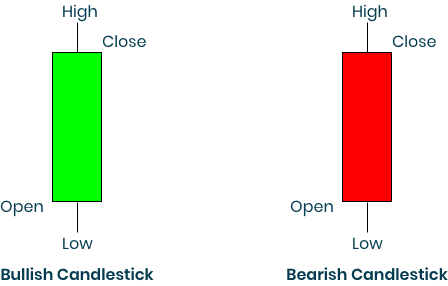

A Candlestick is a type of a price chart that displays the open, high, low and close of specific security for a given time period.

The vertical rectangle of the candlestick represents the real body and can be used to identify if the closing price was higher or lower than the opening price.

Generally, green is used to represent a bullish pattern meaning the closing price of the stock was higher than the opening price and red is used to represent a bearish pattern meaning the closing price was lower than the opening price. Here is a pictorial representation of the same below:

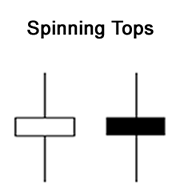

Trend: Neutral

A spinning top is a candlestick pattern with a short real body that’s vertically centered between long upper and lower shadows. The candlestick pattern represents indecision about the future direction of the asset. Neither the buyers nor the sellers could gain the upper hand. The buyers pushed the price up during the period, and the sellers pushed the price down during the period, but ultimately the closing price ended up very close to the open. After a strong price advance or decline, spinning tops can signal a potential price reversal, if the candle that follows confirms.

Find the Bearish and Bullish candlestick chart below:

Trend: Neutral

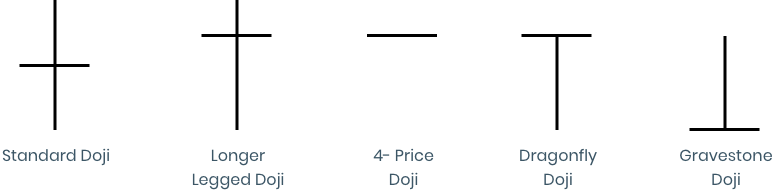

In doji candlestick, there is no body is almost have same opening & closing price near the opening price and can have long shadows formed for the high and low prices, which were tested but fought back from by each side.

A Doji candle is the name given to patterns which signify indecision in the price action of a chart.

Usually, they form at areas where the bulls and bears commence battle and are fighting each other for direction.

This pattern signifies uncertainty, indecision, and is waiting for either the bulls or bears to take control. Often the next direction is an upwards or downwards sustained move in price as the Chart breaks beyond the Doji candle.

Although the Doji candle is often not a great entry candle for a trade (due to its nature it could be broken either way by the bulls or bears), it does offer a heads up that sentiment may be changing.

Find the Doji candlestick chart below:

Standard &Long legged Doji Chart

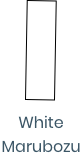

Marubozu means there are no shadows from the bodies.

Trend: Bullish

White Marubozu contains a long white body with no shadows. The open price equals the low price and the close price equals the high price.

This is a very bullish candle as it shows that buyers were in control the entire session. It usually becomes the first part of a bullish continuation or a bullish reversal pattern.

Trend: Bearish

Black Marubozu contains a long black body with no shadows. The open equals the high and the close equals the low.

This is a very bearish candle as it shows that sellers controlled the price action the entire session. It usually implies bearish continuation or bearish reversal.

Find the Bearish and Bullish candlestick chart below:

Bearish Marubozu Chart

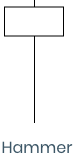

Trend: Bullish

The hammer is a bullish reversal pattern that forms during a downtrend. It is named because the market is hammering out a bottom. When price is falling, hammers signal that the bottom is near and price will start rising again. The long lower shadow indicates that sellers pushed prices lower, but buyers were able to overcome this selling pressure and closed near the open.Just because you see a hammer form in a downtrend doesn’t mean you automatically place a buy order! More bullish confirmation is needed before it’s safe to pull the trigger.

Recognition Criteria for Hammer:

- The long shadow is about two or three times of the real body.

- Little or no upper shadow.

- The real body is at the upper end of the trading range.

- The color of the real body is not important.

Find the Bullish candlestick chart below:

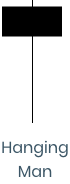

Trend: Bearish

The hanging man is a bearish reversal pattern that can also mark a top or strong resistance level. When price is rising, the formation of a hanging man indicates that sellers are beginning to outnumber buyers. The long lower shadow shows that sellers pushed prices lower during the session. Buyers were able to push the price back up some but only near the open. This should set off alarms since this tells us that there are no buyers left to provide the necessary momentum to keep raising the price.

Recognition Criteria Hanging Man:

- A long lower shadow which is about two or three times of the real body.

- Little or no upper shadow.

- The real body is at the upper end of the trading range.

- The color of the body is not important, though a black body is more bearish than a white body.

Find the Bullish candlestick chart below:

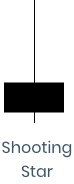

Trend: Bearish

The shooting star is a bearish reversal pattern that looks identical to the inverted hammer but occurs when price has been rising. Its shape indicates that the price opened at its low, rallied, but pulled back to the bottom. This means that buyers attempted to push the price up, but sellers came in and overpowered them. This is a definite bearish sign since there are no more buyers left because they’ve all been murdered.

