- Pound climbed against the greenback with investors showing shaky optimism towards diplomatic solution on the Ukraine crisis.

- Russian oil for imports severely impacted the sterling.

- Investors keep an eye in the US Consumer Price Index (CPI) numbers, which is due later today.

Cable is trading high cheering the much-awaited compromise between the Kremlin and Kyiv. Ukraine has agreed to the stipulations of Moscow and is ready for a diplomatic solution to halt the deaths and destruction in Ukraine. This has build confidence in investors and they are turning towards the risk perceived assets like pound.

In a interview on Tuesday, Ukrainian President Volodymyr Zelensky again called on Russian President Vladimir Putin for dialogue, stressing that Ukraine is ready to talk and seek compromises, but is not ready to capitulate.

“First of all, I’m ready for a dialogue, but we’re not ready for surrender,” Zelensky said when asked whether Ukraine is ready to comply with the demands of the Russian Federation for a ceasefire: to change the Constitution and refuse to join NATO, recognize Crimea as Russian, recognize the independence of the so-called LPR/DPR.

He added “Because it’s not about me, it’s about the people who elected me. Regarding NATO, I lost interest in this issue after we realized that NATO is not ready to accept Ukraine. The alliance is afraid of contradictory things and confrontation with the Russian Federation.” A meeting between the two countries will, reportedly, be on Thursday in Turkey.

Meanwhile, The Pound was severely impacted by the the prohibition of Russian oil for imports. The US had levied a ban on Russian oil on the US ports. And the British is determined to discontinue the imports of Russian oil by the end of 2022.

US will not be effected with the ban of Russian oil as it produces oil itself and does not bank heavily on imports from Russia. However, a nation like the UK, which heavily depends upon oil imports from Russia will face major turmoil in shuffling the suppliers going forward.

However, risk appetite has returned to the market with investors having shaky optimism about a diplomatic solution to the conflict.

Apart from the Russia- Ukraine meeting, The other main event due today is U.S. inflation data, The US CPI is likely to land at 7.6%, higher than the prior figure of 7.5%.

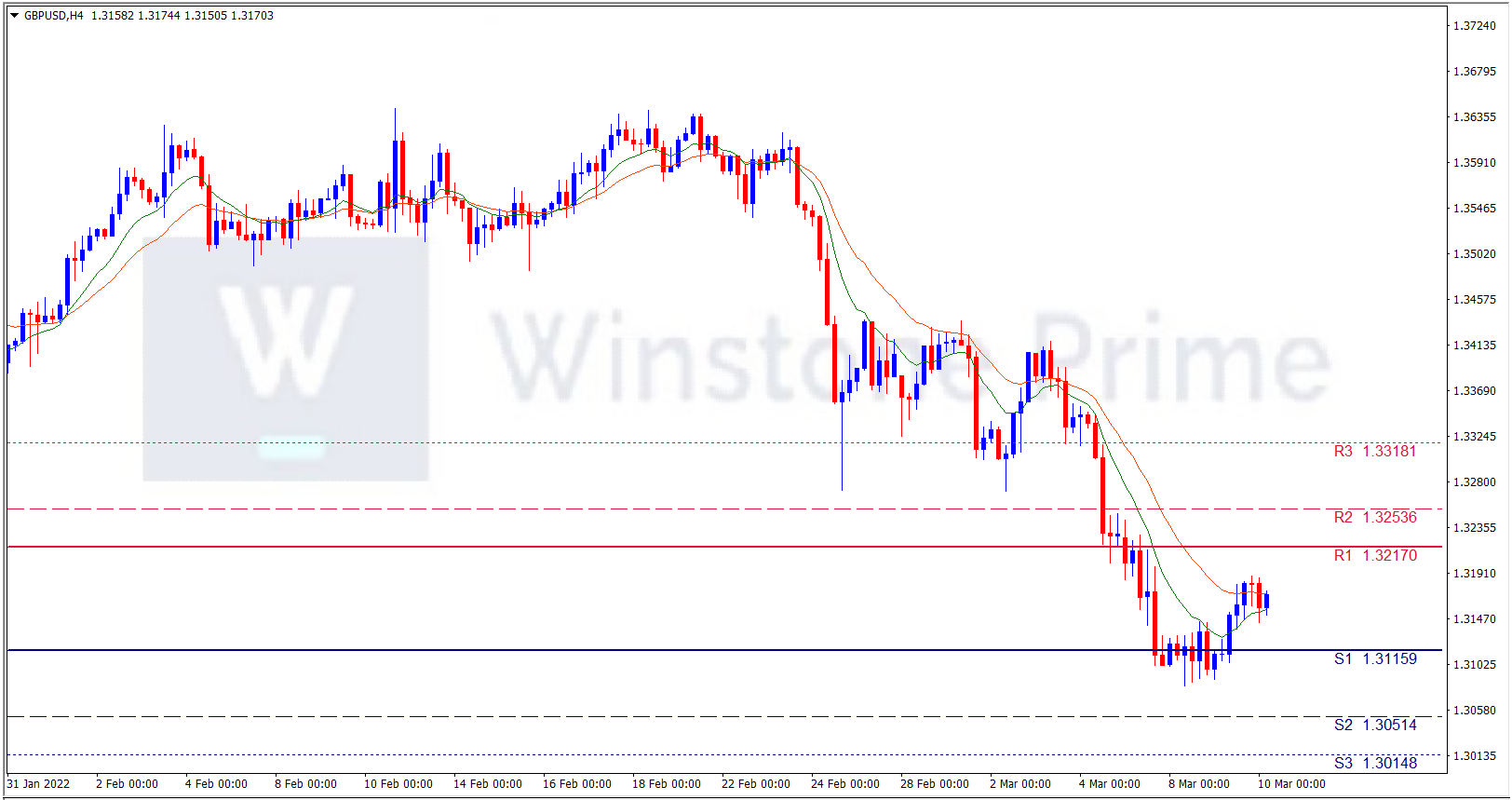

GBP/USD 4 Hour Chart:

Support: 1.3116 (S1), 1.3051 (S2), 1.3015 (S3).

Resistance: 1.3217 (R1), 1.3254 (R2), 1.3318 (R3).

Pound trades high with market cheering the compromise between the Kremlin and Kyiv. We expect a bullish trend for GBP/USD.