Fundamental view:

Cable managed to portray a uptrend after 3 weeks of downtrend, despite a cautious Bank of England (BOE) rate hike. Ukraine crisis dominated the financial markets, but it did not show any peace talks progress. However, during the first half, Optimism over a probable truce between the two gave sigh of relief to risk-sensitive currencies such as the British pound. Market sentiment became sour on Thursday after officials from both sides reported no significant progress on the negotiations. US Secretary of State Antony Blinken said that Russia may be contemplating a chemical-weapons attack late Thursday. Traders also turned cautious, as US President Joe Biden met with his Chinese counterpart Xi Jinping on Friday to discuss Ukraine.

US Federal Reserve monetary policy decision also acted as a major catalyst in driving the market which helped the US dollar. The Fed has increased fund rate by 25 basis points to 0.50% for the first time since 2018 and meet the market expectation. On the other hand, The British central bank raised rates by 0.25% for the third straight meeting, although remained hesitant in signaling the future policy path amidst Ukrainian uncertainty and its risks to the country’s growth.

In this week, US PPI monthly report on 15th March and US Retail Sales monthly report on 16th March boosted bearish trend whereas UK Claimant Count Change on 15th March and US Building Permits on 17th March boosted bullish trend for the pair.

The major economic events deciding the movement of the pair in the next week are Fed Chair Powell Speech at Mar 21, UK Spring Forecast Statement, EIA Crude Oil Stocks Change at Mar 23, BoE FPC Meeting Minutes, US Core Durable Goods Orders monthly report, Initial Jobless Claims at Mar 24, UK Retail Sales monthly report, Michigan Consumer Sentiment and Fed Governor Waller Speech at Mar 25.

GBP/USD Weekly outlook:

Technical View:

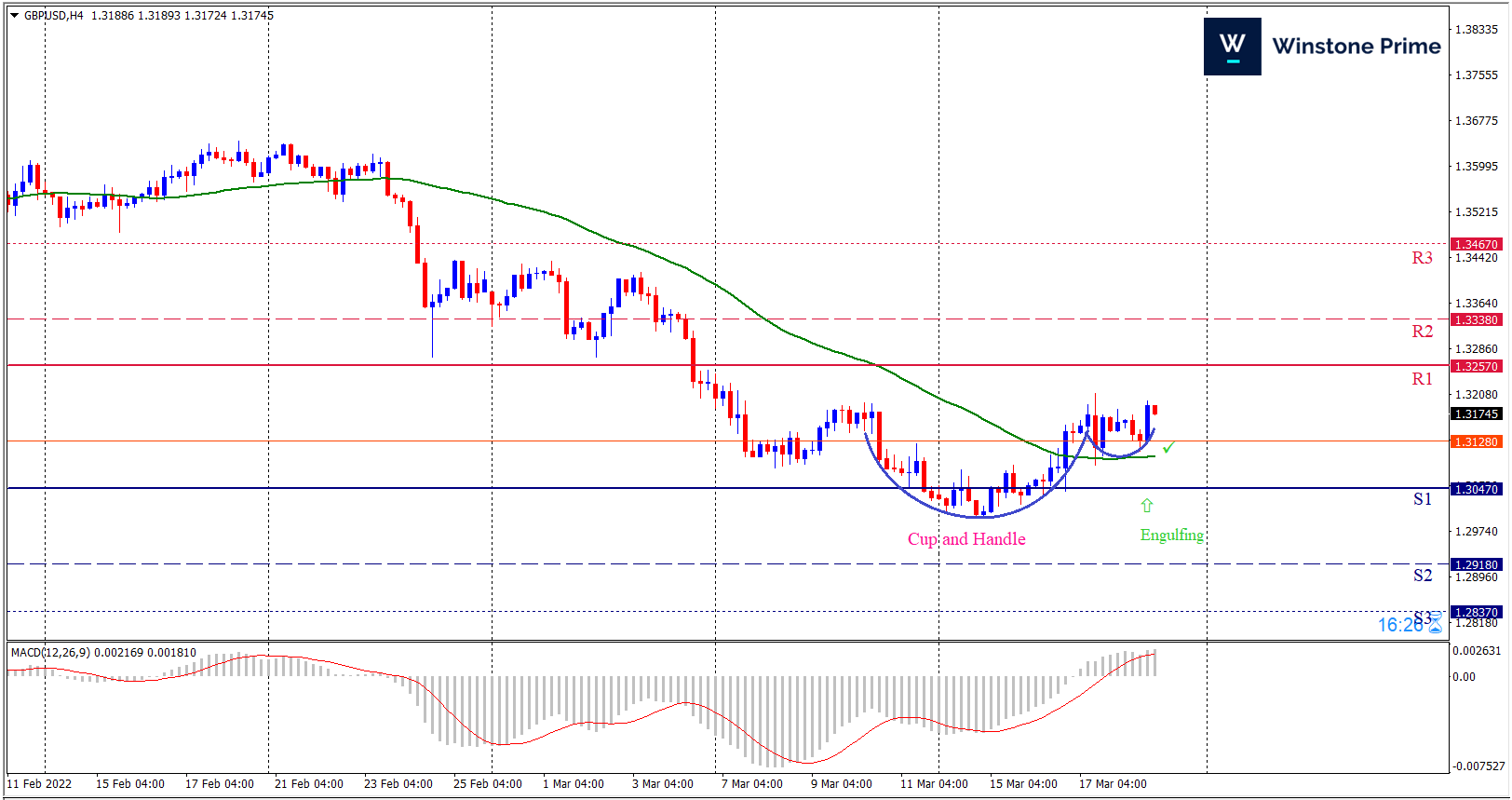

Last week’s high was 0.25% lower than the previous week. Maintaining high at 1.3210 and low at 1.3000 showed a movement of 210 pips.

In the upcoming week we expect GBP/USD to show a bullish trend. The currency pair is trading above the 50 Simple Moving Average and the MACD trades to the upside. A solid breakout above 1.3257 may open a clean path towards 1.3338 and may take a way up to 1.3467. Should 1.3047 prove to be unreliable support, the GBPUSD may sink downwards 1.2918 and 1.2837 respectively. Chart formation of cup and handle pattern in H4 chart favors prospects of a bullish trend. Bullish engulfing pattern formation escalates the expectation for a bullish trend.

| Preference |

| Buy: 1.3171 target at 1.3377 and stop loss at 1.3042 |

| Alternate Scenario |

| Sell: 1.3042 target at 1.2838 and stop loss at 1.3171 |