Find the Bearish candlestick chart below:

Trend: Bullish

The bullish engulfing pattern is a two-candlestick pattern that signals a strong up move may be coming. It happens when a bearish candle is immediately followed by a larger bullish candle. This second candle “engulfs” the bearish candle. This means buyers are flexing their muscles and that there could be a strong up move after a recent downtrend or a period of consolidation.

Trend: Bearish

The bearish engulfing pattern is the opposite of the bullish pattern. This type of candlestick pattern occurs when the bullish candle is immediately followed by a bearish candle that completely “engulfs” it. This means that sellers overpowered the buyers and that a strong move down could happen.

Trend: Bearish

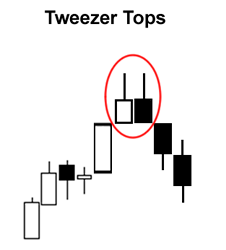

The tweezers are dual candlestick reversal patterns.

The Tweezer Tops candlestick pattern are usually be spotted after an extended uptrend, indicating that a reversal will soon occur.

The Tweezer Tops is opposite the overall trend. If price is moving up, then the second candle should be bearish.

Find the Bearish candlestick chart below:

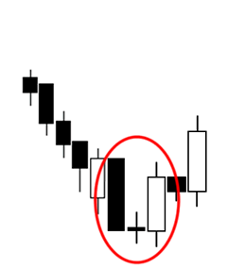

Trend: Bullish

The tweezers are dual candlestick reversal patterns.

The Tweezer Bottoms candlestick pattern are usually be spotted after an extended downtrend, indicating that a reversal will soon occur.

The Tweezer Bottoms candlestick is the same as the overall trend. If price is moving up, then the first candle should be bullish.

Find the Bullish candlestick chart below:

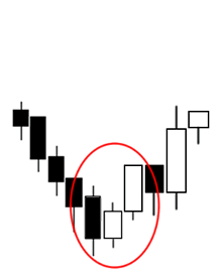

Trend: Bullish

The morning star is triple candlestick patterns that you can usually find at the end of a trend.They are reversal patterns that can be recognized through three characteristics.

We’ll use the morning star Pattern on the right as an example of what you may see:

- The first candlestick is a bearish candle, which is part of a recent downtrend.

- The second candle has a small body, indicating that there could be some indecision in the market. This candle can be either bullish or bearish.

- The third candlestick acts as a confirmation that a reversal is in place, as the candle closes beyond the midpoint of the first candle.

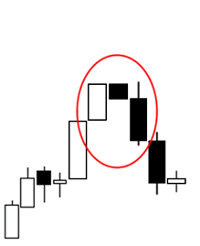

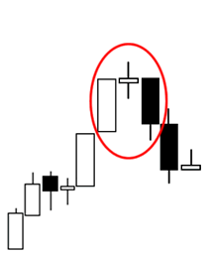

Trend: Bearish

The Evening Star is triple candlestick patterns that you can usually find at the end of a trend. They are reversal patterns that can be recognized through three characteristics.

We’ll use the Evening StarPattern on the right as an example of what you may see:

- The first candlestick is a bullish candle, which is part of a recent uptrend.

- The second candle has a small body, indicating that there could be some indecision in the market. This candle can be either bullish or bearish.

- The third candlestick acts as a confirmation that a reversal is in place, as the candle closes beyond the midpoint of the first candle.

Trend: Bullish

This type of triple candlestick pattern is considered as one of the most potent in-yo-face bullish signals, especially when it occurs after an extended downtrend and a short period of consolidation.

The first of the three soldiers is called the reversal candle. It either ends the downtrend or implies that the period of consolidation that followed the downtrend is over.

For the pattern to be considered valid, the second candlestick should be bigger than the previous candle’s body.

Also, the second candlestick should close near its high, leaving a small or non-existent upper wick.

For the three white soldiers pattern to be completed, the last candlestick should be at least the same size as the second candle and have a small or no shadow.

Find the Bullish candlestick chart below:

Trend: Bearish

The three black crows candlestick pattern is just the opposite of the three white soldiers. It is formed when three bearish candles follow a strong UPTREND, indicating that a reversal is in the works.

The second candle’s body should be bigger than the first candle and should close at or very near its low.

Finally, the third candle should be the same size or larger than the second candle’s body with a very short or no lower shadow.

Find the Bearish candlestick chart below:

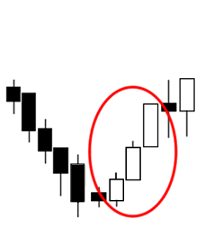

Trend: Bullish

The three inside up candlestick formation is a trend-reversal pattern that is found at the bottom of a DOWNTREND.

This triple candlestick pattern indicates that the downtrend is possibly over and that a new uptrend has started.

For a valid three inside up candlestick formation, look for these properties:

- The first candle should be found at the bottom of a downtrend and is characterized by a long bearish candlestick.

- The second candle should at least make it up all the way up to the midpoint of the first candle.

- The third candlestick needs to close above the first candle’s high to confirm that buyers have overpowered the strength of the downtrend.

Find the Bullish candlestick chart below:

Trend: Bearish

The three inside down candlestick formation is found at the top of an UPTREND. It means that the uptrend is possibly over and that a new downtrend has started.

A three inside down candlestick formation needs to have the following characteristics:

- The first candle should be found at the top of an uptrend and is characterized by a long bullish candlestick.

- The second candle should make it up all the way down the midpoint of the first candle.

- The third candlestick needs to close below the first candle’s low to confirm that sellers have overpowered the strength of the uptrend.

Find the Bearish candlestick chart below: