The yellow metal is trading low against the greenback today. The metal witnessed a volatile session on Tuesday that plucked away multi-day peak of the pair towards the heaviest daily loss in a fortnight.

Yesterday’s volatility could be linked to the Upbeat US retail data, Fedspeak trying to suppress the reflation fears and the start of the virtual meeting between US President Joe Biden and his Chinese counterpart Xi Jinping.

The US monthly Retail Sales exceeded the expectation and recorded a strong growth of 1.7% in October. Excluding autos, core retail sales also climbed by 1.7% in October which is also higher than market expectations of 1%.

Federal Reserve officials said on Tuesday that they are vigilant of the ways that higher inflation can affect U.S. households and dampen consumer sentiment and want to get it under control. Which also underpinned the US dollar strength.

Elsewhere, U.S. President Joe Biden pressed his Chinese counterpart on human rights in a video call which lasted for more than three hours, while Xi Jinping has warned that China would respond to provocations on Taiwan, according to official accounts of the exchange.

US Treasury yields reached fresh weekly highs, with that on the 10-year note reaching 1.63%, further supporting the dollar’s demand.

Hawkish comment from the St. Louis Fed President James Bullard also underpinned the US dollar strength. He said “If inflation happens to go away we are in great shape for that. If inflation doesn’t go away as quickly as many are currently anticipating it is going to be up to the (Federal Open Market Committee) to keep inflation under control.”

“The inflation rate is quite high,” Bullard said. “It behooves the committee to tack in a more hawkish direction in the next couple of meetings so that we are managing the risk of inflation appropriately.”

