The common symbol for ripple units on exchanges and brokers is XRP.

Trading on Crypto Exchanges

The easiest way for many people to obtain some cryptocurrency units is via many exchanges. Convenientlly, the same exchanges offer speculative trading opportunities to their customers. Not only can traders transact by exchanging one currency (crypto or fiat) for another, they can also engage in leveraged trading using a margin account.

Margin Trading

Leveraged trading on exchanges is funded by margin lending provided by other exchange participants (margin investors). Traders borrow funds for each trade they make at a varying interest rate and pay it for as long as the position remains open. The entire process is performed by the trading platform in an automatic mode.

Trading via Forex Brokers

Forex brokers had been quick to realize that they could be offering cryptocurrency pairs alongside the normal fiat currency pairs. They normally offer crypto trading in form of CFDs (contracts for difference), where each trade is effectively a bet as no exchange between assets is actually performed. In theory, this allows brokers to offer a higher leverage and lower commission, but in practice, due to low competition, these parameters remain quite close to their exchange counterparts.

The list of trader’s expenditures when trading cryptocurrency CFDs is similar to that of an exchange trader: You probably already have an account at some FX broker, so you do not need to open an exchange account to trade cryptocurrencies. Trading infrastructure (MetaTrader platform, for example) is usually more sophisticated than on exchanges; it is also more familiar if you are an experienced Forex trader.

Trading big amounts is easier – your deals do not affect the underlying market.

Trading Futures

Since December 2017, Bitcoin futures contracts are available for trading. This allows traditional financial traders to participate in the cryptocurrency market. The advantages of trading Bitcoin via futures are the following:

♦ Regulated environment with nearly zero counterparty or execution risk.

♦ No risk of hacking.

♦ Low cost of opening and holding positions.

♦ Open to US traders.

Why Trade Cryptocurrency Pairs at All?

A common question asked by many new to speculative cryptocurrency trading is “Isn’t it better to buy and hold?” It is an important question, which does not have an obvious answer.

On the one hand, if you look at the long-term charts of the cryptocurrencies discussed above, you can see that they all have significantly appreciated against the US dollar in just a few years. The return on investment is thousands percent. Clearly, had you simply invested in Bitcoin in 2013, or earlier you would be well rewarded by now.

On the other hand, all cryptocurrencies go through boom-and-bust cycles with significant corrections that may last for years. Margin trading enables monetization of such movements by shorting cryptocurrencies. At the same time, riding the rallies on leverage should allow higher gains than simply buying and holding the same cryptocurrency.

Trading cryptocurrencies don’t require any specialist knowledge, and in fact, it’s not all that different to trading in Forex, commodities or many other markets. Despite its unusual nature, crypto still rises and falls like any other market, and is still subject to predictable external factors in a way that gives you the opportunity to make substantial profits. You needn’t rely on guesswork to predict which cryptocurrencies are worth in investing.

Why Trade Crypto CFDs With Winstone prime?

♦Uncompromised Safety –With regulatory authorities and segregated accounts, your money is protected at all times.

♦ Many Cryptos to Choose From –Trade on the wide variety of cryptos available on our trading platforms.

♦ No Hidden Fees – We offer zero commissions and no bank fees on transactions!

♦Crypto Never Goes to Sleep – Winstone Prime is one of the few brokers offer around-the-clock service and support many languages.

♦ Generous Leverage – Increase your initial capital with generous leverage and get far more exposure to trade than your account balance.

♦ Limit Your Risk –You can preset profit and loss levels by using stop losses or take profit limits when you trade. Determine the maximum amount you are prepared to risk when speculating on the price, or set a price at which you want to take profits. Future orders like Buy Stops and Buy Limits are also available.

♦ Trade Cryptos Against Fiat Currencies – Unlike many exchanges out there, who are restricting their clients to trade only Crypto to Crypto, our clients can trade Cryptos against Fiat currencies (USD, EUR, JPY etc.), as well.

