Fundamental view:

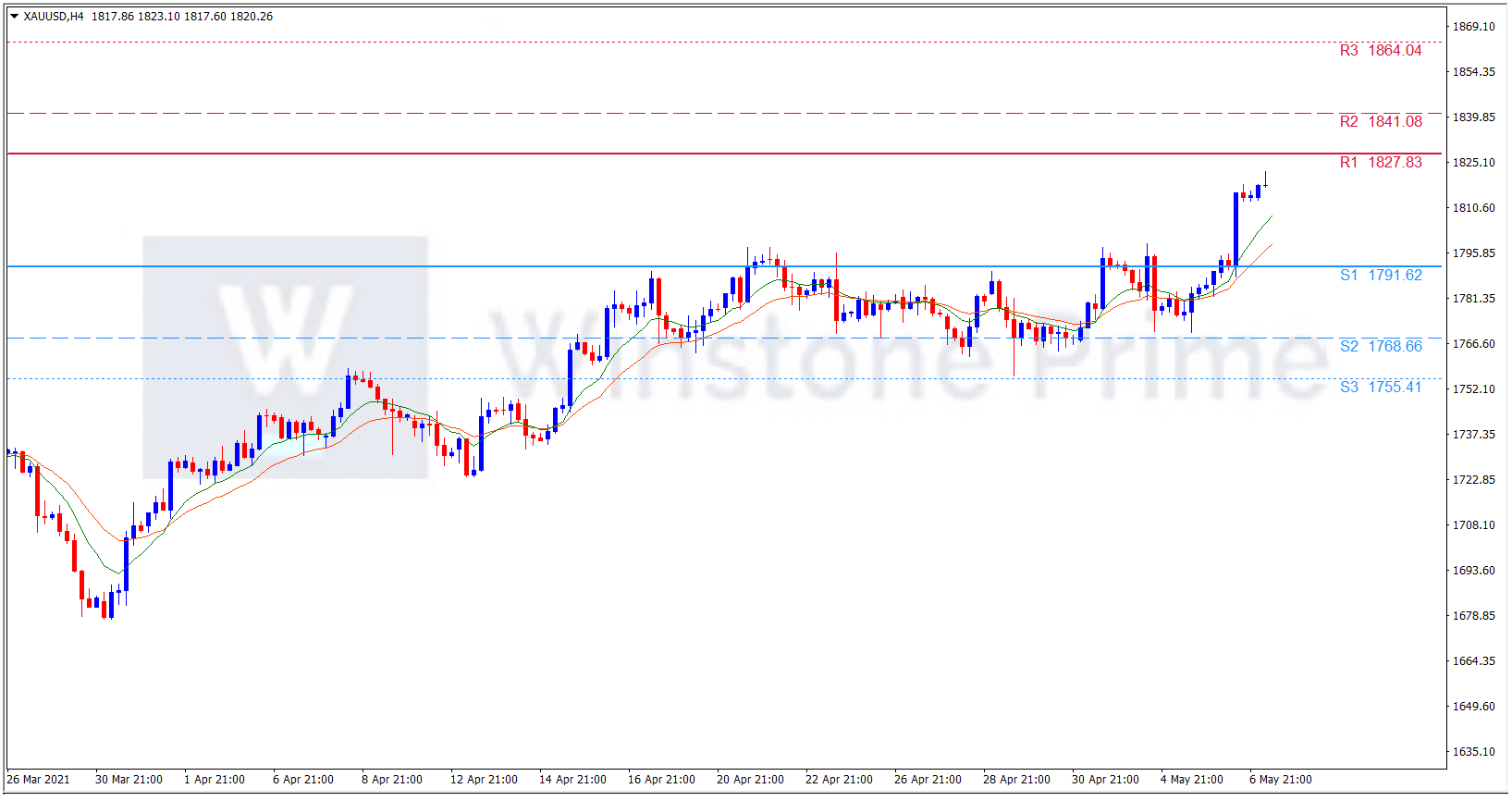

During the initial half of the previous week, the yellow metal had to struggle to rise above $1,800 and it fluctuated in a horizontal channel. As the greenback came under sell trend in the second half of the week, yellow metal gained traction and touched its highest level of 1843 since March.

The higher impact on the yellow metal trading upside came as the U.S. posted much weaker-than-expected employ006Dent data. The U.S. saw only 266,000 jobs created in April. And even though that the number is still healthy, markets were expecting to see one million jobs. The disappointment was doubled when the March figures were revised from 916,000 to 770,000.

