Fundamental view:

Pound dropped against the US dollar during the trading course of the week. Risk-off wave dominated the week, as Market flocked towards the safe haven US dollar and gold and dumped the higher-yielding currencies such as the pound. The West continued to pressure Russia by threatening to increase economic warfare. Market stayed under pressure most of the week, However, it got a positive turn on Friday after Russian President Vladimir Putin said that “there were certain positive shifts” in negotiations with Ukraine. Whereas President Volodymyr Zelenskyy said that it would take time and patience to achieve victory.

The BOE is under focus on the upcoming week. BOE is expected to lift policy rates amid soaring inflation. Market keeps a hawkish outlook from the BOE as the ECB signaled faster tapering at its March 10 policy decision, despite of Ukrainian crisis. On the other hand, The Fed is expected to raise interest rates for the first time since 2018, and policymakers will likely hint at a faster pace of hikes in 2022.

In this week, UK RICS House Price Balance on 10th March and Michigan Consumer Sentiment on 11th March favored bullish trend whereas UK Halifax HPI monthly report on 7th March and US JOLTS Job Openings on 9th March favored bearish for the pair.

The major economic events deciding the movement of the pair in the next week are UK Claimant Count Change, NY Fed Empire State Manufacturing Index at Mar 15, US Retail Sales monthly report, Fed Interest Rate Decision at Mar 16, BoE Interest Rate Decision, Initial Jobless Claims, US Fed Industrial Production yearly report at Mar 17 and Fed Governor Bowman Speech at Mar 18.

GBP/USD Weekly outlook:

Technical View:

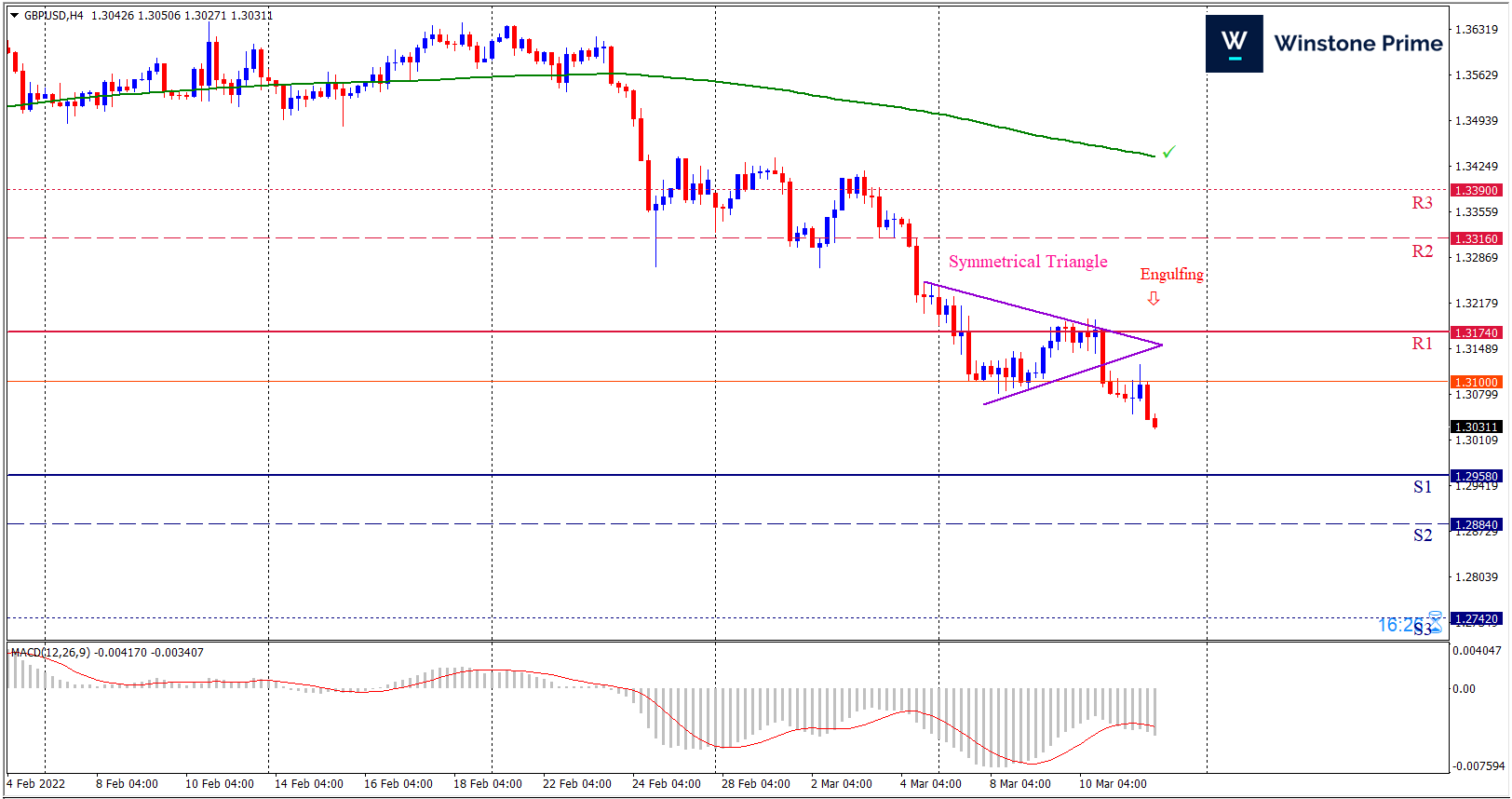

Last week’s high was 1.44% lower than the previous week. Maintaining high at 1.3243 and low at 1.3027 showed a movement of 216 pips.

In the upcoming week we expect GBP/USD to show a bearish trend. The currency pair is trading below the 200 Simple Moving Average and the MACD trades to the downside. Should 1.2958 proves to be unreliable support then the pair may fall further to 1.2884 and 1.2742 respectively whereas a solid breakout above 1.3174 will open a clear path upward to 1.3316 and then will further raise up to 1.3390. Chart formation of symmetrical triangle breakout downside in H4 chart favors prospects of a bearish trend. Bearish engulfing pattern formation escalates the expectation for a bearish trend.

| Preference |

| Sell: 1.3031 target at 1.2822 and stop loss at 1.3179 |

| Alternate Scenario |

| Buy: 1.3179 target at 1.3389 and stop loss at 1.3031 |