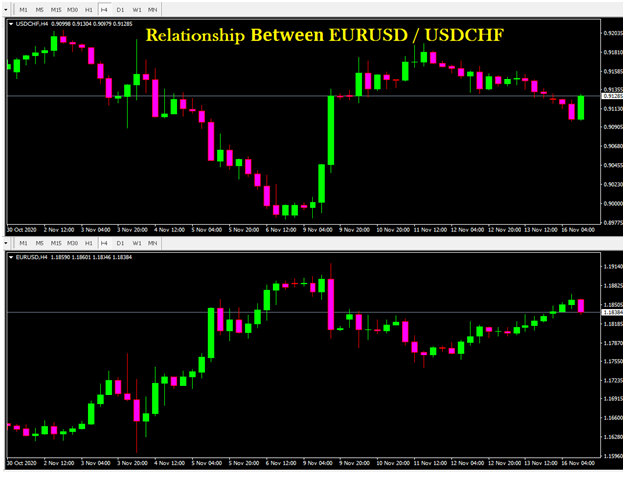

2. However, the relationship between the Swiss franc and euro is even stronger than this. This is because Switzerland is situated directly in the middle of the eurozone, even though it is not part of it. Both the close physical proximity and strong trade ties tend to create a much stronger correlation between the two currencies than is found with other currencies. For example, strong growth in the eurozone translates into strong growth in Switzerland – creating similar upward pressure on both currencies. Because the two economies are intimately linked, if the eurozone contracts, Switzerland will feel the ripple effects.

Criticisms of the Euro/Swiss Franc Relationship

The relationship between the EUR/USD and USD/CHF decouples when there are divergent political or monetary policies. For example, if elections bring uncertainty in Europe but not in Switzerland, the EUR/USD might slide further in value than the USD/CHF rallies. Conversely, if the eurozone raises interest rates aggressively and Switzerland does not, the EUR/USD might appreciate more in value than the USD/CHF slides.

Because the ranges of the two currencies can vary more or less than the point difference, interest rate arbitrage in the FX market using these two currency pairs does not work. The ratio of the range is calculated by dividing the USD/CHF range by the EUR/USD range.

Factors influencing the EUR/CHF rate

Every currency pairing has distinct factors which can cause the rate to rise or fall. Let’s take a look at what specifically can affect the EUR/CHF rate and what information traders should look at. We’ll start with the euro and then take a look at the franc.

Role of EUR

The European Central Bank (ECB) releases monthly reports about the economic health of the European economy. This information can be essential for traders and investors and can affect the value of the euro. Interest rates and other details that can help traders figure out which way the euro could move can be found in reports like these. There are, however, other factors which come into play when determining which way the euro will move, including: employment figures around Europe, import/export data, and the various crises that can occur throughout the economic and political landscape.

Role of CHF

Despite having a relatively small economy, Switzerland has very strict banking policies in place which can massively affect the overall movement of the price of the franc. This is partly due to the fact that the country has historically been viewed as somewhat of a neutral country politically, and a leading force for financial privacy and security. GDP data is regularly released which details many factors which can influence the CHF. Figures about trade balances, inflation rates, retail sales, industrial production, employment figures can be scoured for information which could help indicate how the Swiss franc price could move.

Why is EUR/CHF important to traders?

The currency pairing of the euro and Swiss franc is one of the most popular pairs for traders on the forex market. It’s actually what’s known as a cross-currency pairing, which means that the pair is traded directly as opposed to first being converted into a base currency such as the USD.

As the third-most frequently traded cross currency pairing on the forex market, the volume and daily movement in EUR/CHF trading can often offer up big opportunities for traders and investors.

Important to be noted while trading

Understanding this relationship is very important when managing risk. For instance, if you take a short position in USD/CHF and a long one in the EUR/USD, you are essentially doubling your risk. If the two currency pairs weren’t strongly correlated, then they could rise and fall independently. However, the correlation means that you will gain or lose on both positions at the same time – compounding your losses or profits.

In general, it is not a good idea because of this to trade both pairs. Some inexperienced traders also think that they can use differences in interest rates to carry out arbitrage with these two pairs – for example, going long on both currency pairs so that the risk is zero, and then pocketing the interest differences between the two pairs. However, for various reasons this often doesn’t work, particularly because the correlation is not perfect – the two currencies can decouple at times due to local economic and political factors.