Monetary policy is determined by a country’s central bank acting independent from government. The process of drafting, announcing & Implementing the plan of actions taken by the Central Bank of a Country that controls the quantity of money in an Economy. Monetary policy involves money supply and interest rates, aimed at achieving macroeconomic objectives such as controlling inflation, consumption, growth and liquidity.

- Money supply and Interest rates

- Controlling inflation and consumption

- Economy Growth

- liquidity

Now we have learned about what monetary policy is, let’s go one step further. Have you ever heard monetary policy referred to as being Hawkish or Dovish? Pretty often, when reporting monetary policy releases, the media announces whether a central bank is adopting a “hawkish” or a “dovish” policy.

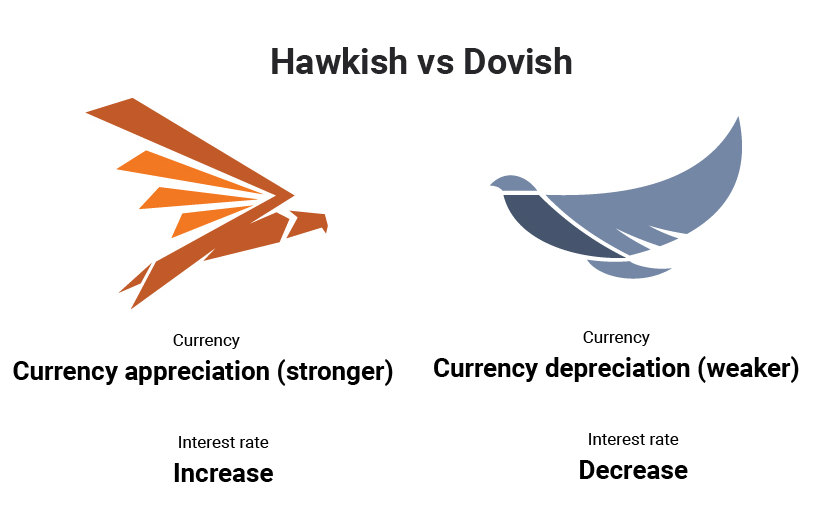

Central Bank monetary policies tend to affect the value of the currency in the Forex market. A hawkish monetary policy stance often results in the appreciation of a currency, while a dovish announcement will tend to have the opposite effect. The actions of the central banks determine the value of a particular currency and make it easier to predict the movements on the forex market. So it is important to keeps updated on monetary policy decision for Forex traders.

This article will clarify these concepts, and also explain better role of central banks in the Forex market. The better you as a trader understand this role and the effect of monetary policy, the better you can utilize basic fundamental analysis to trade Forex more profitably.

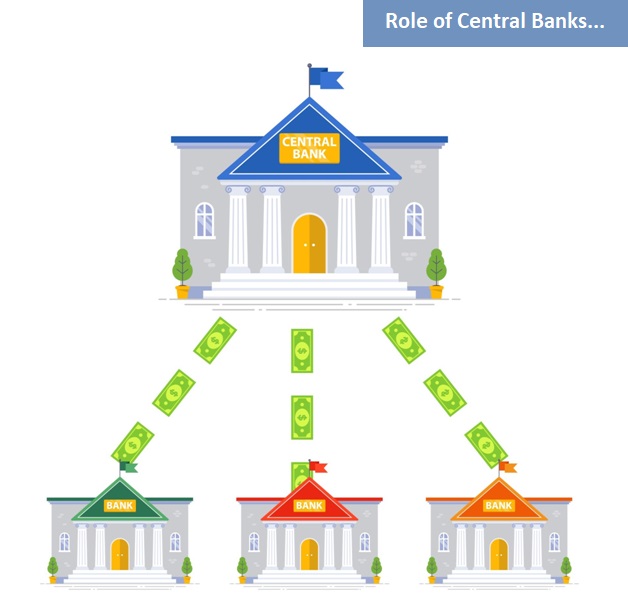

Role of Central Banks

A key role of central banks is to conduct monetary policy to achieve price stability and to help manage economic fluctuations. There are several tools that central banks can use to achieve these objectives. While the most prominent one is setting the interest rate, other tools can be used, such as open market operations. For instance, a central bank may reduce the amount of money by selling government bonds under a “sale and repurchase” agreement, thereby taking in money from commercial banks.

The purpose of such open market operations is to steer short-term interest rates, which in turn influence longer-term rates and overall economic activity.

