Fundamental view:

The Australian dollar traded low against the American dollar during the trading course of the week. The divergence in the monetary policy was the major catalyst behind the move. US March’s Nonfarm Payrolls report came at 431K jobs added, more than the 80K foreseen by economists. Thus market perceived it as a solid report. Further, the Unemployment rate lowered from 3.8% YoY in February to 3.6% in March and beat the 3.7% expected.That keeps the Fed on track for aggressive monetary policy, which favored the greenback.

On the other hand, An interest rate hike in Australia this year is “plausible,” Reserve Bank of Australia (RBA) Governor Philip Lowe said last month The RBA gradually walked back on its pledge of no rate rise before 2024 and still remains in a patient mode after highlighting that the war in Ukraine is a major new source of uncertainty in its March policy announcements. The RBA is about to maintain its stance even in coming days as it is unlikely to change this time around, as it may continue to remain data-dependent, waiting for signs of wage inflation before responding to broad inflationary pressures.

In this week, Australia Retail Sales monthly report on 29th March and US GDP quarterly report on 30th March favored bullish trend whereas Australia NAB Quarterly Business Confidence on 28th March, US Core PCE Price Index monthly report on 31st March and Nonfarm Payrolls on 1st April the bearish trend for the pair.

The major economic events deciding the movement of the pair in the next week are Australia Commonwealth Bank Services PMI at Apr 04, RBA Interest Rate Decision, US ISM Non-Manufacturing PMI, Fed Governor Brainard Speech at Apr 05, EIA Crude Oil Stocks Change, FOMC Minutes at Apr 06, US Initial Jobless Claims at Apr 07, RBA Financial Stability Review and US WASDE Report at Apr 08.

AUD/USD Weekly outlook:

Technical View:

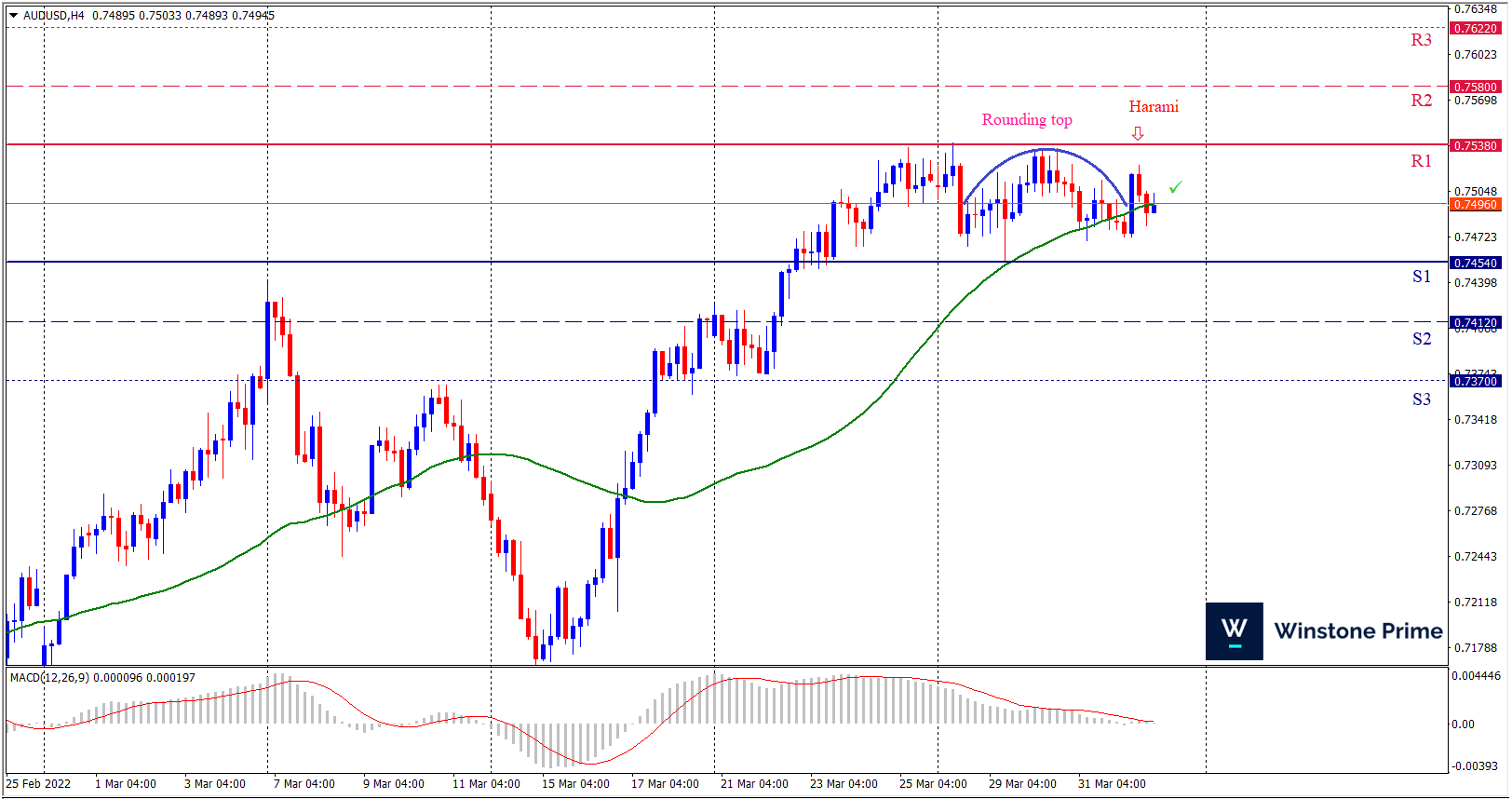

Last week’s high was 0.04% higher than the previous week. Maintaining high at 0.7539 and low at 0.7455 showed a movement of 84 pips.

In the upcoming week we expect AUD/USD to show a bearish trend. The currency pair is trading below the 50 Simple Moving Average and the MACD trades to nearly neutral. Should 0.7454 proves to be unreliable support then the pair may fall further to 0.7412 and 0.7370 respectively whereas a solid breakout above 0.7538 will open a clear path upward to 0.7580 and then will further raise up to 0.7622. In H4 chart rounding top pattern favors prospects of a bearish trend. Also to be noted bearish harami formation exerts the expectation of downtrend for the pair.

| Preference |

| Sell: 0.7495 target at 0.7415 and stop loss at 0.7542 |

| Alternate Scenario |

| Buy: 0.7542 target at 0.7621 and stop loss at 0.7495 |