In the world of foreign exchange (forex) trading, an expert advisor (EA) is a piece of software that tells you when to make trades or even automatically initiates and executes trades according to preprogrammed instructions.

Expert advisors are most often deployed on the MetaTrader trading platforms. You can use an existing EA or create your own based on the trading parameters you like. These EAs are written in a programming language called MetaQuotes Language (MQL). Both MetaTrader and MQL were developed by MetaQuotes Software Corp.

In this article we have given deep explanation about What is Expert Advisor & How does it work.

Importance of Expert Advisor

An expert advisor (EA) is a piece of software that takes care of analysis and uses internal algorithms and technical indicators to notify you when a trade should be taking place – finding the best entry points for high-probability trades.

Created to help both experienced traders and complete beginners, most expert advisers will calculate the lowest price to enter a market and the highest price to sell, following a specific set of trade signals and user settings.

EAs provide users with fast data-processing and higher accuracy than even the most experienced human trader – allowing analysis day and night. There are always trades taking place across the world, and it would be impossible for a single user to monitor, analyse and act on market movements 24 hours a day.

Created in Meta Quotes Language (MQL) as code, the expert advisor is created to work on the MetaTrader platform and, using a series of yes/no rules as parameters, it uses a complex mathematical model that creates sophisticated trading strategies.

These trading strategies have been perfected by the developers, and the best of them have been backtested – used alongside historical data to see how it performs when challenged with market movements – so you know that they will react quickly when necessary.

