Fundamental view:

The British pound stayed on front foot against the greenback during the trading course of the week. Hotter UK inflation and dovish Fed were the major catalysts in driving the quote, Russia-Ukraine crisis that dominated all through the week on financial market had less impact the cable. UK annual inflation rate arrived at 5.5% which is a fresh 30-year high. Market rushed to an aggressive BOE rate hike expectation in the year ahead. On the other hand, US Federal Reserve officials are giving clues at upcoming rate hikes. The Federal Reserve released Minutes of the latest FOMC meeting on Wednesday, and the document portrayed that the policymakers are ready to rate hike and preparing for plans to reduce the balance sheet. However, Market expectation was not meet as voting members maintained a measured approach to monetary policy tightening.

Whereas Russia – Ukraine headlines dominated throughout the week while on Friday, Ukrainian military and rebels fired grenades and mortars in four Luhansk People’s Republic (LPR) localities, which are in the war-torn Donbass region. Risk off sentiment intensified on the the US’s warnings over a potential Russian incursion of Ukraine, which capped the Pound bulls. Amidst the Russia-Ukraine conflict, looming Brexit concerns took a back seat, as geopolitics led the way.

In this week, US PPI monthly report on 15th February and US Building Permits on 17th February boosted downtrend whereas UK Claimant Count Change on 15th February and UK CPI monthly report and EIA Crude Oil Stocks Change on 16th February boosted uptrend for the pair.

The major economic events deciding the movement of the pair in the next week are UK Markit/CIPS Manufacturing PMI, Fed Governor Bowman Speech at Feb 21, BoE Deputy Governor Markets and Banking Ramsden Speech, US CB Consumer Confidence Index at Feb 22, US GDP quarterly report, Initial Jobless Claims, EIA Crude Oil Stocks Change at Feb 24, US Core Durable Goods Orders monthly report and Michigan Consumer Sentiment at Feb 25.

GBP/USD Weekly outlook:

Technical View:

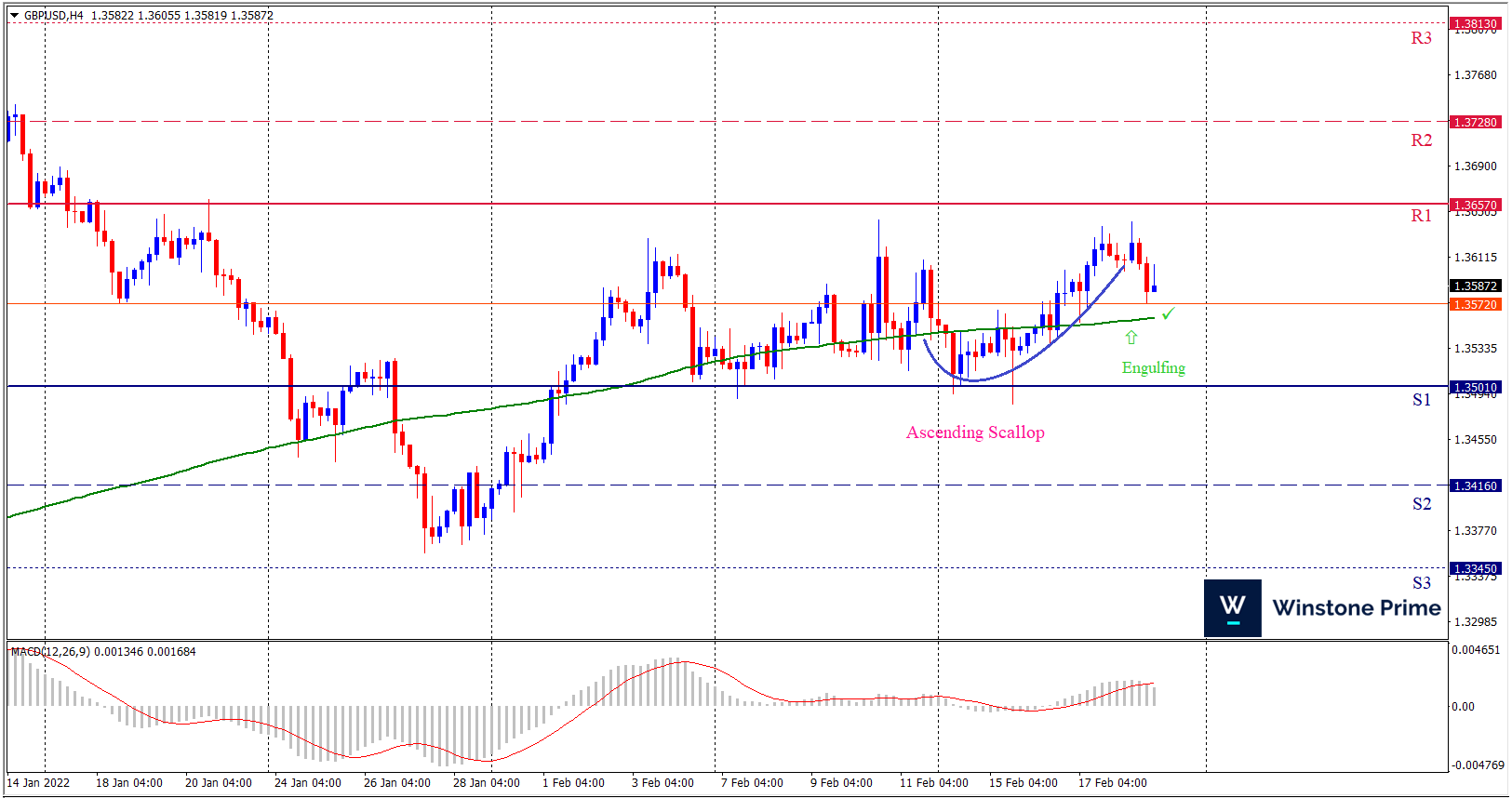

Last week’s high was 0.01% lower than the previous week. Maintaining high at 1.3642 and low at 1.3486 showed a movement of 156 pips.

In the upcoming week we expect GBP/USD to show a bullish trend. The currency pair is trading above the 200 Simple Moving Average and the MACD trades to the upside. A solid breakout above 1.3657 may open a clean path towards 1.3728 and may take a way up to 1.3813. Should 1.3501 prove to be unreliable support, the GBPUSD may sink downwards 1.3416 and 1.3345 respectively. Chart formation of ascending scallop pattern in H4 chart favors prospects of a bullish trend. Bullish engulfing pattern formation escalates the expectation for a bullish trend.

| Preference |

| Buy: 1.3587 target at 1.3727 and stop loss at 1.3496 |

| Alternate Scenario |

| Sell: 1.3496 target at 1.3346 and stop loss at 1.3587 |