Fundamental view:

The Euro traded high at 1.1382 but failed to retain its gains and fell to 1.1266 at the week end. A number of factors lead to the sour market sentiment this week. The newly discovered coronavirus variant named Omicron was the first factor in this regard, South Africa reported it on November 25, and the global panic had resulted in border closures and restrictive measures. With progress in time, authorities acknowledged that Omicron had been circulating in Western Europe before the strain was identified. And the experts believe that vaccines will still offer protection against severe cases and death. Meanwhile, US Federal Reserve Chair Jerome Powell and Treasury Secretary Janet Yellen, testified on the CARES act before the Senate. Powell noted that inflation had spread more broadly and that the risk of persistent inflation has risen. He added that it’s time to remove the term transitory to describe price pressures, and the Fed would discuss speeding up tapering in their December meeting, to counter inflation. These catalysts favored the safe haven US dollar.

Eurozone Markit Manufacturing PMI on 1st December and US initial Jobless claims on 2nd December created downtrend for the pair whereas Eurozone PPI monthly report on 29th November and Eurozone GDP quarterly report on 30th November created uptrend of the pair in this week.

The major economic events deciding the movement of the pair in the next week are Eurozone Employment Change quarterly report, Eurozone GDP quarterly report, US Nonfarm Productivity quarterly report at Dec 7, EIA Crude Oil Stocks Change at Dec 08, Initial Jobless Claims at Dec 09, Eurozone Industrial Production monthly report, Michigan Consumer Sentiment and US Federal Budget Balance at Dec 10.

EUR/USD Weekly outlook:

Technical View:

Last week’s high was 0.48% lower than the previous week. Maintaining high at 1.1382 and low at 1.1235 showed a movement of 147 pips.

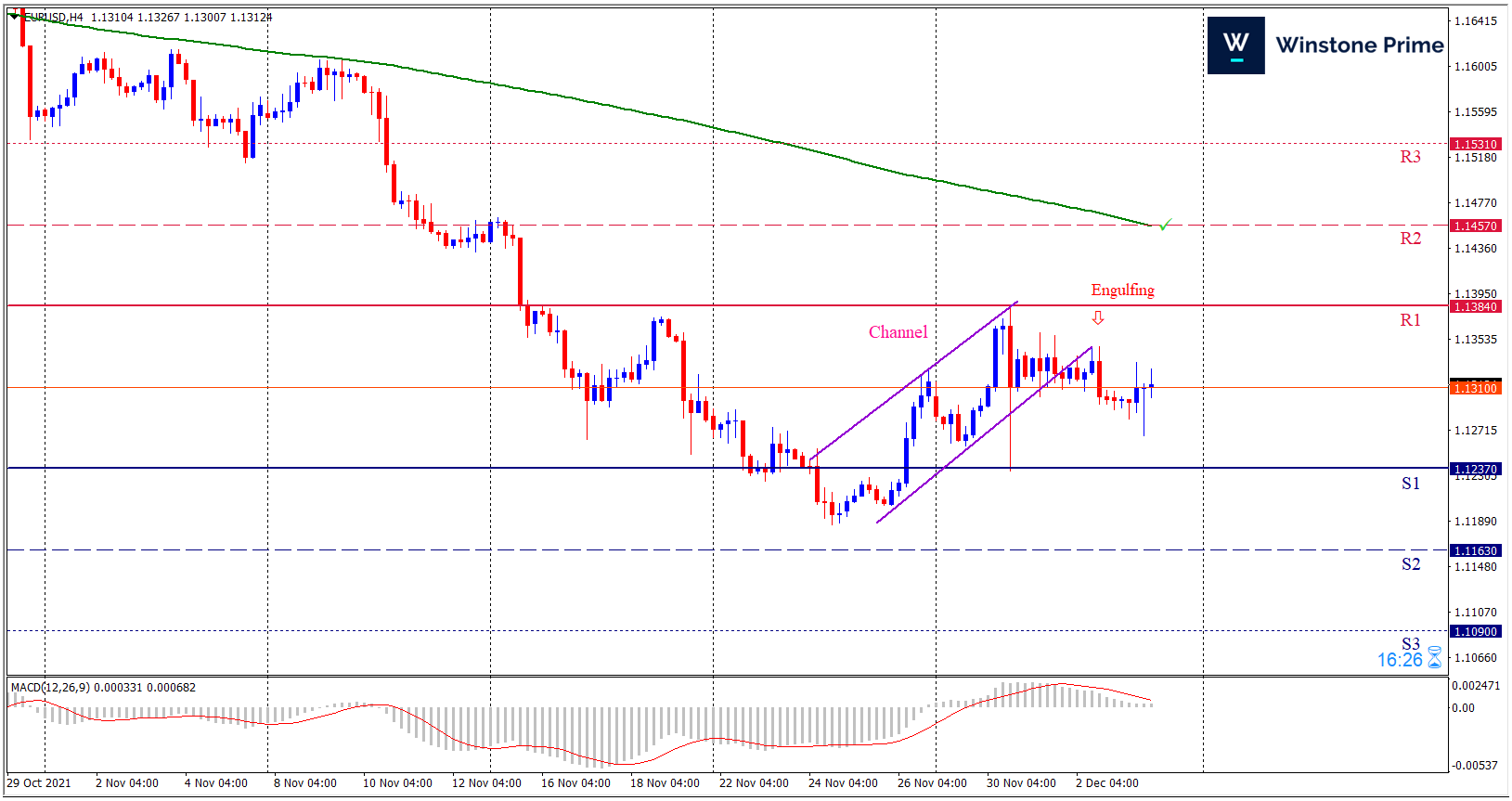

In the upcoming week we expect EUR/USD to show a bearish trend. The currency pair is trading below the 200 Simple Moving Average and the MACD trades to the downside. Should 1.1237 prove to be unreliable support then the pair may fall further to 1.1163 and 1.1090 respectively whereas a solid breakout above 1.1384 will open a clear path upward to 1.1457 and then will further raise up to 1.1531. Chart formation of a channel pattern breakout in H4 chart sets prospects for a bearish trend. Bearish engulfing formation in H4 chart further escalates the expectation for a bearish trend.

| reference |

| Sell: 1.1307 target at 1.1164 and stop loss at 1.1389 |

| Alternate Scenario |

| Buy: 1.1389 target at 1.1530 and stop loss at 1.1307 |