Fundamental view:

The British pound dropped heavily against its US counterpart during this week. The risk off market mood and the Fed-BoE monetary policy divergence were the market movers of the week. A lack of progress on the Russia-Ukraine diplomacy front weighed on the investors sentiment favoring safe-haven dollar. Meanwhile hawkish fed also underpinned the bullish trend of USD. Market Participants has priced a 70% chance of double-dose Fed rate hikes in May and June after US inflation soared to a four-decade high of 8.5% in March. And St. Louis Fed President James Bullard made a case for a 75 bps rate hike if needed. Fed Jerome Powell endorsed front-loading rate hikes, confirming a 50 bps lift-off in May.

On the other hand, BOE Governor Andrew Bailey also spoke at an event on Thursday and expressed his concerns over a slowdown in UK economic growth. The monetary policy divergence between Fed and BOE also weighed on the cable.

In this week, US Building Permits on 19th April and US Initial Jobless claims on 21st April underpinned bullish trend whereas Fed Powell speech on 21st April and UK GfK Consumer Confidence and UK Retail Sales monthly report on 22nd April underpinned bearish trend for the pair.

The major economic events deciding the movement of the pair in the next week are BoE Deputy Governor for Prudential Regulation Woods Speech, US Core Durable Goods Orders monthly report, US CB Consumer Confidence Index at Apr 26, UK Nationwide HPI yearly report at Apr 27, US GDP quarterly report, US Initial Jobless Claims at Apr 28, US Employment Cost Index quarterly report and Michigan Consumer Sentiment at Apr 29.

GBP/USD Weekly outlook:

Technical View:

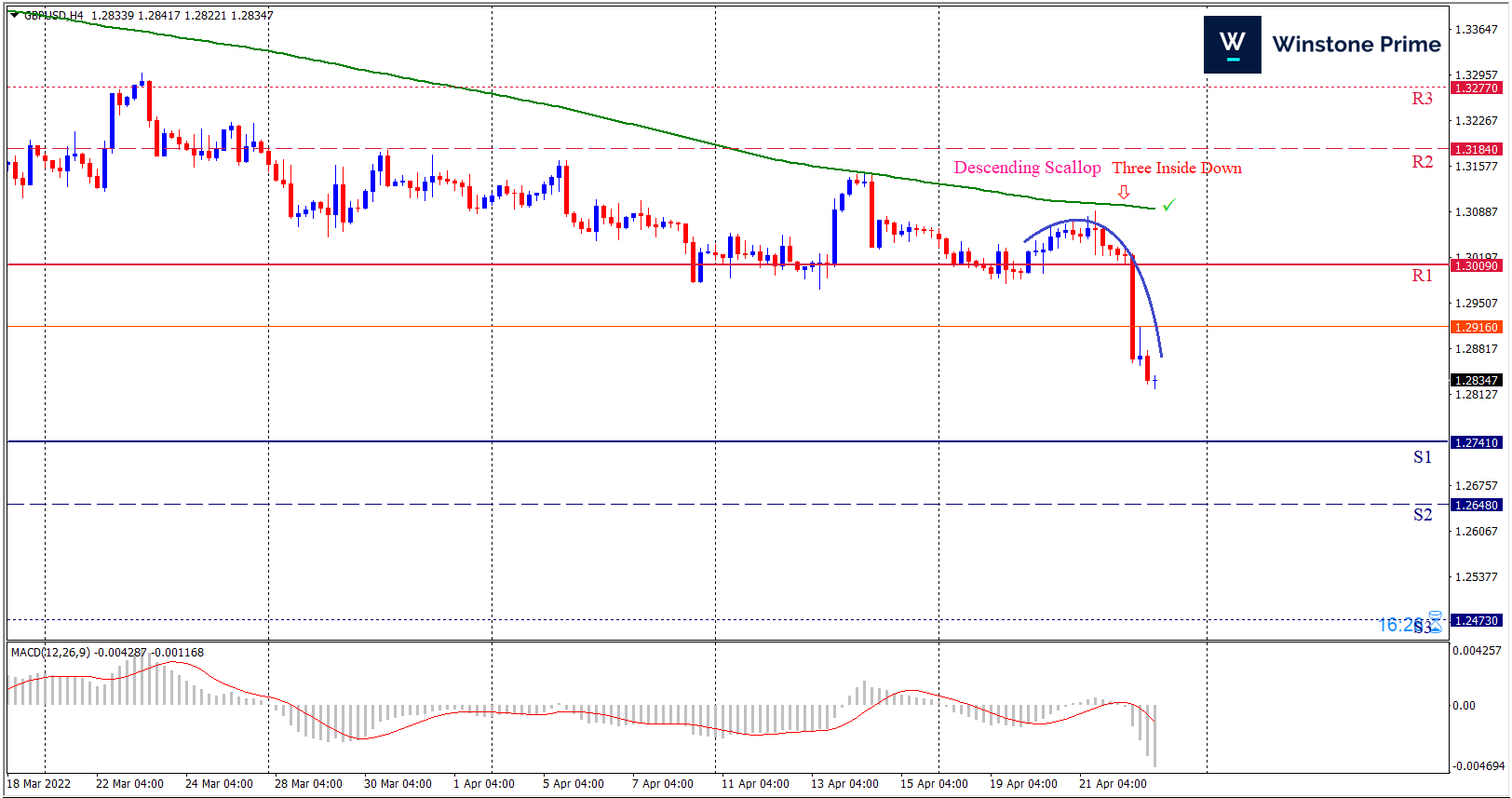

Last week’s high was 0.43% lower than the previous week. Maintaining high at 1.3090 and low at 1.2822 showed a movement of 268 pips.

In the upcoming week we expect GBP/USD to show a bearish trend. The currency pair is trading below the 200 Simple Moving Average and the MACD trades to the downside. Should 1.2741 proves to be unreliable support then the pair may fall further to 1.2648 and 1.2473 respectively whereas a solid breakout above 1.3009 will open a clear path upward to 1.3184 and then will further raise up to 1.3277. Chart formation of descending scallop pattern in H4 chart favors prospects of a bearish trend. Three Inside down pattern formation escalates the expectation for a bearish trend.

| Preference |

| Sell: 1.2835 target at 1.2591 and stop loss at 1.3014 |

| Alternate Scenario |

| Buy: 1.3014 target at 1.3276 and stop loss at 1.2835 |