Fundamental view:

Bitcoin traded high against the US dollar during the trading course of the week. News of Russia accepting cryptocurrency in exchange of oil and gas exports favors the Bitcoin. Russia’s head of the energy committee has said the country is willing to accept bitcoin in exchange for oil and gas exports from countries like China and Turkey, as sweeping sanctions over its war in Ukraine hit trade. In a news conference televised on Thursday, Pavel Zavalny said Western countries can pay in the ruble and gold if they want to buy Russian energy, according to translated remarks. But for “friendly” countries like China and Turkey, the country is open to payment in their own currencies – or even in the leading cryptocurrency, he said. Meanwhile, US Secretary of the Treasury Janet Yellen nodded to the benefits offered by cryptocurrencies, stating that the Treasury wants to provide guidance for future regulation that supports innovation in the space, this also helped the Bitcoin bulls.

On the other hand, Federal Reserve Chairman Jerome Powell talked about the need to establish new regulation for crypto currency during a panel discussion on digital currencies organized by the Bank for International Settlements (BIS). He noted that new forms of digital money, including cryptocurrencies and stablecoins, will require new rules to protect consumers. This news weighed on the Bitcoin. Besides this, FOMC members hawkish stance on rate hike and escalating Ukraine saga weighed on the Bitcoin.

The major economic events deciding the movement of the pair in the next week are Goods Trade Balance at Mar 28, CB Consumer Confidence Index at Mar 29, ADP Nonfarm Employment Change, GDP quarterly report, EIA Crude Oil Stocks Change at Mar 30, Initial Jobless Claims at Mar 31 and Nonfarm Payrolls at Apr 01 for US.

BTC/USD Weekly outlook:

Technical View:

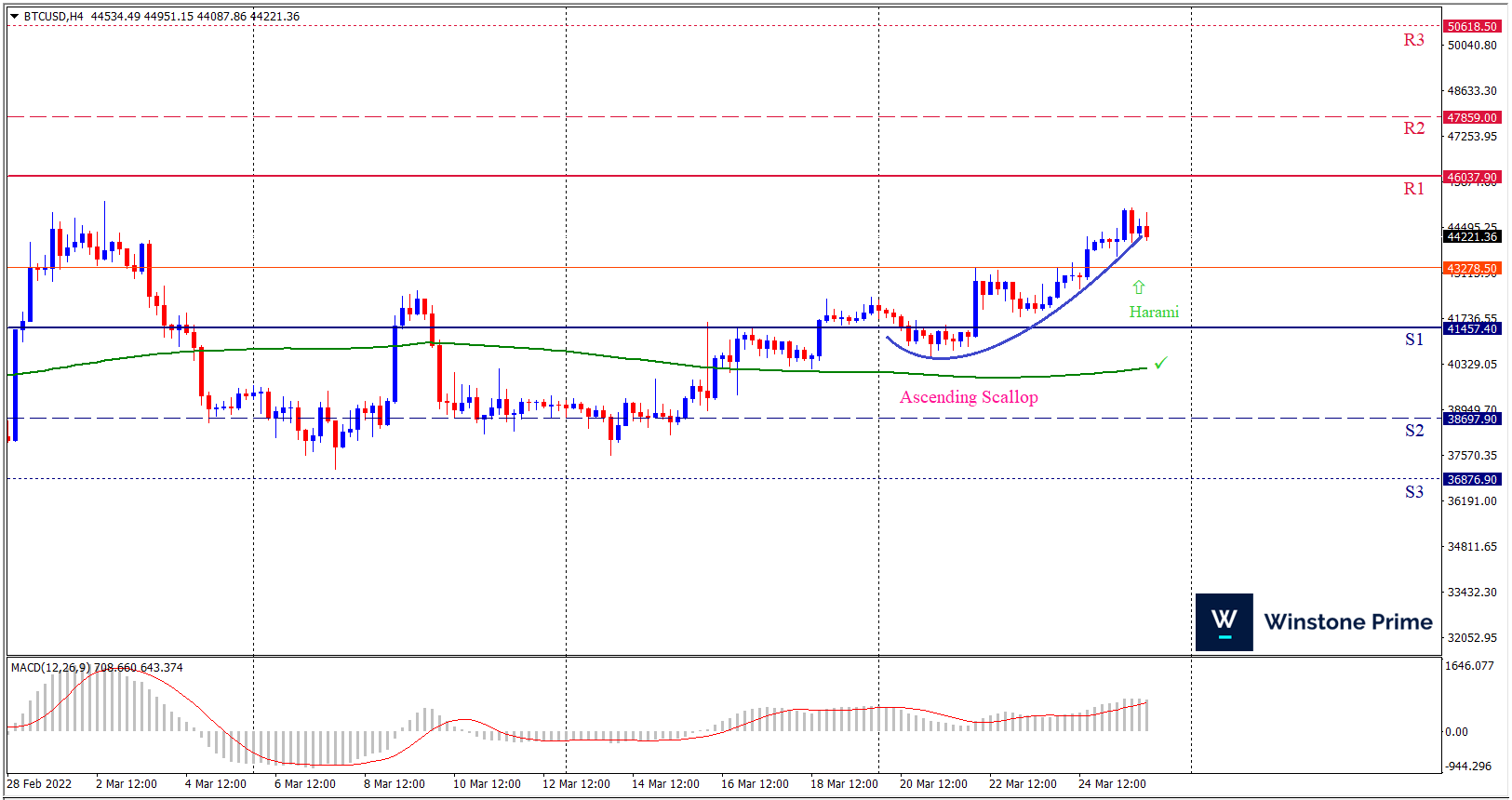

Last week’s high was 6.05% higher than the previous week. Maintaining high at 45099.5 and low at 40519.0 showed a movement of 4580 pips.

In the upcoming week we expect BTC/USD to show a bullish trend. The Instrument is trading above the 200 Simple Moving Average and the MACD trades to the upside. A solid breakout above 46037.9 may open a clean path towards 47859.0 and may take a way up to 50618.5. Should 41457.4 prove to be unreliable support, the BTCUSD may sink downwards 38697.9 and 36876.9 respectively. In H4 chart ascending scallop pattern favors prospects of a bullish trend. Bullish harami pattern constructs a bullish outlook for the pair in the upcoming week.

| Preference |

| Buy: 44268.5 target at 48387.9 and stop loss at 41452.6 |

| Alternate Scenario |

| Sell: 41452.6 target at 36877.4 and stop loss at 44268.5 |