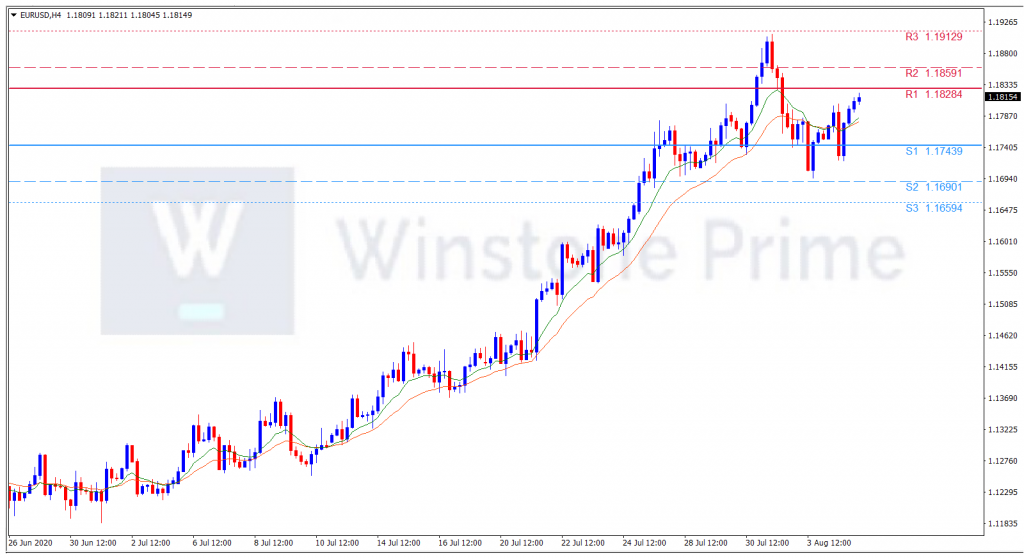

Support: 1.1744 (S1), 1.1690 (S2), 1.1659 (S3).

Support: 1.1744 (S1), 1.1690 (S2), 1.1659 (S3).

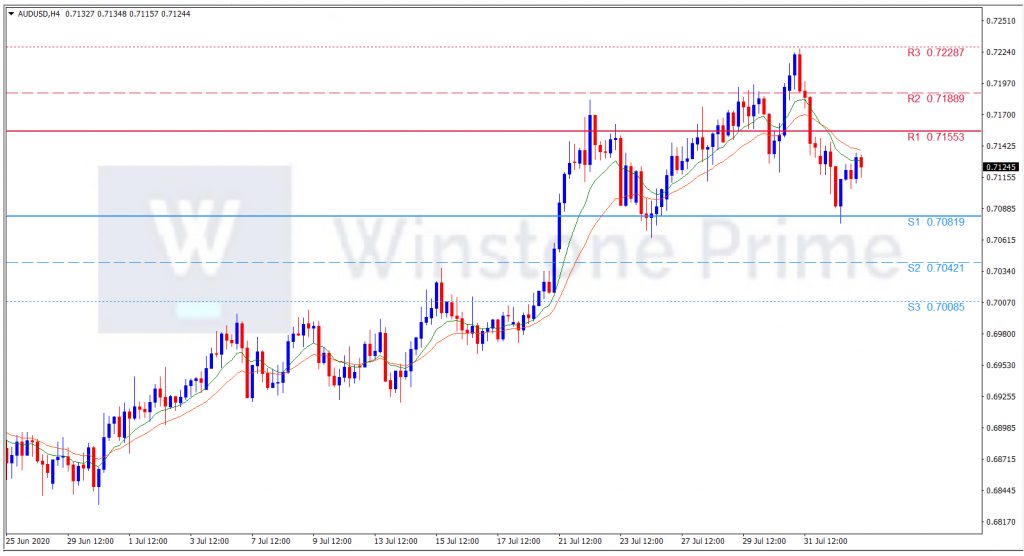

Support: 0.7082 (S1), 0.7042 (S2), 0.7009 (S3).

Support: 0.7082 (S1), 0.7042 (S2), 0.7009 (S3).