Fundamental view:

The US dollar has gone back and forth against the Japanese yen. Federal Reserve is flooding the market with dollars so it is possible to see this pair drop. But the market’s mood is mixed as participants are still trying to find equilibrium from fundamental headlines. The pair’s bounce has little to do with the dollar’s strength, instead of linked to a modest bounce in US Treasury yields and equities. Japan didn’t publish relevant data, with the focus on the US November Nonfarm Payrolls report. The country is expected to have added 481K new positions in the month, below the previous 638K. The unemployment rate is seen improving from 6.9% to 6.8%, while wages are expected to have risen by 0.1% MoM and 4.3% YoY.

In the past week, Japan Prelim Industrial Production monthly report and Housing Starts yearly report on 30th Nov and Japan Capital Spending on 1st Dec created a bearish trend for the pair whereas US Average Hourly Earnings m/m, Unemployment Rate & Factory Orders monthly report on 4th Dec created a bullish trend for the pair.

The major economic events deciding the movement of the pair in the next week are Japan GDP quarterly report at Dec 07, US Nonfarm Productivity quarterly at Dec 08, BoJ Corporate Goods Price Index monthly report, US JOLTS Job Openings at Dec 09, Initial Jobless Claims at Dec 10, and US CPI monthly report at Dec 11.

USD/JPY Weekly outlook:

Technical View:

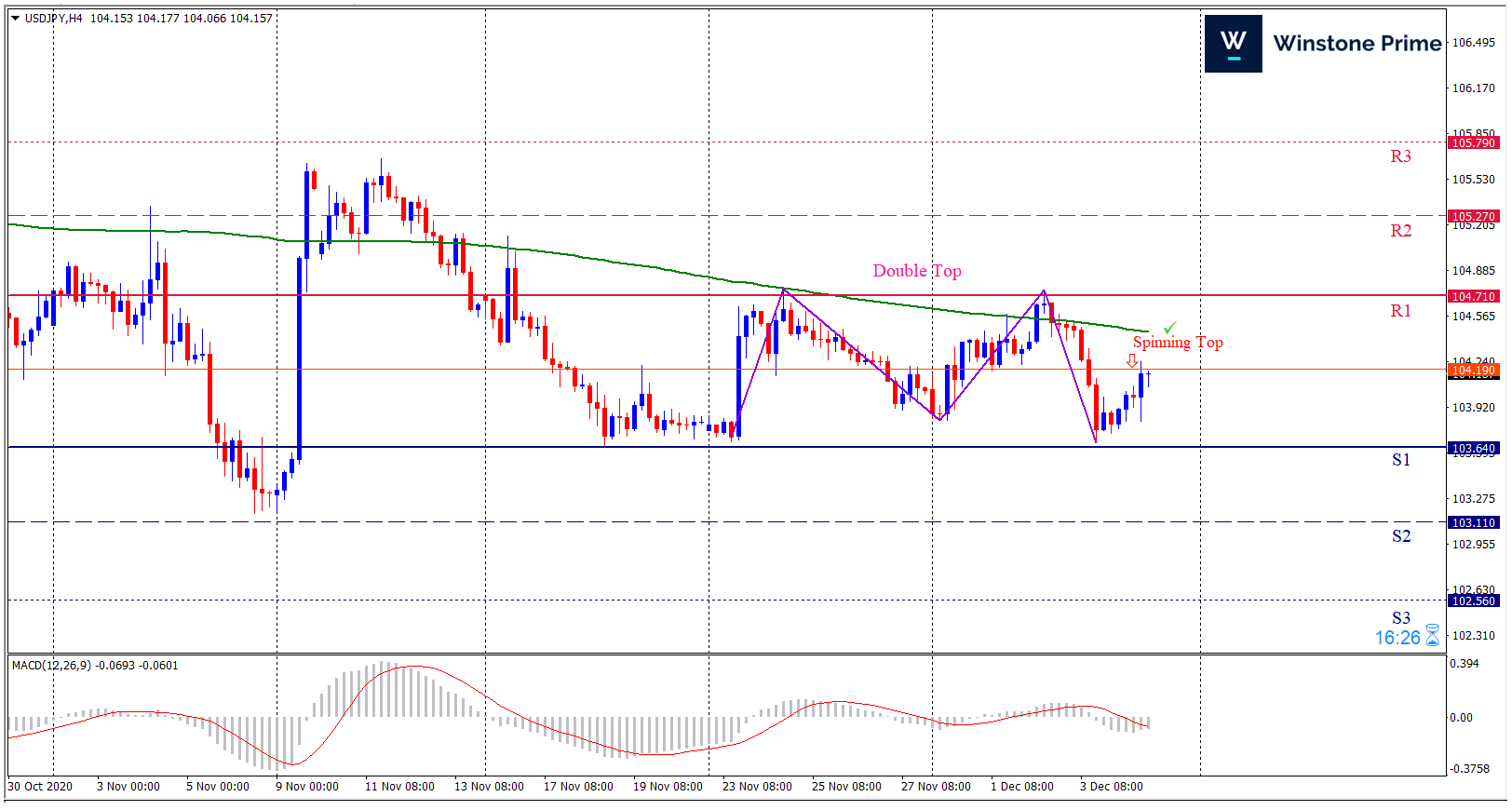

Last week’s high was 0.01% lower than the previous week. Maintaining high at 104.75 and low at 103.67 showed a movement of 108 pips.

In the upcoming week we expect USD/JPY to show a bearish trend. The currency pair is trading below the 200 Simple Moving Average and the MACD trades to the downside. A solid breakout below 103.64 may open a clean path towards 103.11 and may take a way down to 102.56. Should 104.71 prove to be unreliable resistance, the USDJPY may raise upwards 105.27 and 105.79 respectively. In H4 chart, Formation of double top pattern indicates reversal of the trend creating prospects of a bearish trend Along with a bullish spinning top formation braces our expectation.

| Preference |

| Sell: 104.18 target at 103.12 and stop loss at 104.76 |

| Alternate Scenario |

| Buy: 104.76 target at 105.78 and stop loss at 104.18 |