Fundamental view:

USD/JPY had a fall and reached to a one-month low of 113.60 during the trading course of the week. The US central bank is about to have a monetary policy meeting next week and will announce the monetary policy decision on January 26. Meanwhile Traders have priced in the Fed’s first hike in March and are expecting details on the rate course for the remainder of the year and the prospective balance sheet reduction at the Wednesday Federal Open Market Committee (FOMC) meeting.

On the other hand, BOJ meeting this week brought no surprises, Japanese overnight call rate unchanged at -0.1%, where it has been for five years. The BOJ said the “recovery was becoming clearer” this is a marginally more positive view than the ‘picking up as a trend’ judgement in October, which seems to indicate the latest viral surge is not creating major dislocations. Japan’s economy had shrank at a 3.6% annualized rate in the third quarter.

In this week, TIC Net Long-Term Transactions and Japan Industrial Production monthly report on 18th January favored bullish trend whereas US initial jobless claims and Japan Adjusted Trade Balance on 20th January and Japan CPI yearly report on 21st January favored bearish trend.

The major economic events deciding the movement of the pair in the next week are Japan Markit Manufacturing PMI at Jan 24, BoJ Summary of Opinions, US CB Consumer Confidence Index at Jan 25, Fed Interest Rate Decision, FOMC Press Conference at Jan 26, US GDP quarterly report, US Core Durable Goods Orders monthly report, Initial Jobless Claims at Jan 27 and Michigan Consumer Sentiment at Jan 28.

USD/JPY Weekly outlook:

Technical View:

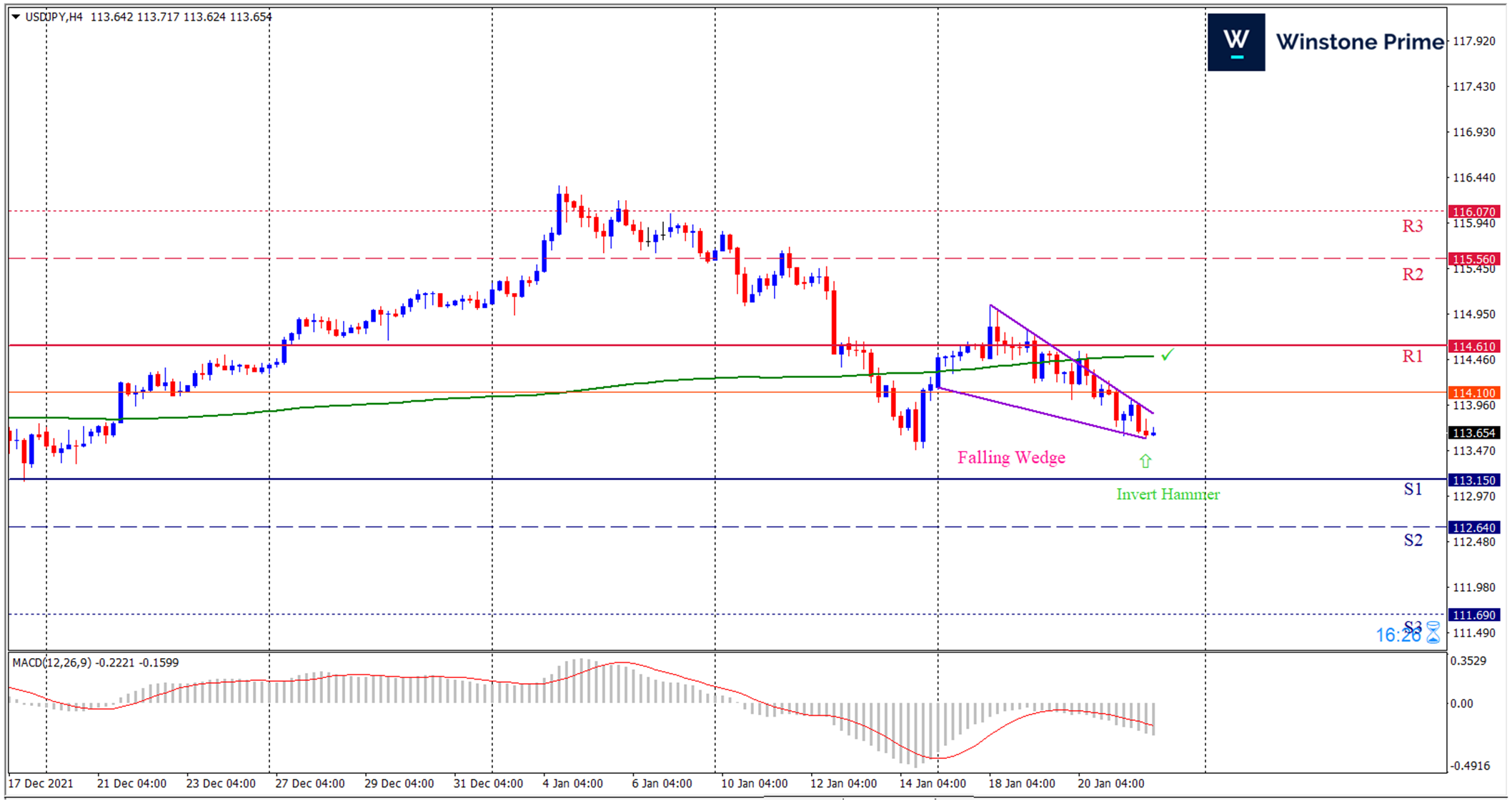

Last week’s high was 0.68 lower than the previous week. Maintaining high at 115.06 and low at 113.60 showed a movement of 146 pips.

In the upcoming week we expect USD/JPY to show a bullish trend. The currency pair is trading below the 200 Simple Moving Average and the MACD trades to the downside. A solid breakout above 114.61 may open a clean path towards 115.56 and may take a way up to 116.07. Should 113.15 prove to be unreliable support, the USDJPY may sink downwards 112.64 and 111.69 respectively. In H4 chart, if breakout of the falling wedge is to the upside then bullish expectation is favored. Also to be noted Invert hammer formation exerts the expectation of uptrend for the pair.

| Preference |

| Buy: 113.70 target at 115.05 and stop loss at 113.10 |

| Alternate Scenario |

| Sell: 113.10 target at 111.71 and stop loss at 113.70 |