Fundamental view:

Gold climbed up against the US dollar during the trading course of the week, with maintaining bid for 4 days of the week. The gains had a courtesy of Russia – Ukraine crisis amid Fed speaking ignored by market players. Russia deployed troops to the region, and Western nations feared an invasion. Moscow wants Ukraine to be permanently barred from joining the North Atlantic Treaty Organization (NATO) and want to cease all military activity in Eastern Europe. The West has aligned behind Kyiv, and at some point, Russia announced it would pull back troops, although in reality, it has done the opposite. Risk off sentiment intensified on the US’s warnings over a potential Russian incursion of Ukraine, favoring the safe haven – gold.

The FOMC meeting minutes was released on Wednesday. Inflation was mentioned 73 times in the text, indeed a record, we do not know how many of the more than 70 people present spoke. Policymakers supported a significant reduction in the balance sheet given its “high level of Federal Reserve securities holdings.” No indication was given for the timing or size of the expected reduction or whether it might be a passive roll-off or active sales. And no clue was provided to the question, will the March rate cut be 0.25% or 0.5%.

The major economic events deciding the movement of the pair in the next week are Fed Governor Bowman Speech at Feb 21, CB Consumer Confidence Index at Feb 22, GDP quarterly report, Initial Jobless Claims, EIA Crude Oil Stocks Change at Feb 24, Core Durable Goods Orders monthly report and Michigan Consumer Sentiment at Feb 25 for US.

XAU/USD Weekly outlook:

Technical View:

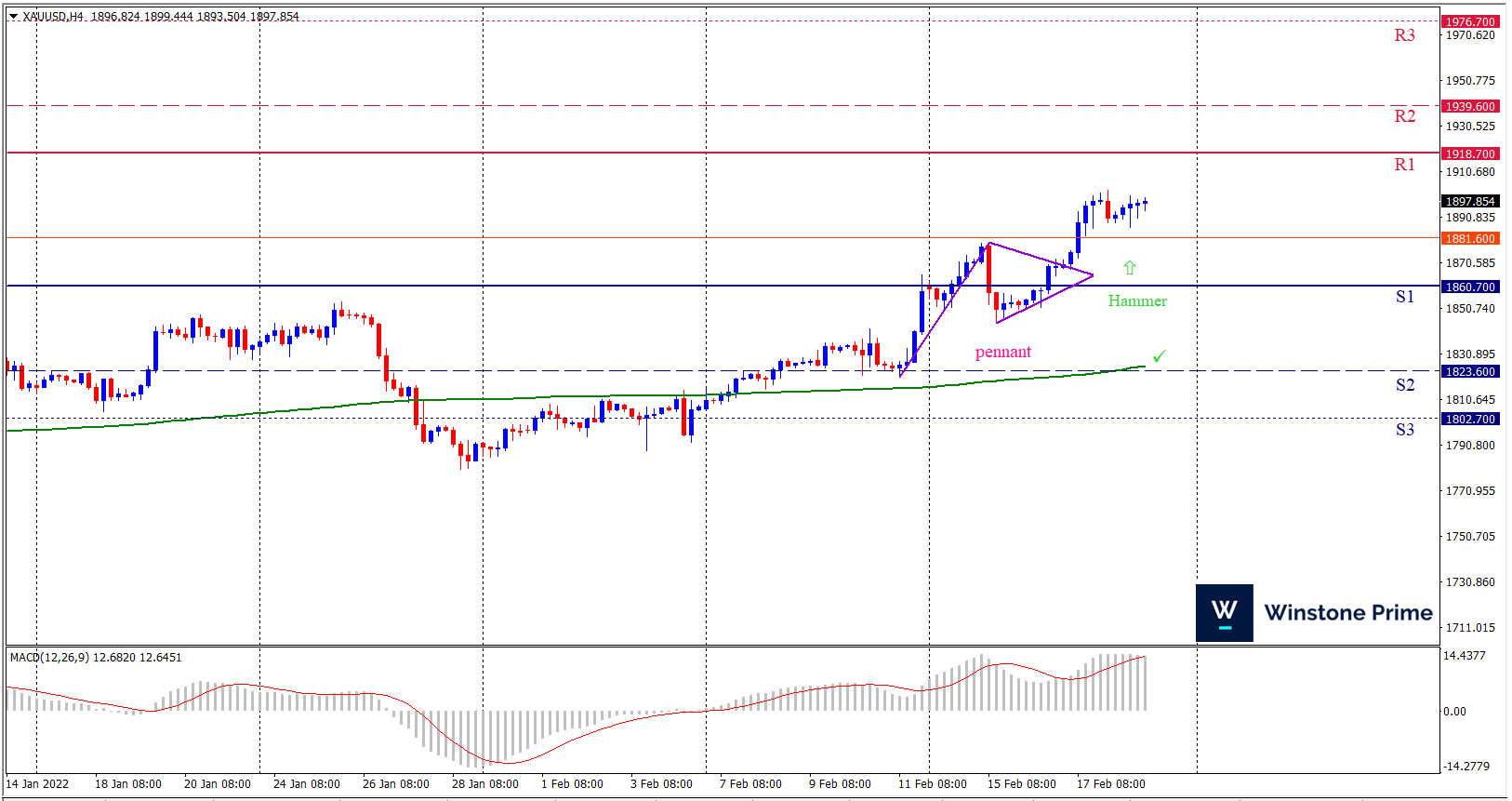

Last week’s high was 1.95% higher than the previous week. Maintaining high at 1902.4 and low at 1844.4 showed a movement of 580 pips.

In the upcoming week we expect XAU/USD to show a bullish trend. The Instrument is trading above the 200 Simple Moving Average and the MACD trades to the upside. A solid breakout above 1918.7 may open a clean path towards 1939.6 and may take a way up to 1976.7. Should 1860.7 prove to be unreliable support, the XAUUSD may sink downwards 1823.6 and 1802.7 respectively. In H4 chart pennant pattern favors prospects of a bullish trend. Also to be noted hammer formation exerts the expectation of uptrend for the pair.

| Preference |

| Buy: 1897.5 target at 1938.8 and stop loss at 1858.7 |

| Alternate Scenario |

| Sell: 1858.7 target at 1807.5 and stop loss at 1897.5 |