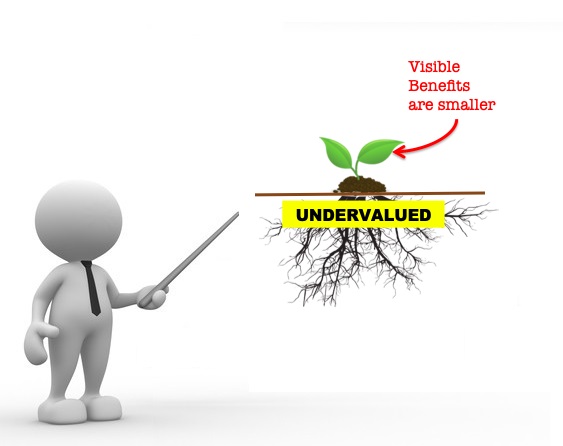

Undervalued Currency :

A undervalued currency is a currency with an exchange rate lower than it must to be. A currency may be undervalued, for instance, when its purchasing power, supply and demand are all strong, but its price is still comparatively low.

Currencies can be undervalued for some natural reasons like political crises which causes the rest of the world to become wary of holding that country’s assets or currency e.g., Brazil and Turkey in the 2013–2019 period.

On the other hand, Some governments keep their currencies undervalued deliberately as it makes their exports less expensive, but this is usually an unsustainable policy. e.g China, whose currency, the RMB (Renminbi yuan), is alleged to have been consistently undervalued by the People’s Bank of China (PBoC) since the early 1990s.

Pros :

- Suppose the currency is undervalued, the exports will be cheaper. In turn, Cheaper exports leads to greater employment in export industries.

- Undervaluation also makes foreign direct investment (FDI) more attractive to outside investors, since their currencies can be converted in to more undervalued currency, with which they can buy land, factories, or any local asset.

- Undervalued currency will make the imports expensive to the consumers, in turn they will divert to domestic goods and hence employment in domestic industries will increase.

Cons :

- As the import becomes expensive due to undervalued currency, this can lead to Imported inflation i.e. all the products using imported components/raw material will become expensive thus effecting the general price level.

- Undervaluation restricts the imports which mean reduced competition, which can make local firms less competitive.

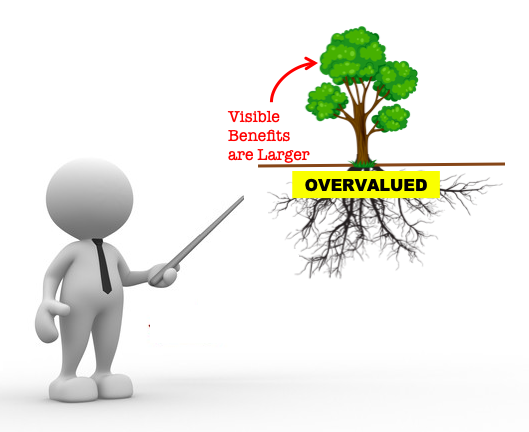

Overvalued Currency

Overvalued currency is the currency with the exchange rate higher exceeding what the market is willing to pay. For example, currency overvaluation may occur when central banks buy more of a currency that they ordinarily do.

Currencies can also be overvalued when foreigners want that currency in the exchange markets and wishing to hold assets in that nation.

Temporarily currencies may also be overloaded if the country’s central bank raises internal interest rates, and the foreigners in the rest part of the world wish to earn high interest then demand that currency in the spot market.

Overvalued currencies are more likely to be found in emerging countries. Although, there are many examples of overvaluation in the rich world, such as Norway and Switzerland.

Pros :

- Downward pressure on inflation i.e. imported goods will be cheaper.

- Will result in to more imports can be bought.

- Overvalued currency forces the domestic producers to improve their efficiency and competitive in the international market.

Cons:

- Overvalued currency will adverse effect on the export industries as it will make exports uncompetitive in the international market.

- Overvalued currency will make domestic industries to struggle as the consumer will buy more Imported products which are relatively cheaper due to overvalued currency.