Fundamental view:

The pound has somewhat rallied a bit during the trading week to reach towards the 1.37 handle and then turned around and showed signs of weakness. The dollar has won the contest against the pound – profit-taking and vaccine issues have weighed on the pound more than Fed-related vulnerability has hurt the greenback.

Prime Minister Boris Johnson made an announcement that pubs, gyms and other places would reopen on April 12, initially giving sterling a boost. This move came as Britain’s COVID-19 cases continue falling and while US infections has followed a minor upswing. However, sterling was also hit by issues with its homegrown AstraZeneca vaccine. Another issue that pressured pound is the Brexit.

US ISM-NY Business Conditions Index & US Factory Orders monthly report on 5th April and Britain RICS House Price Balance on 8th April favored uptrend for the pair whereas US JOLTS Job Openings on 6th April and US EIA Crude Oil Stocks Change on 7th April favored downtrend for the pair.

The major economic events deciding the movement of the pair in the next week are UK GDP quarterly report, UK Manufacturing Production monthly report, US CPI monthly report at April 13, US EIA Crude Oil Stocks Change, Fed Chair Powell Speech at April 14, US Retail Sales monthly report, US Initial Jobless Claims at April 15 and US Building Permits at April 16.

GBP/USD Weekly outlook:

Technical View:

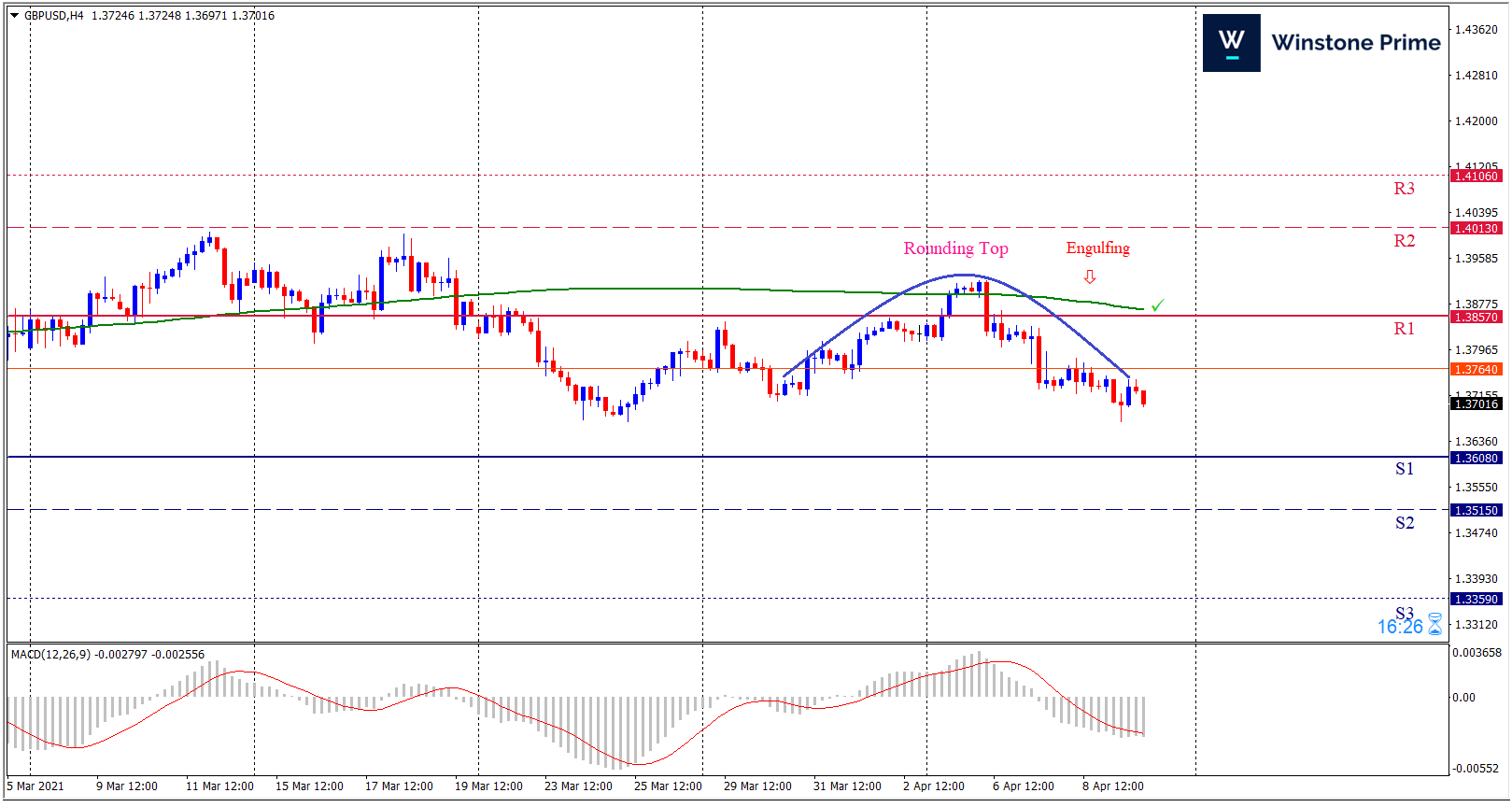

Last week’s high was 0.48% higher than the previous week. Maintaining high at 1.3919 and low at 1.3670 showed a movement of 249 pips.

In the upcoming week we expect GBP/USD to show a bearish trend. The currency pair is trading below the 200 Simple Moving Average and the MACD trades to the downside. A solid breakout below 1.3608 may open a clean path towards 1.3515 and may take a way down to 1.3359. Should 1.3857 prove to be unreliable resistance, the GBPUSD may raise upwards 1.4013 and 1.4106 respectively. Chart formation of rounding top pattern in H4 chart favors prospects of a bearish trend. Engulfing pattern formation escalates the expectation for a bearish trend.

| Preference |

| Sell: 1.3713 target at 1.3516 and stop loss at 1.3862 |

| Alternate Scenario |

| Buy: 1.3862 target at 1.4105 and stop loss at 1.3713 |