Fundamental view:

The British pound gained for the second consecutive week against the greenback, However it is far less than 1.3300 (its 3 week high). The hawkish stance of Fed policymakers weighed on the pound. US Federal Reserve Chair Jerome Powell aggressive speech helped the dollar. Speaking about the economic outlook at the National Association for Business Economics Annual Economic Policy Conference, he said “inflation is much too high” and that the central bank will respond accordingly. A slew of Fed members along with Powell favored the 50bps hike and has noted they would support such a move as soon as May. He noted that their plans to reduce the balance sheet would likely be completed by the next meeting, although he did not clarify when they would start shrinking it. The BOE had already turned cautious at its March policy announcement due to the negative impact of higher inflation on economic activity. The monetary policy divergence between the Fed and the BOE came into play and weighed heavily on cable.

Meanwhile, the dollar was strengthened by the invitation of Ukrainian President Volodymyr Zelenskyy to address a NATO summit scheduled for Thursday but sterling remained resilient amid markets’ optimism over the Russia-Ukraine conflict. Further, Zelenskyy said they are prepared to discuss NATO membership and the post-ceasefire status of Crimea and Donbas.

In this week, US Initial Jobless Claims on 24th March and UK GfK Consumer Confidence on 25th March favored bearish trend whereas UK PPI Input monthly report on 23rd March and US Pending Home Sales monthly report on 25th March favored bullish trend for the pair.

The major economic events deciding the movement of the pair in the next week are BoE Governor Bailey Speech, US Goods Trade Balance at Mar 28, US CB Consumer Confidence Index at Mar 29, US ADP Nonfarm Employment Change, US GDP quarterly report at Mar 30, UK GDP quarterly report, US Initial Jobless Claims at Mar 31 and US Nonfarm Payrolls at Apr 01.

GBP/USD Weekly outlook:

Technical View:

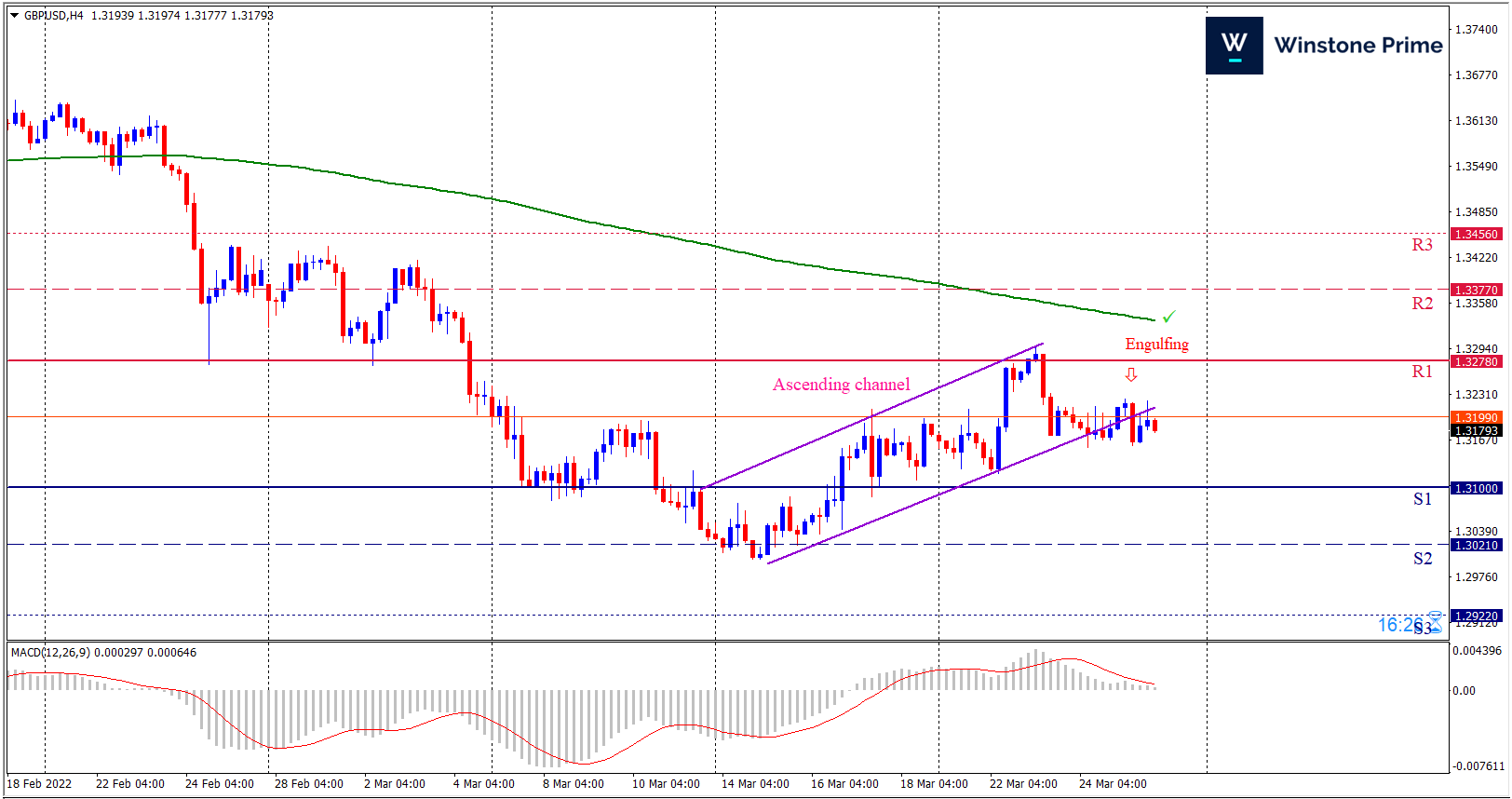

Last week’s high was 0.67% higher than the previous week. Maintaining high at 1.3298 and low at 1.3120 showed a movement of 178 pips.

In the upcoming week we expect GBP/USD to show a bearish trend. The currency pair is trading below the 200 Simple Moving Average and the MACD trades to the downside. Should 1.3100 proves to be unreliable support then the pair may fall further to 1.3021 and 1.2922 respectively whereas a solid breakout above 1.3278 will open a clear path upward to 1.3377 and then will further raise up to 1.3456. In H4 chart ascending channel pattern breakout downside favors prospects of a bearish trend. Also to be noted Bearish engulfing formation exerts the expectation of downtrend for the pair.

| Preference |

| Sell: 1.3175 target at 1.3022 and stop loss at 1.3282 |

| Alternate Scenario |

| Buy: 1.3282 target at 1.3455 and stop loss at 1.3175 |