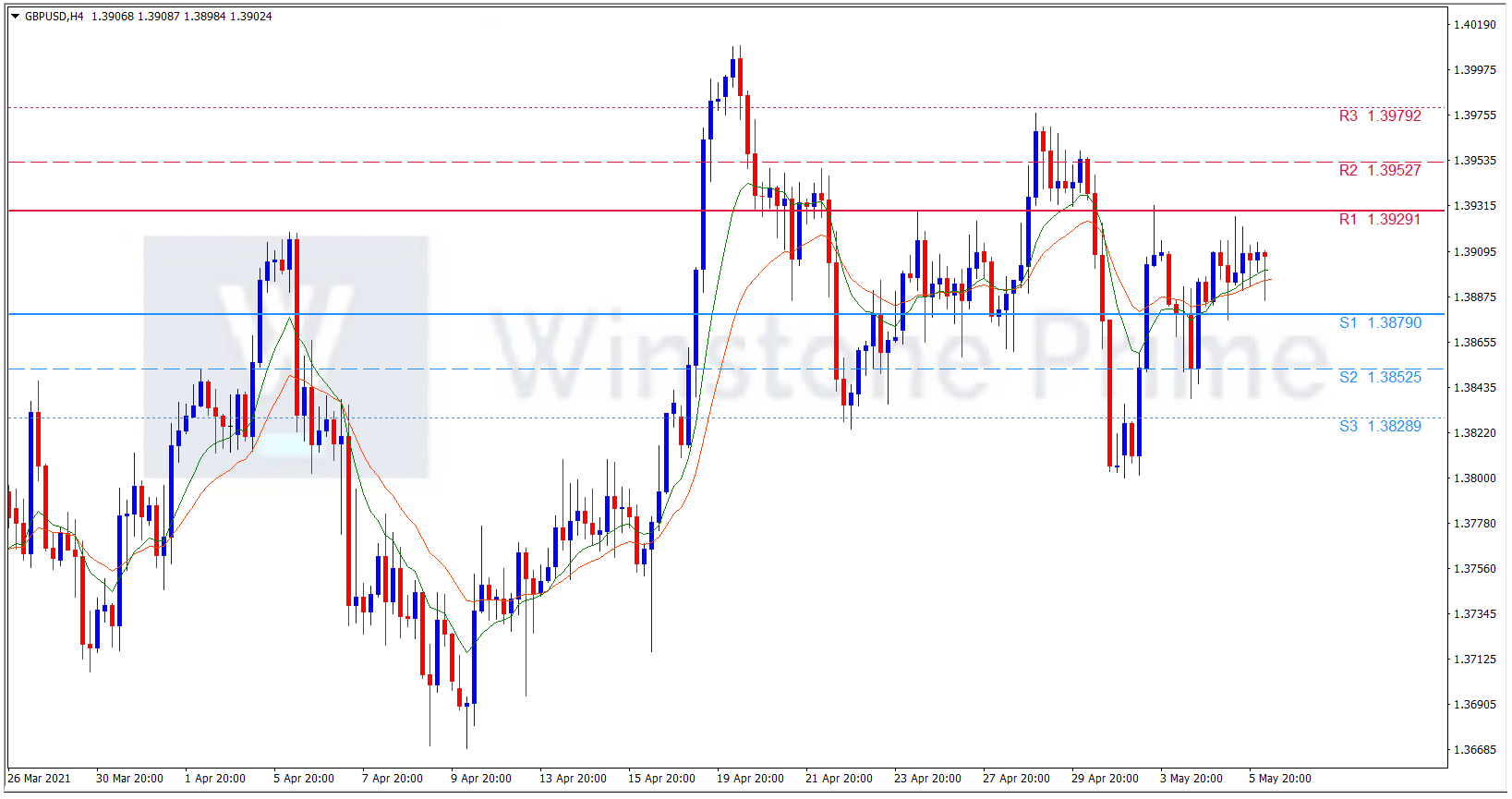

The major economic events deciding the movement of the pair in the next week are JOLTS Job Openings at May 11, Core CPI monthly report, EIA Crude Oil Stocks Change at May 12, Initial Jobless Claims at May 13, Retail Sales monthly report and Fed Industrial Production yearly report at May 14 for US.

