Fundamental view:

The Euro dropped against the US dollar during the trading course of the week. The Federal Reserve policymakers hawkish stance favored the greenback meanwhile escalating Ukraine – Russia saga weighed on the Euro. US Federal Reserve Chair Jerome Powell aggressive speech helped the dollar. A slew of Fed members along with Powell favored the 50bps hike and has noted they would support such a move as soon as May. He noted that their plans to reduce the balance sheet would likely be completed by the next meeting, although he did not clarify when they would start shrinking it. Meanwhile, several members of the ECB have hinted at a rate hike by the end of the year. This is now planned for the third quarter of the year, earlier than previously planned by the central bank.

US President Joe Biden had a meeting with European leaders, G-7 partners, and NATO allies before a White House press briefing. Besides other things, Biden said he would support the expulsion of Russia from the G-20, noting that sanctions could not deter Russia but might eventually force it to end the invasion. Additionally, he said that the US does not confirm that it will send troops to Ukraine if the Kremlin decides to use weapons of mass destruction.

In this week, ECB President Lagarde Speech on 21st March, EU Leaders Summit on 24th March and US Core Durable Goods Orders monthly report on 24th March underpins the bullish trend whereas Eurozone PPI monthly report on 21st March and US Pending Home Sales yearly report on 25th March underpins the bearish trend for the pair.

The major economic events deciding the movement of the pair in the next week are US Goods Trade Balance at Mar 28, US CB Consumer Confidence Index at Mar 29, US ADP Nonfarm Employment Change, US GDP quarterly report at Mar 30, Eurozone Unemployment Rate, US Initial Jobless Claims at Mar 31, Eurozone Government Budget Balance and US Nonfarm Payrolls at Apr 01.

EUR/USD Weekly outlook:

Technical View:

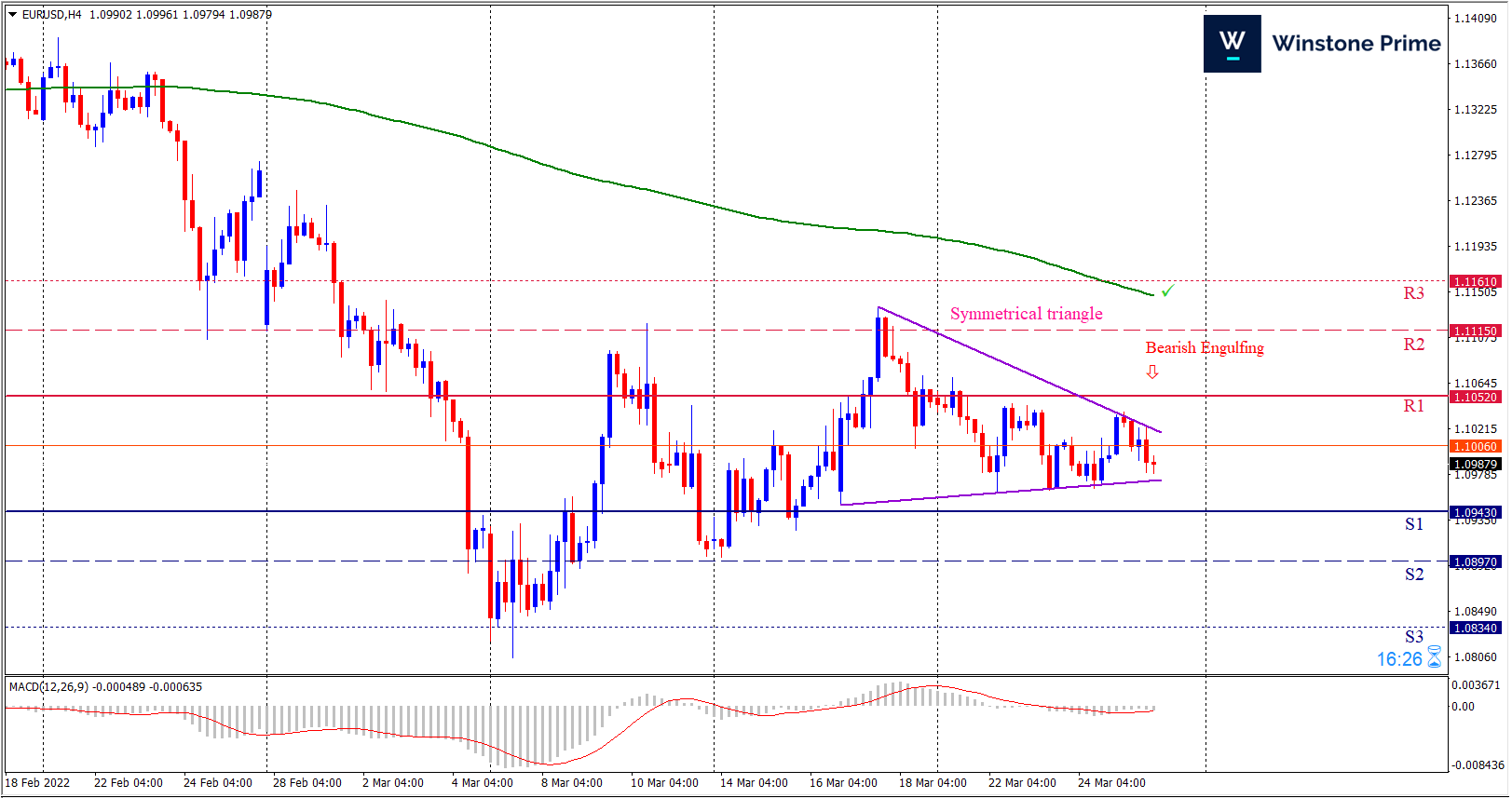

Last week’s high was 0.61% lower than the previous week. Maintaining high at 1.1070 and low at 1.0961 showed a movement of 109 pips.

In the upcoming week we expect EUR/USD to show a bearish trend. The currency pair is trading below the 200 Simple Moving Average and the MACD trades to the downside. Should 1.0943 proves to be unreliable support then the pair may fall further to 1.0897 and 1.0834 respectively whereas a solid breakout above 1.1052 will open a clear path upward to 1.1115 and then will further raise up to 1.1161. In H4 chart, if breakout of the Symmetrical triangle is to the downside then bearish expectation is favored. Also to be noted bearish engulfing pattern formation exerts the expectation of downtrend for the pair.

| Preference |

| Sell: 1.0977 target at 1.0871 and stop loss at 1.1057 |

| Alternate Scenario |

| Buy: 1.1057 target at 1.1160 and stop loss at 1.0977 |