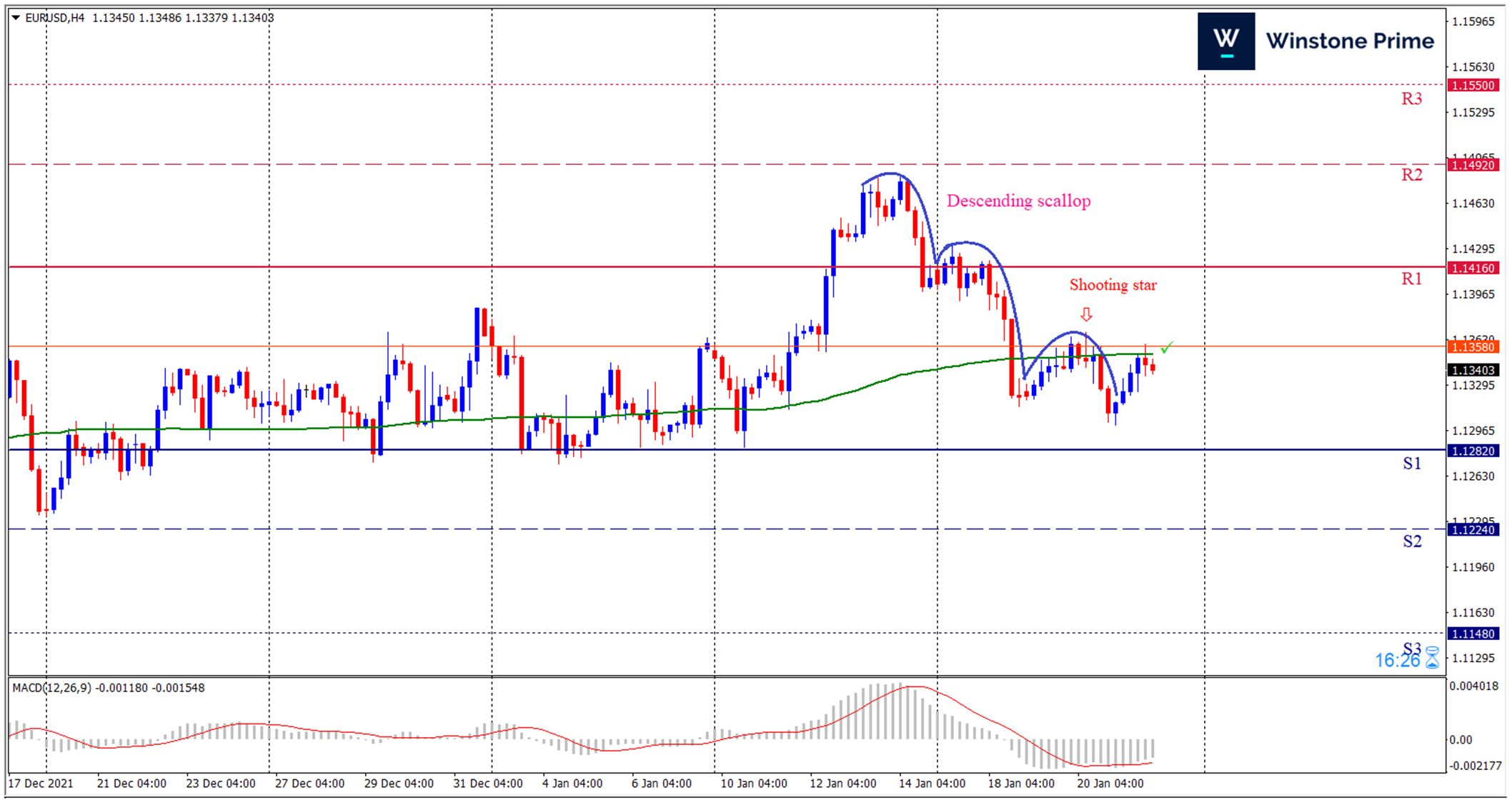

Last week’s high was 0.42% lower than the previous week. Maintaining high at 1.1434 and low at 1.1300 showed a movement of 134 pips.

In the upcoming week we expect EUR/USD to show a bearish trend. The currency pair is trading below the 100 Simple Moving Average and the MACD trades to the downside. Should 1.1282 proves to be unreliable support then the pair may fall further to 1.1224 and 1.1148 respectively whereas a solid breakout above 1.1416 will open a clear path upward to 1.1492 and then will further raise up to 1.1550. Chart formation of a descending scallop pattern in H4 chart sets prospects for a bearish trend. Shooting star formation in H4 chart escalates the expectation for a bearish trend.

| Preference |

| Sell: 1.1340 target at 1.1225 and stop loss at 1.1424 |

| Alternate Scenario |

| Buy: 1.1424 target at 1.1549 and stop loss at 1.1340 |