Generally, in this context a central bank will pay most attention to setting the rate of interest, depending on its assessment of the current state of the economy as well as its forecasts. This assessment is key because it can tilt the balance towards a policy emphasizing increasing employment and economic growth, and policies whose main purpose is keeping inflation under control at a relatively low level.

Currencies tend to move the most when central bankers shift tones from dovish to hawkish or vice versa. For example, if a central banker was recently dovish, stating that the economy still requires stimulus and then, in a later speech, stated that they have seen inflation pressures rising and strong economic growth, you could see the currency appreciate against other currencies.

When you hear the word Hawkish, it means the central bank has tightened monetary policy by increasing interest rates or reducing the central bank’s balance sheet. A monetary policy stance is said to be hawkish if it forecasts future interest rate increases. Central bankers can also be said to be hawkish when they are positive about the economic growth outlook and expect inflation to increase.

When there is a Hawkish approach, the central bank uses all possible means to combat this inflation, which it considers to be the utmost threat that can exert recessionary pressures. Economic growth is not a priority. All means could be used to combat inflation, including an increase in interest rates.

A Hawkish policy is generally applied in a period of economic growth or recovery. In theory, a Hawkish policy is favorable to the currency appreciating on Forex.

Some words that could be used describing a hawkish monetary policy include:

- Strong economic growth

- Inflation increasing

- Reducing the balance sheet

- Tightening of monetary policy

- Interest rate hikes

Generally, words used that indicate increasing inflation, higher interest rates and strong economic growth lean towards a more hawkish monetary policy outcome.

When you hear the word Dovish, it means the central bank has loosened monetary policy by lowering interest rates or increasing quantitative easing to stimulate the economy they are said to be dovish. If central bankers are pessimistic about economic growth and expect inflation to decrease or become deflation and they signal this to the market through their projections or forward guidance, they are said to be dovish about the economy.

When there is a Dovish approach, the central bank uses all possible means to promote economic growth. Inflation is not a concern. A Dovish policy is marked by a fall in interest rates and the use of unconventional measures to boost the economy.

A Dovish policy is usually applied in a period of recession or overheating of the economy. In theory, a Dovish policy depreciates the currency on Forex.

Some words that could be used to describe a dovish monetary policy, include:

- Poor economic growth

- Inflation decreasing/deflation (negative inflation)

- Increasing the balance sheet

- Loosening of monetary policy

- Interest rate cuts

The terms “hawkish” and “dovish” in central banks are related to the attitude that those institutions take regarding the economic situations in their countries and their stance on monetary policy. Both words come from their respective animal features, the hawk and the dove, applied to the behavior of central bankers.

Hawkish refers to the actions that the central bankers will take to prevent high inflation in the economy of a country. They will then increase interest rates and dampen economic growth that is too fast. Dovish would be the opposite situation. Whenever the central banks want to avoid deflation or stimulate a slow economy, they decrease the interest rates. This action reduces the costs of obtaining credit, helping to improve the growth of the economy.

Hawkish and dovish are opposite stances of policymakers. Hawkish central bankers will increase interest rates to prevent inflation or heated economic growth. If a central bank decides to be hawkish, the currency of the country will likely strengthen, making it attractive for Forex investors.

On the other hand, a dovish central banker will reduce the interest rates to promote growth and prevent deflation. If a central bank becomes dovish, then the value of the currency will usually decline, making it cheaper for foreigners to purchase goods and services in that country. This action also stimulates the investments of other countries and helps economic growth.

Conclusion:

Forex traders can profitably increase their trading discrepancies by monitoring the central banks’ policies governing the currencies they trade in and trading accordingly. The increasing or decreasing of the interest rates has many consequences on the Forex markets. So, currency traders and investors pay close attention to the information that the central banks announce periodically.

In a country where the central bank decisions are hawkish, investors will start placing their money in the currency of that country, so they can benefit from the high-interest rates that it offers. Hawkish doesn’t mean that the currency will strengthen immediately, but it is a sign that the possibilities are high that it will, so it is assumed to be a safe bet.

In a country where the central bank is dovish, Forex traders will be selling the currency of that country as they will expect its value to decline. International trade will also be affected as the costs of goods and services from this country will decrease at a global level, which leads to more demand from abroad. However, It is essential to pay attention to how low interest rates go because if they are still higher than other countries, it probably will mean that there won’t be so significant changes in the value of that currency.