Fundamental view:

The Australian dollar climbed higher against the American dollar and reached a fresh 2022 high – 0.7536. Although market had a risk averse environment, AUD climbed up with the help of commodity prices. Talking about the central banks, A slew of influential FOMC members, including Fed Chair Jerome Powell, left the door open for a larger rise in borrowing costs to bring down unacceptably high inflation. The markets were quick to price in the possibility of a 50 bps Fed rate hike move at the May policy meeting. On the other hand, Reserve Bank of Australia Governor Philip Lowe, maintained the patient stance, barely indicating that a rate hike before year-end is possible.

The escalating tensions in the Ukraine-Russia saga boosted commodity prices which helped the commodity linked currency – AUD. US President Joe Biden had a meeting with European leaders, G-7 partners, and NATO allies before a White House press briefing. Besides other things, Biden said he would support the expulsion of Russia from the G-20, noting that sanctions could not deter Russia but might eventually force it to end the invasion. Additionally, he said that the US does not confirm that it will send troops to Ukraine if the Kremlin decides to use weapons of mass destruction.

In this week, Fed Chair Powell Speech on 21st March, Commonwealth Bank Manufacturing PMI on 24th March and US Pending Home Sales monthly report on 25th March boosted downtrend whereas US New Home Sales on 23rd March and US Core Durable Goods Orders monthly report on 24th March boosted uptrend for the pair.

The major economic events deciding the movement of the pair in the next week are Retail Sales monthly report, US Goods Trade Balance at Mar 28, US CB Consumer Confidence Index at Mar 29, US ADP Nonfarm Employment Change, US GDP quarterly report at Mar 30, RBA Private Sector Credit ,US Initial Jobless Claims at Mar 31 and US Nonfarm Payrolls at Apr 01.

AUD/USD Weekly outlook:

Technical View:

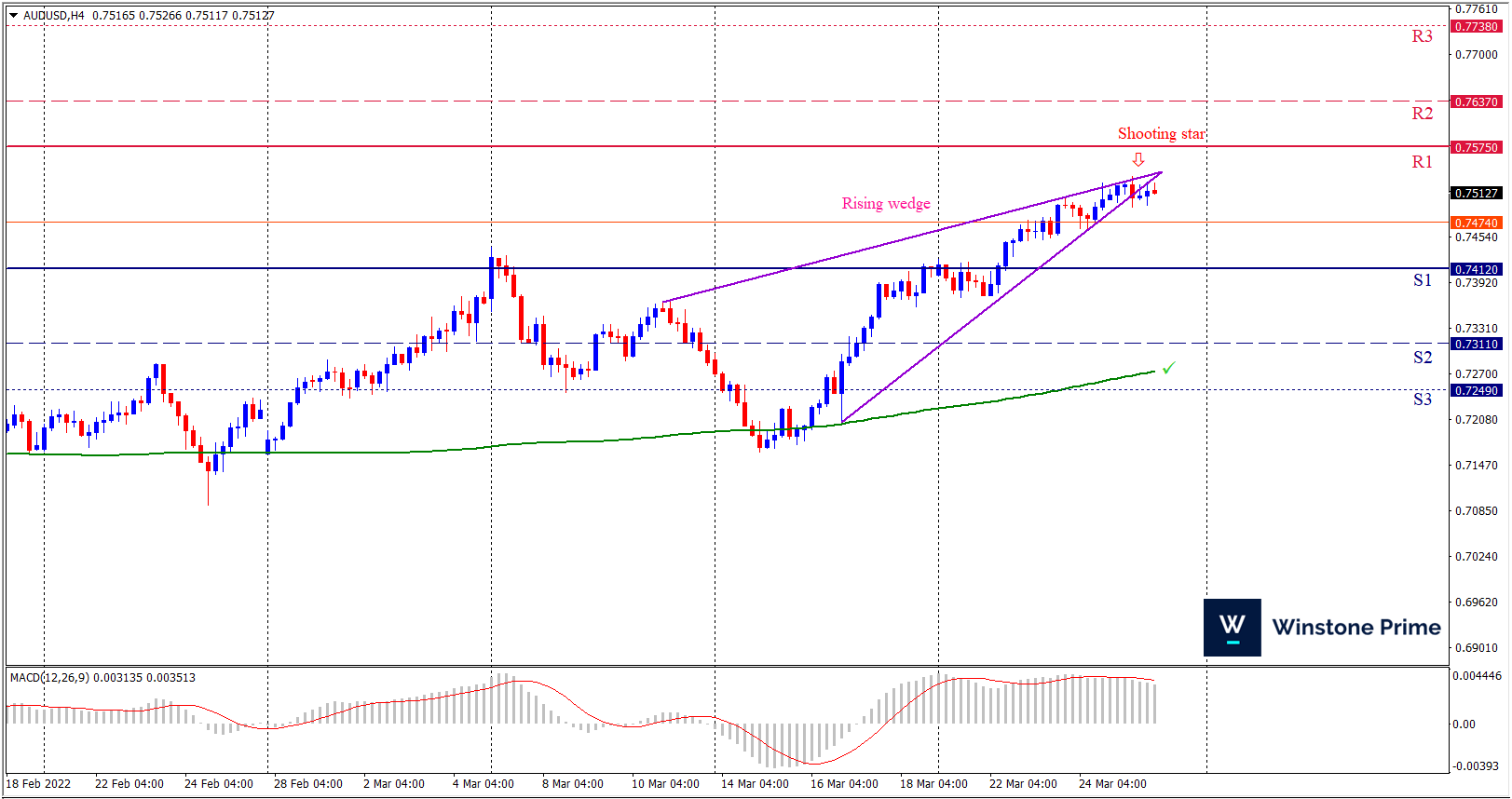

Last week’s high was 1.58% higher than the previous week. Maintaining high at 0.7536 and low at 0.7373 showed a movement of 163 pips.

In the upcoming week we expect AUD/USD to show a bearish trend. The currency pair is trading above the 200 Simple Moving Average and the MACD trades to the upside. Should 0.7412 proves to be unreliable support then the pair may fall further to 0.7311 and 0.7249 respectively whereas a solid breakout above 0.7575 will open a clear path upward to 0.7637 and then will further raise up to 0.7738. In H4 chart rising wedge pattern breakout favors prospects of a bearish trend. Also to be noted shooting star formation exerts the expectation of downtrend for the pair.

| Preference |

| Sell: 0.7511 target at 0.7372 and stop loss at 0.7580 |

| Alternate Scenario |

| Buy: 0.7580 target at 0.7737 and stop loss at 0.7511 |