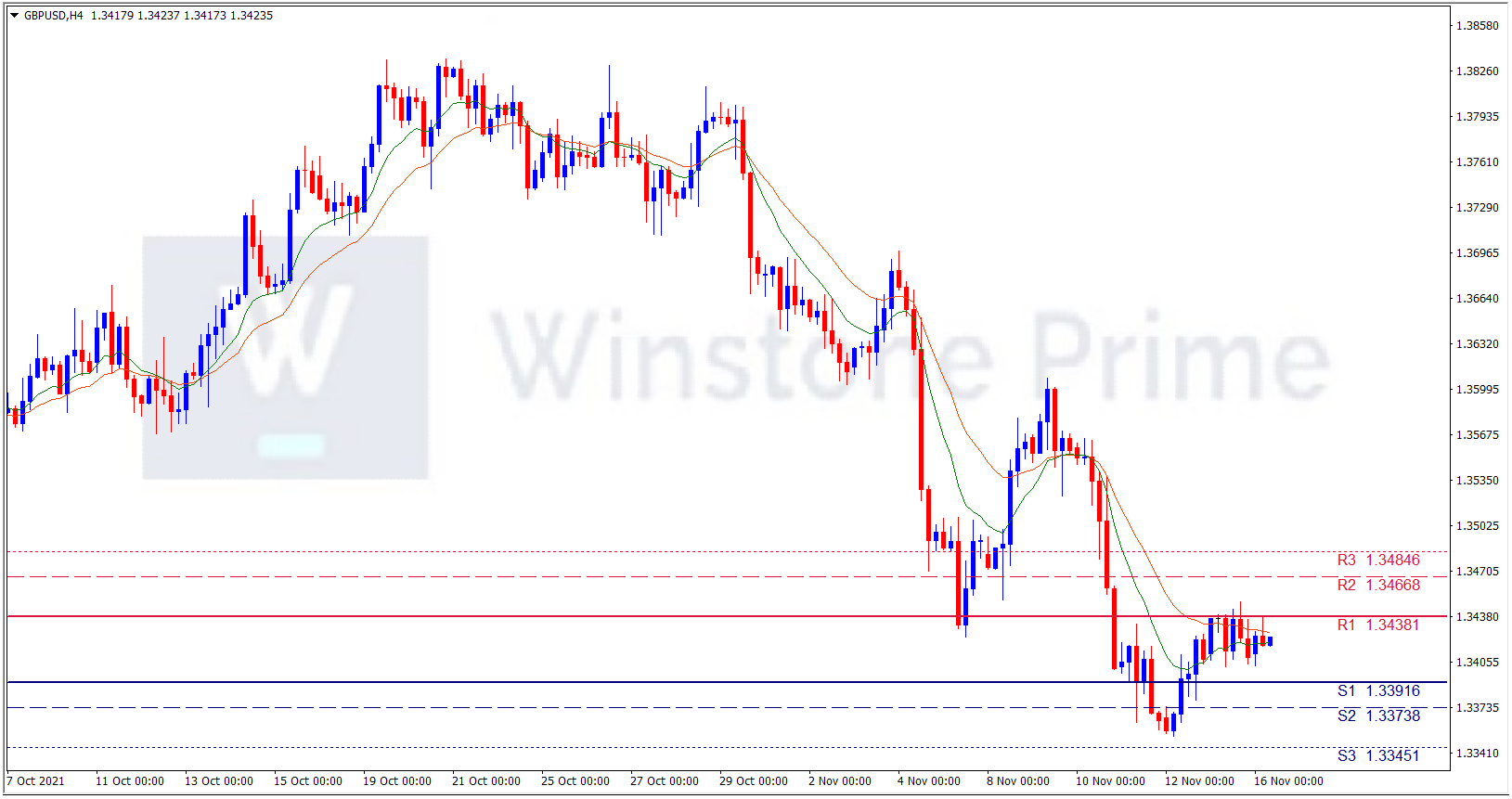

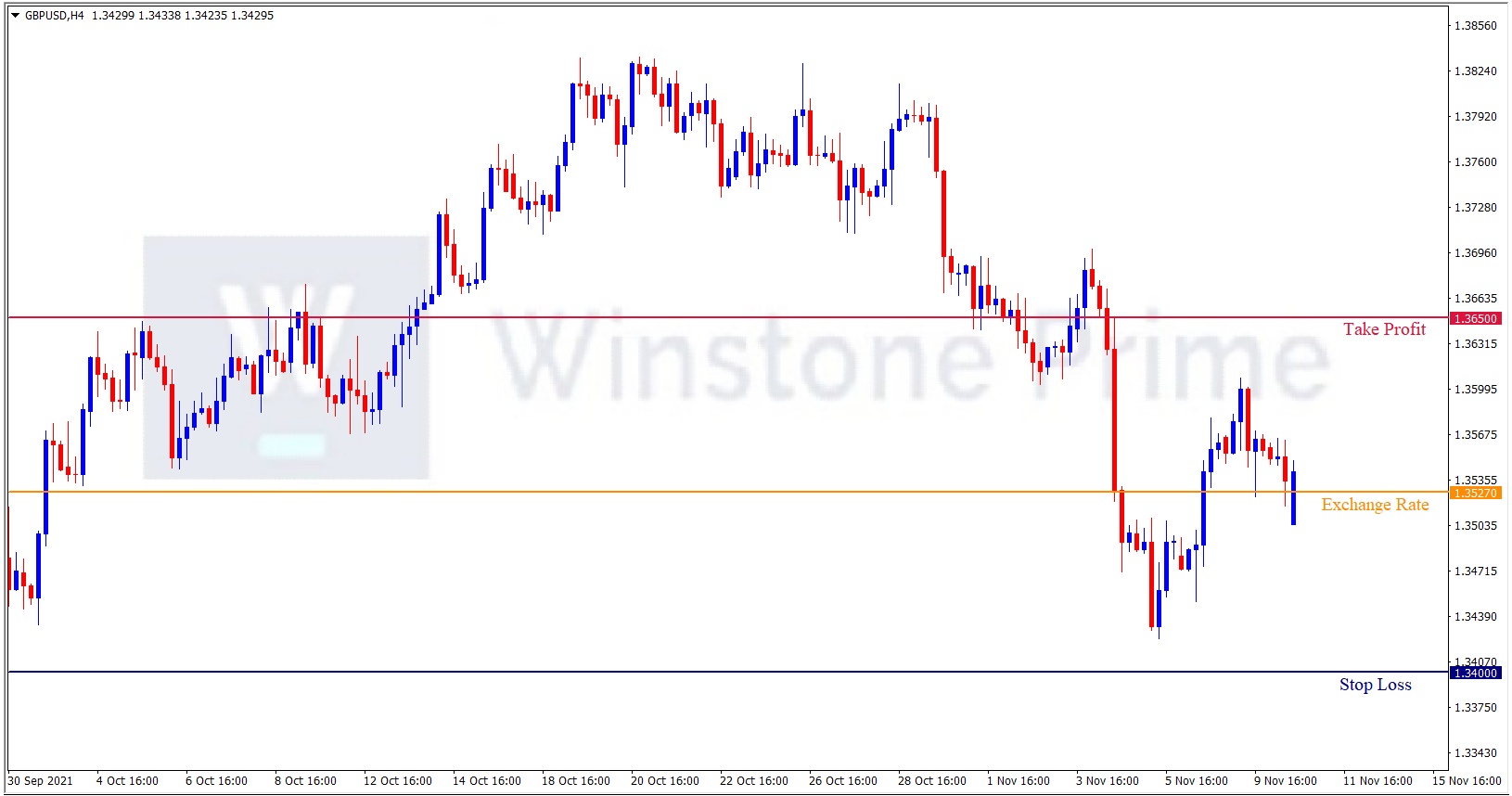

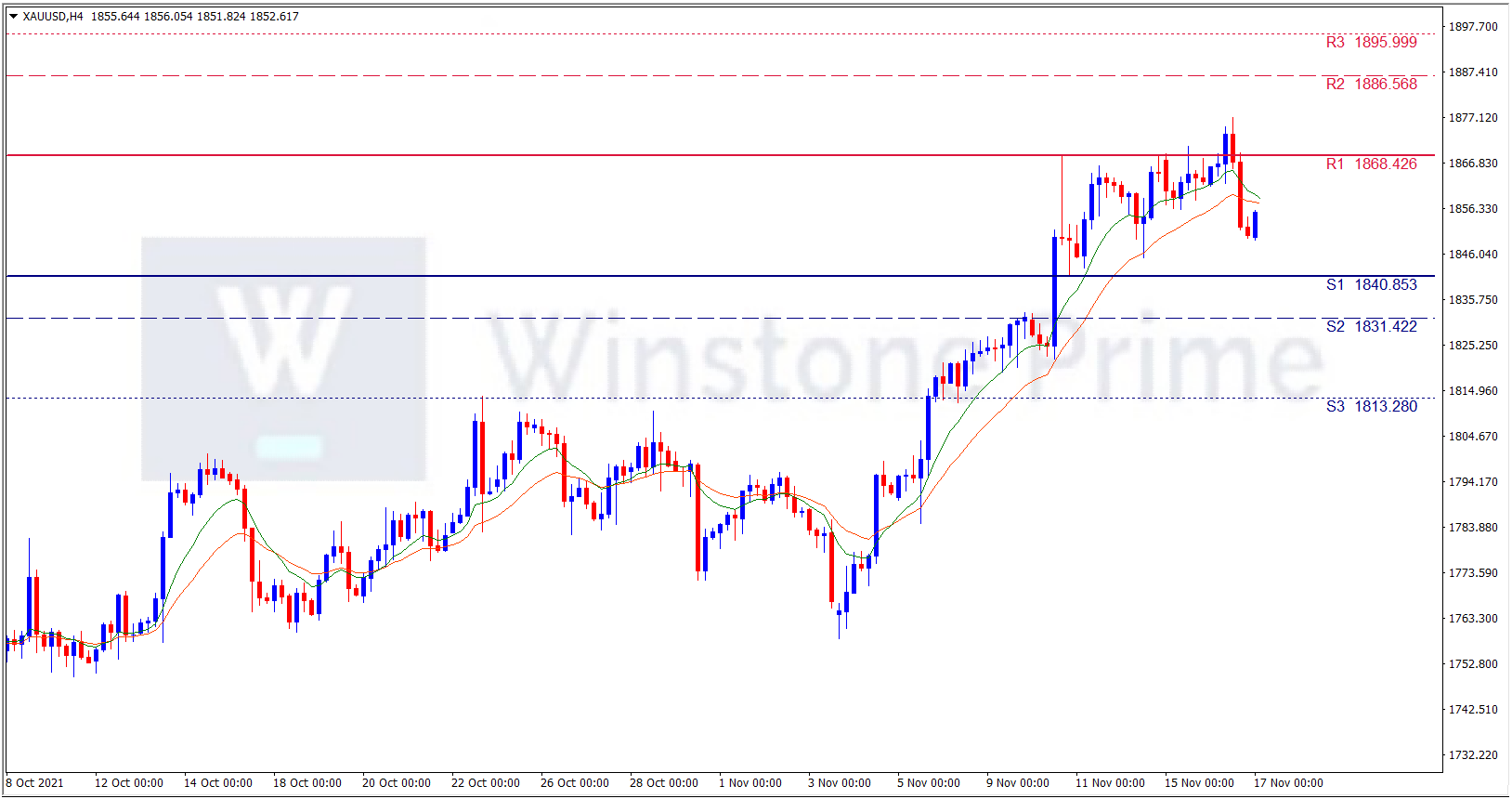

XAU/USD 4 Hour Chart:

Support: 1840.9 (S1), 1831.4 (S2), 1813.3 (S3).

Resistance: 1868.4 (R1), 1886.6 (R2), 1896.0 (R3).

Meanwhile, strong US Retail Sales along with the Fedspeak favors the US dollar and weighs on the yellow metal. We expect a bearish trend for XAU/USD.