Bank of Japan (BOJ) Governor Haruhiko Kuroda while speaking before the parliament on Friday said that “Japan’s economy continued to expand gradually due to aggressive monetary easing, which has had a positive impact on bank profits.”

He also added that “Banks’ profitability has diminished as a trend due to prolonged low-rate environment, structural factors such as aging population.”

He also commented that the “government is ready to tap reserves set aside for covid relief to deal with further costs if infections rise more or battle with a pandemic is prolonged.”

Prime Minister Yoshihide Suga is set to declare a state of emergency Friday in Tokyo and the western Japan prefectures of Osaka, Kyoto and Hyogo in an effort to curb a surge in COVID-19 during the upcoming Golden Week Tougher restrictions such as the closure of establishments that serve alcohol and major commercial facilities will be in place from Sunday through May 11.holidays.

Although the state of emergency will not entail a hard lockdown like some other countries have imposed, spectators will effectively be banned from large events while train and bus operators will be asked to end operations earlier on weekdays, with fewer running on weekends and holidays.

Shigeru Omi, an infectious disease expert who chairs a government subcommittee on the coronavirus response said that “The state of emergency may be extended if the situation does not improve sufficiently.”

Suga said “We must take strong measures in a focused manner while many people are on break during Golden Week to bring the virus under control.”

On the other hand, US dollar index (DXY) prints mild losses of 0.08% while taking offers around 91.22 during early Friday.

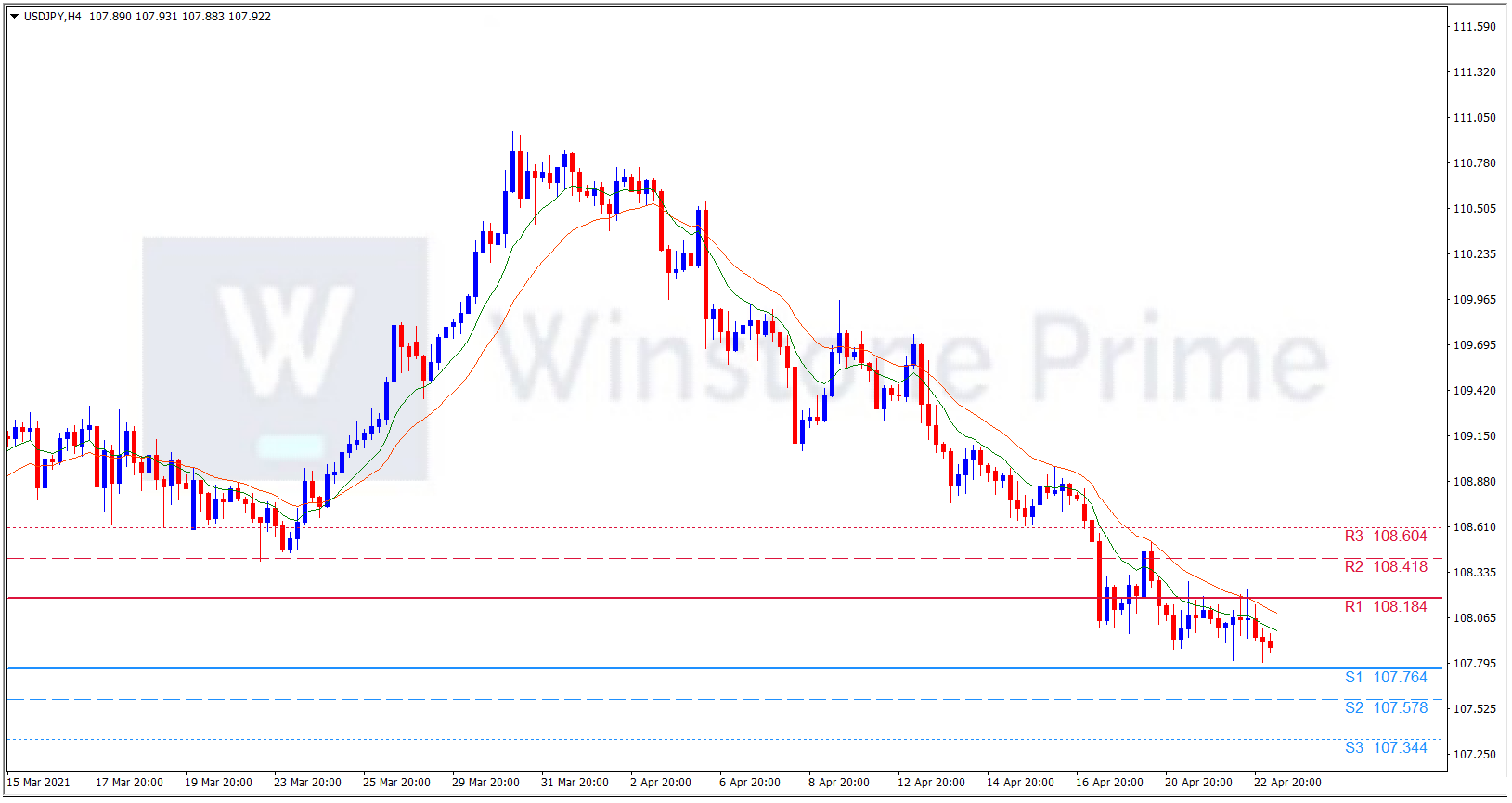

USD/JPY 4 Hour Chart:

Support: 107.76 (S1), 107.58 (S2), 107.34 (S3).

Resistance: 108.18 (R1), 108.42 (R2), 108.60 (R3).

Traders are now waiting for the official announcement of the Japan lockdown news and US President Joe Biden’s proposal for the capital gains tax hike. With this news in line, we expect a bearish trend for USD/JPY as of now.