Fundamental view:

Pound had a drop against greenback after three-week bullish trend amid a geopolitical storm in Ukraine. Hawkish Bank of England (BOE) expectations due to hotter UK inflation favored the pound to maintain the bullish trend in the first three weeks of February but it gave up towards the month end, as Russia invaded Ukraine. According to US intelligence, the main goal is to depose Ukrainian President Volodymyr Zelenskyy and impose a leader favorable to the Russian regime. Hawkish speech from Fed policymakers also favored the US dollar and weighed on the pound. The Hawkish comment from Atlanta Fed President and FOMC member Raphael Bostic and Richmond Fed President, as well as an FOMC member, Thomas Barkin underpinned the bullish move of the US dollar Even though Cleveland Fed President Loretta Mester said that she doesn’t think raising interest rates by 50 bps in March is compelling. Meanwhile, Market is waiting to taking clues from BOE speech next week.

In this week, UK Markit/CIPS Manufacturing PMI on 21st February, US Markit Manufacturing PMI on 22nd February and EIA Crude Oil Stocks Change on 24th February framed bullish trend whereas Fed Governor Bowman Speech on 21st February and US GDP quarterly report on 24th February framed bearish trend for the pair.

The major economic events deciding the movement of the pair in the next week are UK Markit/CIPS Manufacturing PMI, US ISM Manufacturing PMI at Mar 01, BoE Deputy Governor Financial Stability Cunliffe Speech, US ADP Nonfarm Employment Change, Fed Chair Powell Testimony at Mar 02, Initial Jobless Claims, US ISM Non-Manufacturing PMI at Mar 03 and US Nonfarm Payrolls at Mar 04.

GBP/USD Weekly outlook:

Technical View:

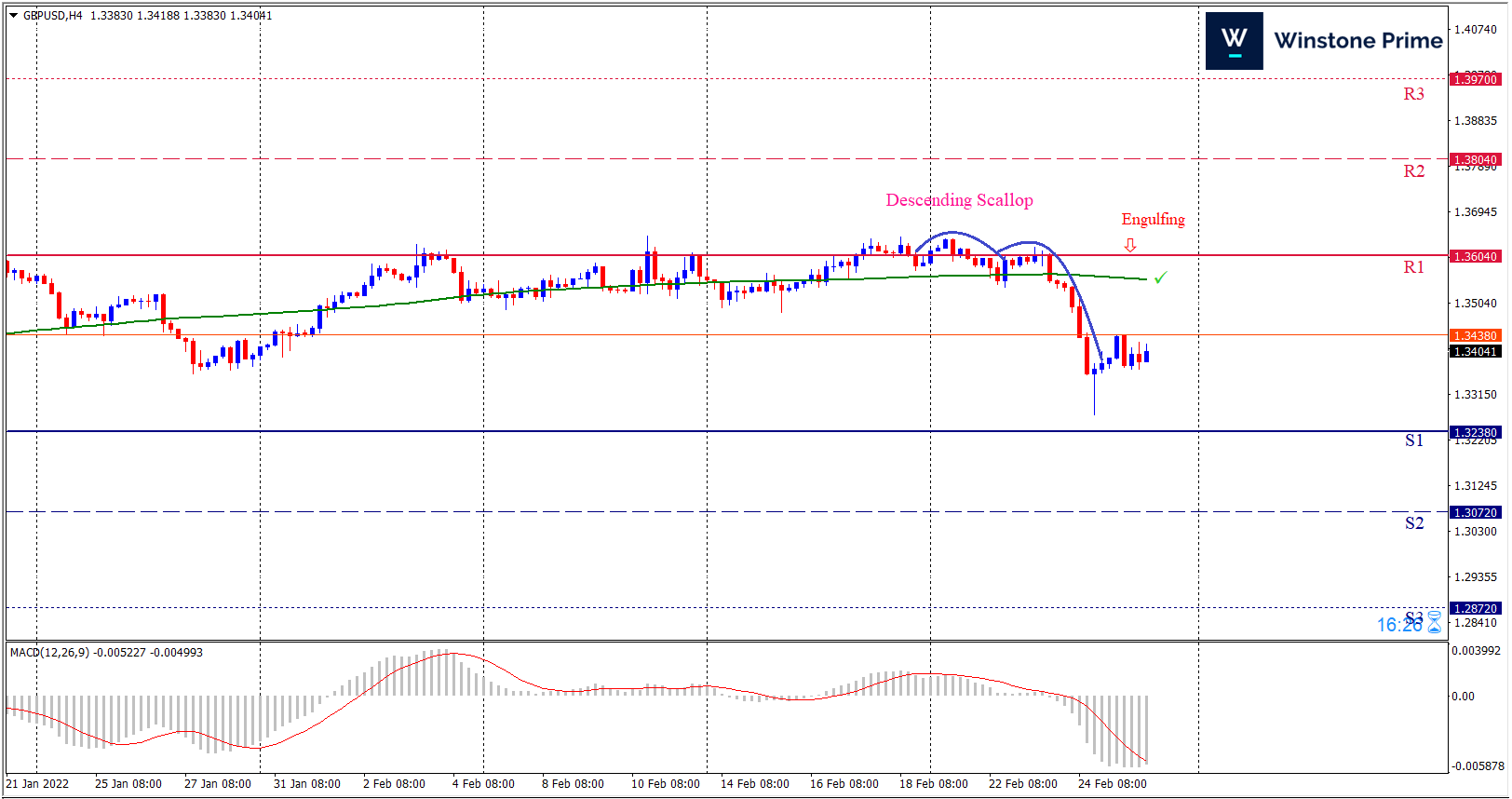

Last week’s high was 0.03% lower than the previous week. Maintaining high at 1.3638 and low at 1.3272 showed a movement of 366 pips.

In the upcoming week we expect GBP/USD to show a bearish trend. The currency pair is trading below the 200 Simple Moving Average and the MACD trades to the downside. Should 1.3238 proves to be unreliable support then the pair may fall further to 1.3072 and 1.2872 respectively whereas a solid breakout above 1.3604 will open a clear path upward to 1.3804 and then will further raise up to 1.3970. Chart formation of descending scallop pattern in H4 chart favors prospects of a bearish trend. Bearish engulfing pattern formation escalates the expectation for a bearish trend.

| Preference |

| Sell: 1.3401 target at 1.3073 and stop loss at 1.3609 |

| Alternate Scenario |

| Buy: 1.3609 target at 1.3965 and stop loss at 1.3401 |