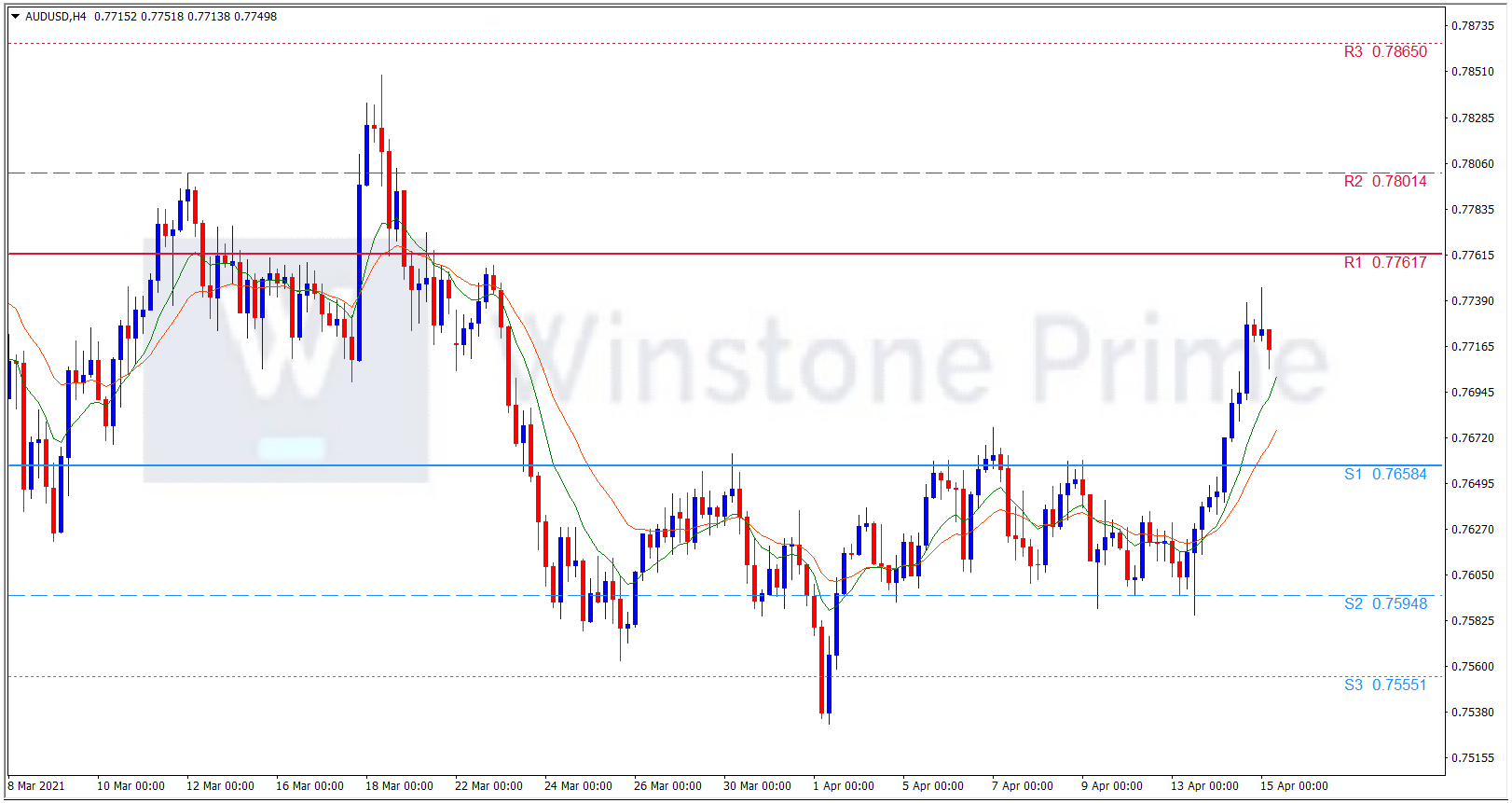

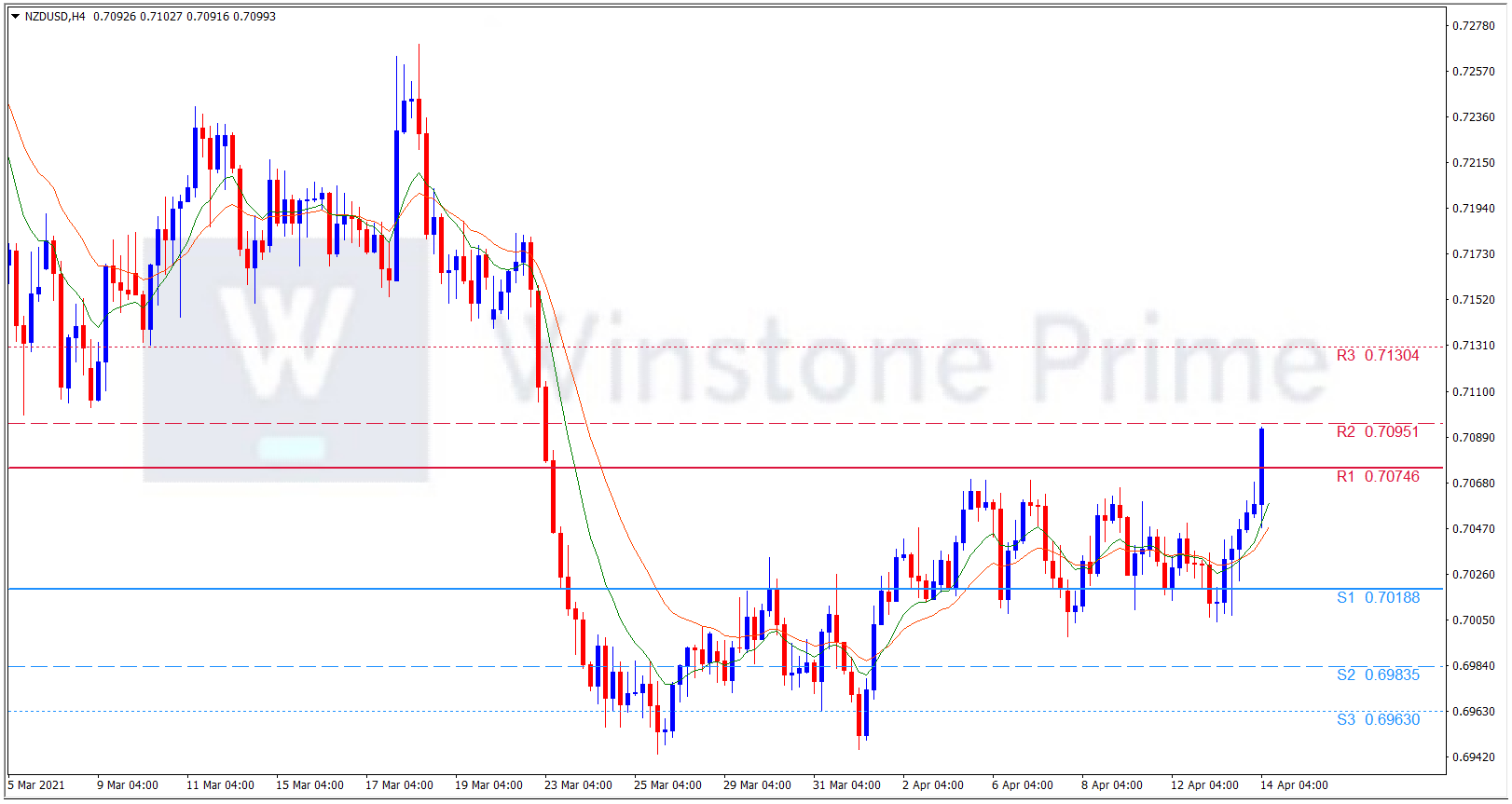

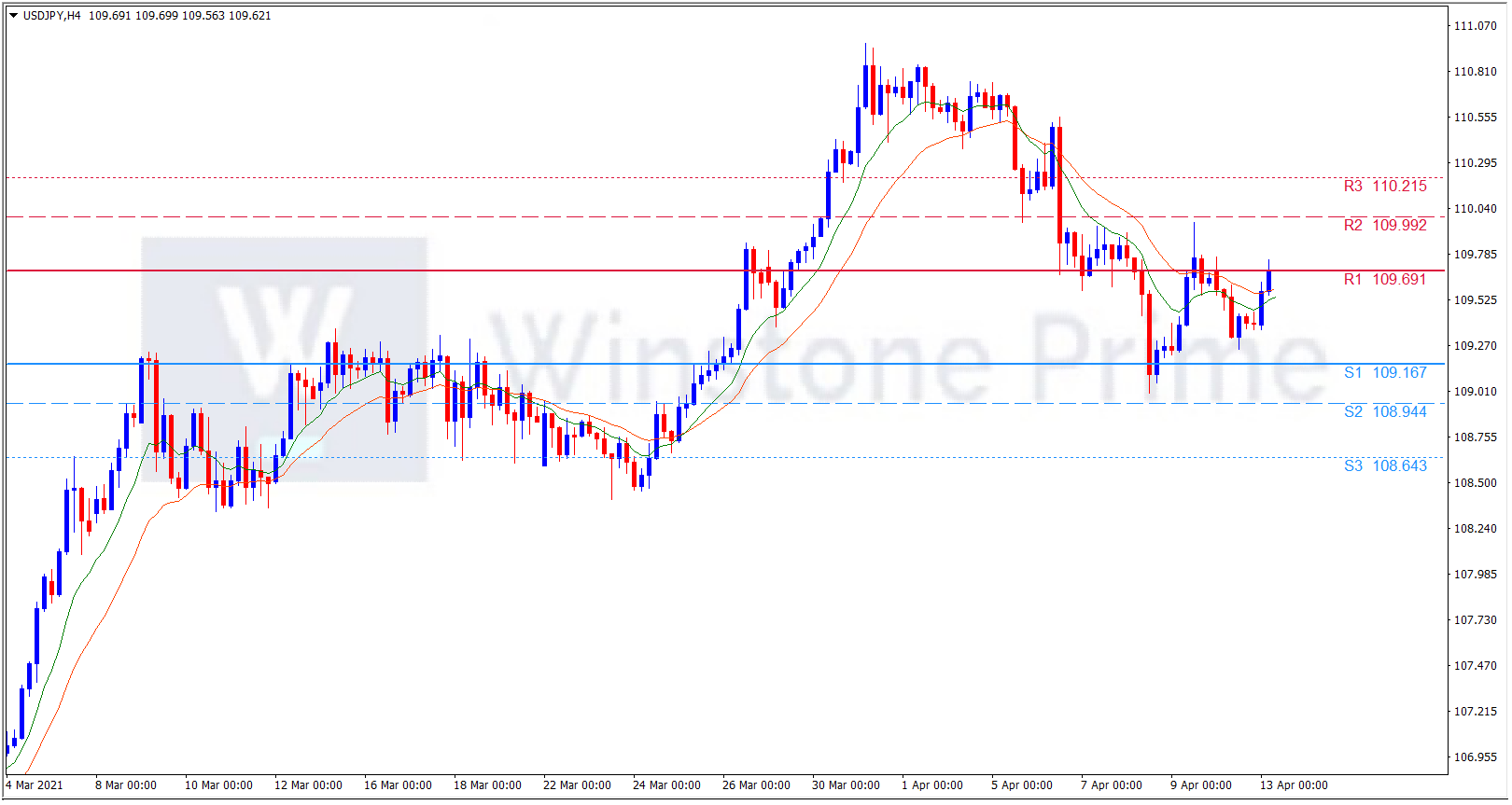

Example of Expert Advisor

A simple EA could monitor one or two markets, notifying you about potential trades when set conditions are fulfilled.

