Fundamental view:

Australian dollar has rallied significantly during the week. The United States is currently debating a stimulus package, which is normally bad for the US dollar and of course good for commodities which the Aussie dollar represents and this favored the Aussie in the last week.

In the past week, US Revised Nonfarm Productivity quarterly on 8th Dec and US JOLTS Job Openings on 9th Dec created bearish atmosphere for the pair whereas US Consumer Credit monthly report & Australia HPI quarterly report on 8th Dec and US Unemployment Claims on 10th Dec created bullish atmosphere for the pair.

The major economic events deciding the movement of the pair in the next week are RBA Meeting Minutes at Dec 15, US Retail Sales monthly report, US EIA Crude Oil Stocks Change, Fed Interest Rate Decision at Dec 16, Australia Employment Change, US Building Permits, and US Initial Jobless Claims at Dec 17.

AUD/USD Weekly outlook:

Technical View:

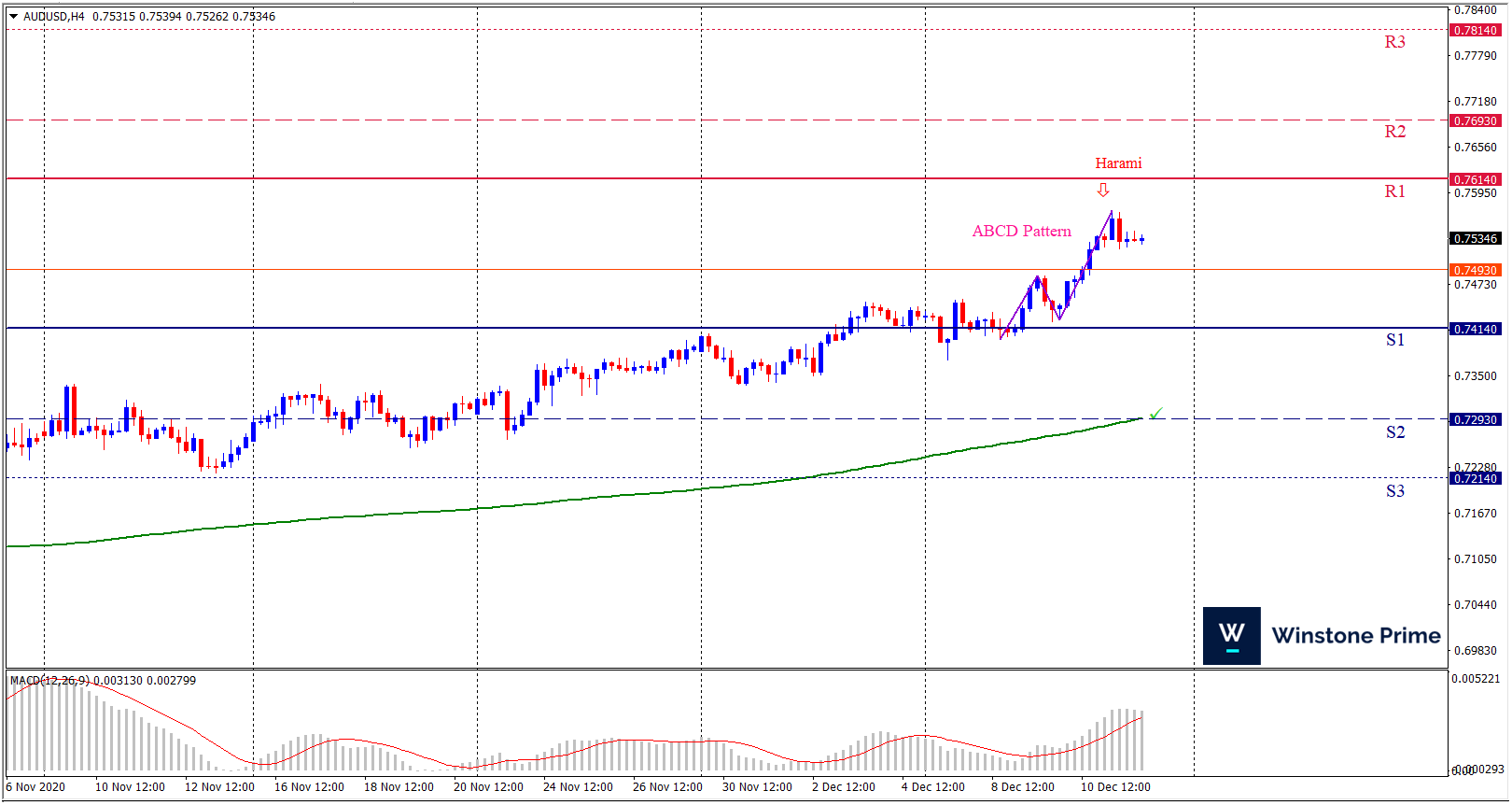

Last week’s high was 1.65% higher than the previous week. Maintaining high at 0.7572 and low at 0.7372 showed a movement of 200 pips.

In the upcoming week we expect AUD/USD to show a bearish trend. The currency pair is trading above the 200 Simple Moving Average and the MACD trades to the downside. A solid breakout below 0.7414 may open a clean path towards 0.7293 and may take a way down to 0.7214. Should 0.7614 prove to be unreliable resistance, the AUDUSD may raise upwards 0.7693 and 0.7814 respectively. In H4 chart ABCD pattern breakout favors prospects of a bearish trend. Also to be noted bearish harami formation exerts the expectation of downtrend for the pair.

| Preference |

| Sell: 0.7518 target at 0.7325 and stop loss at 0.7619 |

| Alternate Scenario |

| Buy: 0.7619 target at 0.7813 and stop loss at 0.7518 |