XAU/USD Weekly outlook:

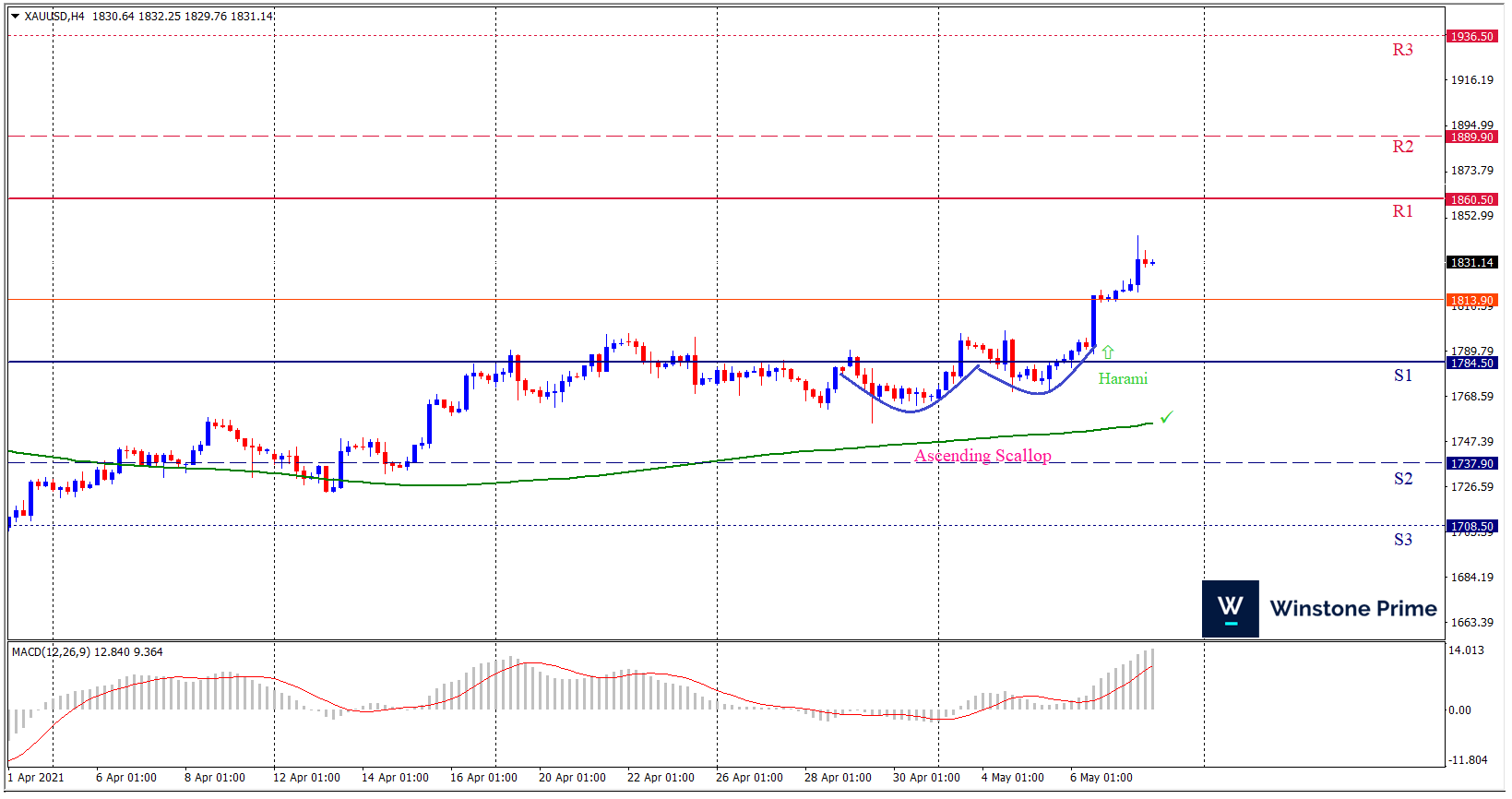

Technical View:

Last week’s high was 2.98% higher than the previous week. Maintaining high at 1843.3 and low at 1767.3 showed a movement of 760 pips.

In the upcoming week we expect XAU/USD to show a bullish trend. The Instrument is trading above the 200 Simple Moving Average and the MACD trades to the upside. A solid breakout above 1860.5 may open a clean path towards 1889.9 and may take a way up to 1936.5. Should 1784.5 prove to be unreliable support, the XAUUSD may sink downwards 1737.9 and 1708.5 respectively. In H4 chart ascending scallop pattern favors prospects of a bullish trend. Also to be noted Bullish harami formation exerts the expectation of uptrend for the pair.

| Preference |

| Buy: 1828.4 target at 1888.9 and stop loss at 1780.5 |

| Alternate Scenario |

| Sell: 1780.5 target at 1709.7 and stop loss at 1828.4 |