Fundamental view:

Aussie traded low against the greenback in this week. The Australian currency fell following the news from the Evergrande. Evergrande, a Chinese property giant, could default on $305 billion which could disrupting the country’s financial stability. Concerns were extended throughout the first half of the week but later eased on Thursday on market talks, the company may be split to avoid collapse but later on Friday news came indicating Chinese authorities are asking local governments to prepare for the potential downfall of Evergrande Group. The dismal market mood did not help the commodity-linked currency, also affected by falling gold prices. Amidst all these catalysts, Aussie showed a downtrend.

US Building Permits monthly report on 21st Sep and US New Home Sales on 24th Sep created downtrend whereas US EIA Crude Oil Imports Change on 22nd Sep and Australia Commonwealth Bank Services PMI on 23rd Sep created uptrend for the pair.

The major economic events deciding the movement of the pair in the next week are US Core Durable Goods Orders monthly report at Sep 27, Australia Retail Sales monthly report, US CB Consumer Confidence Index at Sep 28, Fed Chair Powell Speech at Sep 29, RBA Private Sector Credit monthly report, US GDP quarterly report, US Initial Jobless Claims at Sep 30 and US ISM Manufacturing PMI at Oct 01.

AUD/USD Weekly outlook:

Technical View:

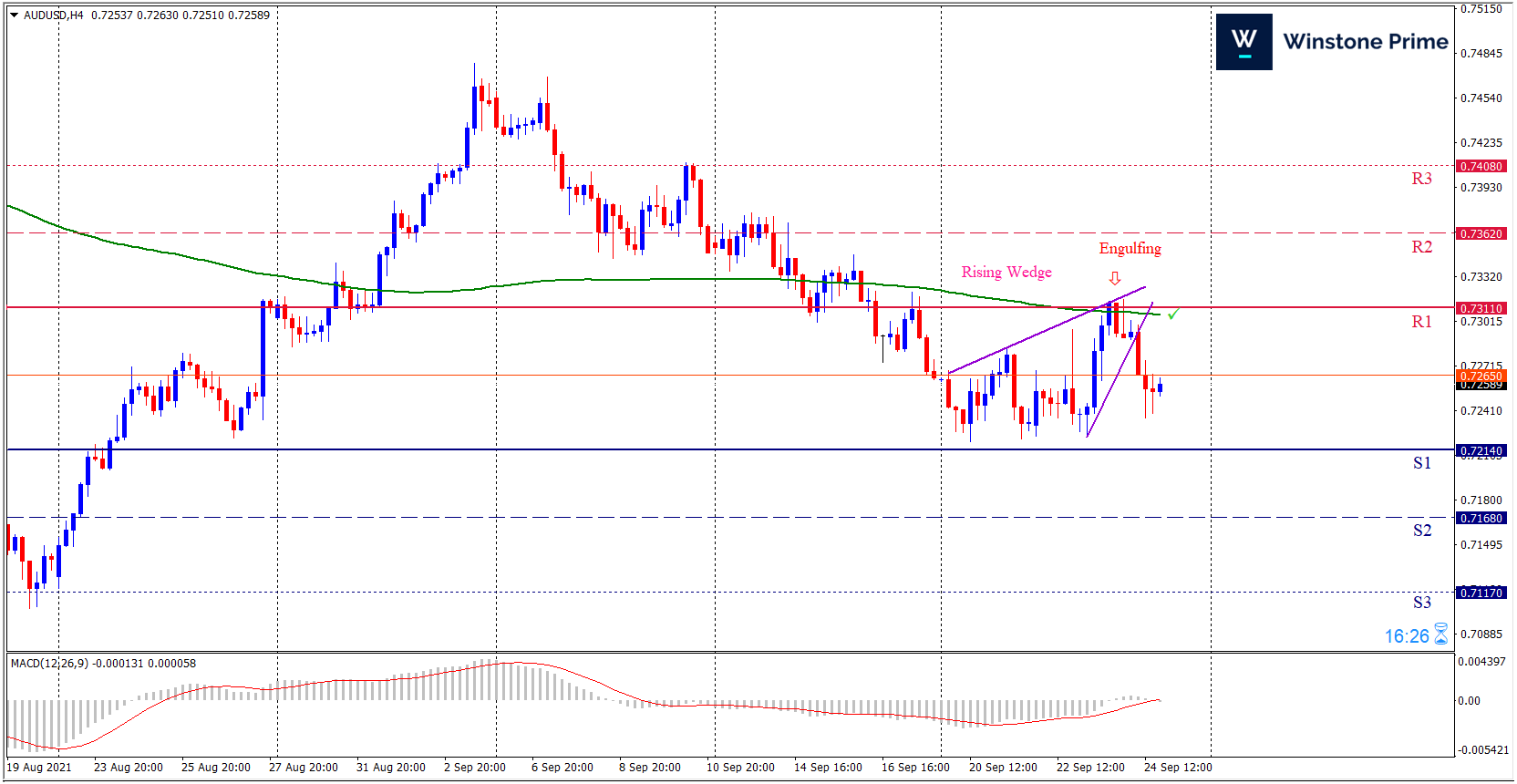

Last week’s high was 0.79% lower than the previous week. Maintaining high at 0.7317 and low at 0.7220 showed a movement of 97 pips.

In the upcoming week we expect AUD/USD to show a bearish trend. The currency pair is trading below the 200 Simple Moving Average and the MACD trades to the nearly neutral. A solid breakout below 0.7214 may open a clean path towards 0.7168 and may take a way down to 0.7117. Should 0.7311 prove to be unreliable resistance, the AUDUSD may raise upwards 0.7362 and 0.7408 respectively. In H4 chart rising wedge pattern breakout favors prospects of a bearish trend. Also to be noted bearish engulfing formation exerts the expectation of downtrend for the pair.

| Preference |

| Sell: 0.7255 target at 0.7169 and stop loss at 0.7316 |

| Alternate Scenario |

| Buy: 0.7316 target at 0.7407 and stop loss at 0.7255 |