Let’s suppose that you wanted an EA to spot any mean reversion opportunities on GBP/USD using the 20-day simple moving average (SMA) indicator. You could import one that someone else has built, or you could build one yourself using a programming language called MQL4.

You’d program your EA to monitor GBP/USD constantly and notify you if the pair breaks out of its 20-day SMA. You could also program your EA to act upon the opportunity instead of just notifying you, for example, by using 2% of your total available balance as the size of the position. From there, how complicated your EA gets is entirely up to you.

virtual private server (VPS) in expert advisor?

A VPS is an online version of your Meta trader platform that is hosted on an external server, enabling your EAs to operate even when your computer is switched off. It solves the problem of needing your computer or mobile device to be running Meta trader platform in order for your EA to function, by hosting an instance of your Meta trader platform on an external server that is always on.

How to get started with Expert Advisors

You can build your own EA or download one that someone else has already built. Whichever way you choose to begin using an EA, it will need to be backtested to ensure that it works in the way you expect before letting it trade with real funds.

Build an Expert Advisor

EAs for Meta trader platforms are built using a programming language called MetaQuotes Language, or MQL Just like any programming language, getting up to speed with the ins and outs of MQL requires a significant investment of time and effort. You can find guides on the MQL site.

You can also build simple EAs using Meta trader platform’s inbuilt wizard, or an external strategy-building tool. These visualise the code that is being written underneath, enabling you to put together strategies without having to learn the programming language itself.

Use a pre-built Expert Advisor

If you have found a pre-built EA you want to use on Meta trader Platform, you’ll need to copy it into the ‘experts’ folder where your MetaTrader 4 is installed on your computer. On a computer, this is usually located on the ‘c:’ drive.

Once that’s done, launch Meta trader platform and expand the ‘Expert Advisors’ section on the left hand side. Your EA should be located there. Drag it onto a chart to get started, and you’ll be asked to review its settings before putting it live.

Backtest your Expert Advisor

You can backtest an EA on Meta trader platform using the strategy tester, which you’ll find by clicking ‘view’ in the top navigation bar. In the tester, select the EA you want to run, as well as the market and timeframe you want to run it against. Backtesting an EA is important to ensure that it is working currently.

EAs can also be run on a demo account within Meta trader platform. Just install the EA in exactly the same way as on a live account, and set it running on your chosen markets. With Winstone Prime Meta trader Platform demo account you will able to trade on different markets ( Forex, Commodities, Indices, Cryptos, Stocks and Bonds) using virtual funds and you can test some of the free indicators and add-ons that are available on our live platform.

Should I Build My Own System Or Buy A Forex Robot?

It’s no surprise that most FX traders who seek a good Forex EA often end up hopping from building an algorithm to buying a ready-made Forex robot. In fact, it’s just like when an FX trader ends up jumping from one trading strategy to another!

For starters, when you see a Forex trading robot come with some money-back guarantees, it certainly offers a level of security when you making a purchase. But, more often than not, vendors won’t honor your request. This type of vendor’s sole purpose is to take your money. And they will trick you by offering an unbeatable deal, on top of providing fake MetaTrader 4 results for the said EA. Due diligence on the vendor and on the EA itself is essential! Ask for the EA’s historical performance as a first move.

Finding a winning automated trading strategy is, by no means, an easy task. But a quick look around various forums will often reveal more negative reviews than positive reviews. Not too hard, then, to spot a scam!

Building your own Meta trader platform EA is certainly not as risky, nor is it as costly as you may have in mind. You don’t need to build a Forex robot that takes trades automatically at first. You can start with a simple alerts EA that notifies you when certain conditions are being met, instead of spending all day looking at your MetaTrader 4 charts.

Do I really need an Automated EA

If you are short on time and can’t dedicate resources to learn Forex, investing in an automated trading Forex system could be the most ideal choice. If you lack confidence in managing risk or you tend to make the opposite decision of what your Forex strategy tells you to, an expert advisor should help as well.

Don’t forget, expert advisors are not only helping with rule automation but also with your entry and exit policies. And more often than not, those are the main variables that lead to losses!

Conclusion

By using automated software like an EA, you can benefit from the following advantages: it can trade while you are sleeping, it is not susceptible to emotions and you can quickly run backtests. However, it is hard to ascertain whether an EA will help you to achieve consistent profits. If you are looking for a free Forex EA that works online, ensure you read plenty of reviews from other traders to find the best one possible.

If you prefer to build your own EA, make sure to take into account the tips we have shared to avoid unpleasant situations.