Fundamental view:

Bitcoin showed a downtrend against the dollar in this week. The adoption of the Bitcoin remains strong but investors does not seem to be interested in it. This week, Twitter released an update providing Twitter users with a Strike account to tip BTC through the Lightning Network. While the rumors of this development were outed a while ago, this feature will allow users to send money across borders without going through intermediaries like Western Union or MoneyGram. According to a recent report by JP Morgan, the Bitcoin futures was in backwardation in May and July, indicating dwindling interest from institutions. All these has helped the Bitcoin Adoption.

On the other hand, Things are getting worse for crypto in China. The People’s Bank of China (PBOC) said bitcoin, ether and stablecoin tether do not qualify as legal tender and cannot be used in the currency market. According to China journalist Colin Wu, the latest central bank statement is quite detailed and mentions tether as illegal for the first time. Tether, the largest stablecoin per market value, is widely used to fund crypto purchases and as collateral in decentralized finance. Amidst all this catalysts Bitcoin showed a downtrend.

The major economic events deciding the movement of the pair in the next week are Core Durable Goods Orders monthly report at Sep 27, CB Consumer Confidence Index at Sep 28, EIA Crude Oil Stocks Change, Fed Chair Powell Speech at Sep 29, GDP quarterly report, Initial Jobless Claims at Sep 30, ISM Manufacturing PMI at Oct 01 for US.

BTC/USD Weekly outlook:

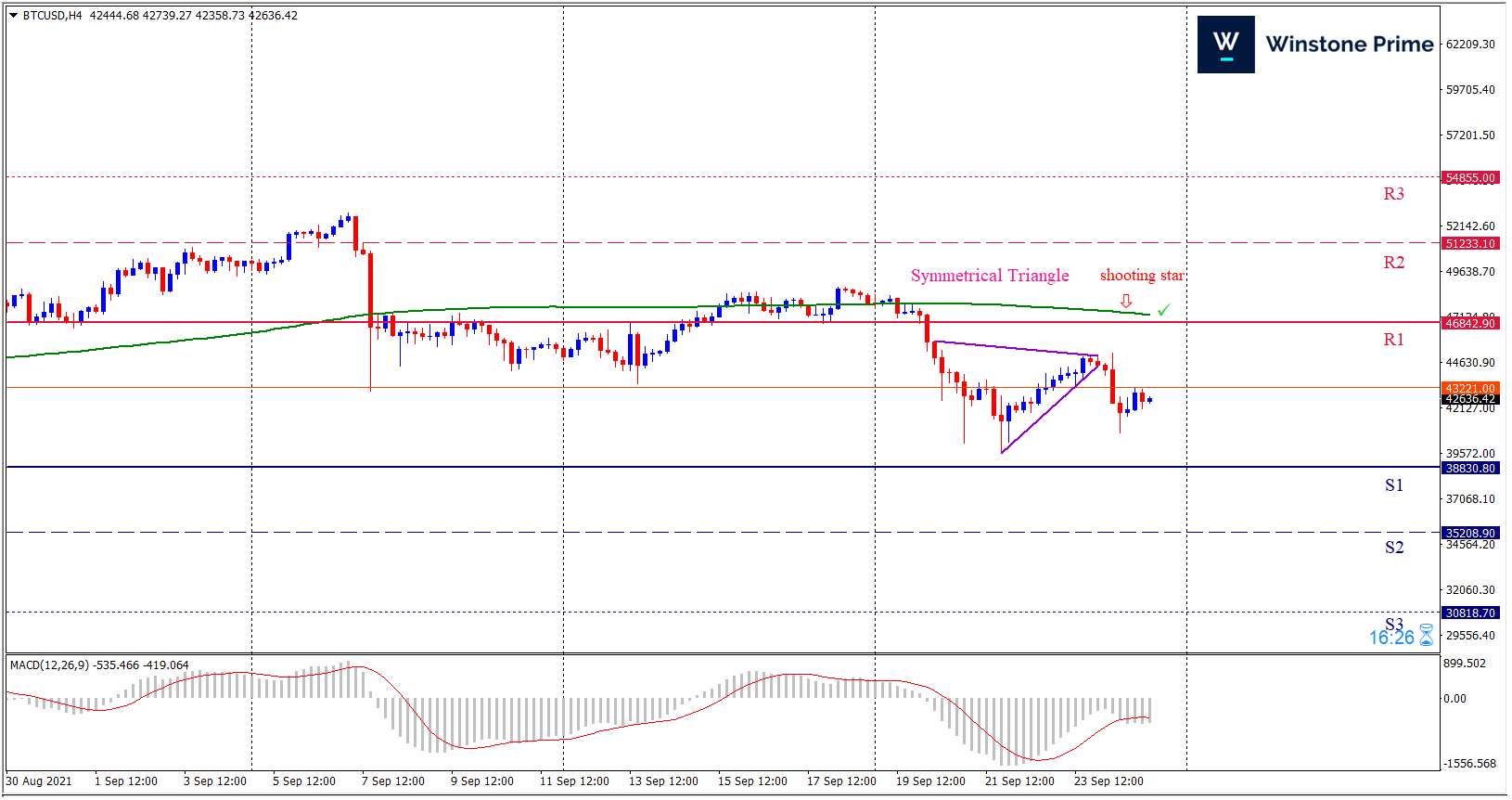

Technical View:

Last week’s high was 2.41% lower than the previous week. Maintaining high at 47611.1 and low at 39599.0 showed a movement of 8012 pips.

In the upcoming week we expect BTC/USD to show a bearish trend. The Instrument is trading below the 200 Simple Moving Average and the MACD trades to the downside. A solid breakout below 38830.8 may open a clean path towards 35208.9 and may take a way down to 30818.7. Should 46842.9 prove to be unreliable resistance, the BTCUSD may raise upwards 51233.1 and 54855.0 respectively. In H4 chart symmetrical triangle pattern breakout favors prospects of a bearish trend. Shooting star pattern constructs a bearish outlook for the pair in the upcoming week.

| Preference |

| Sell: 42580.9 target at 35209.3 and stop loss at 46847.5 |

| Alternate Scenario |

| Buy: 46847.5 target at 54854.4 and stop loss at 42580.9 |