Fundamental view:

The British pound started this week with a bearish trend as greenback continued to gain strength due to rising US Treasury bond yields. But ahead of the weekend, the risk aversion market sentiment led to a sharp drop in yields and helping the pound to erase a small portion of its weekly losses. Bank of England (BoE) policymakers are concerned about wage inflation and reassess the need to hike the policy rate by 20 basis points in December. BoE Monetary Policy Committee (MPC) member Silvana Tenreyro said on Wednesday that she does not want to say specifically if the BoE would make its first rate hike in either December or February. She further added that she was expecting a “modest tightening policy.” Moving to Brexit, According to post brexit negotiations, both sides are not expecting to come to a conclusion before the end of the year. On the Friday, escalating fears over the new coronavirus variant slowing down the global economic recovery caused safe-haven flows to dominate the financial markets and thus causing a risk aversion sentiment.

US Existing Home Sales on 22nd November and US Markit Services PMI on 23rd November created uptrend whereas US Markit Manufacturing PMI on 23rd November and US Core Durable Goods Orders monthly report on 24th November created downtrend for the pair in this week.

The major economic events deciding the movement of the pair in the next week are BoE Consumer Credit monthly report, Fed Chair Powell Speech at Nov 29, US CB Consumer Confidence Index at Nov 30, UK Markit/CIPS Manufacturing PMI, US ADP Nonfarm Employment Change, ISM Manufacturing PMI, EIA Crude Oil Stocks Change at Dec 01 and Nonfarm Payrolls at Dec 03.

GBP/USD Weekly outlook:

Technical View:

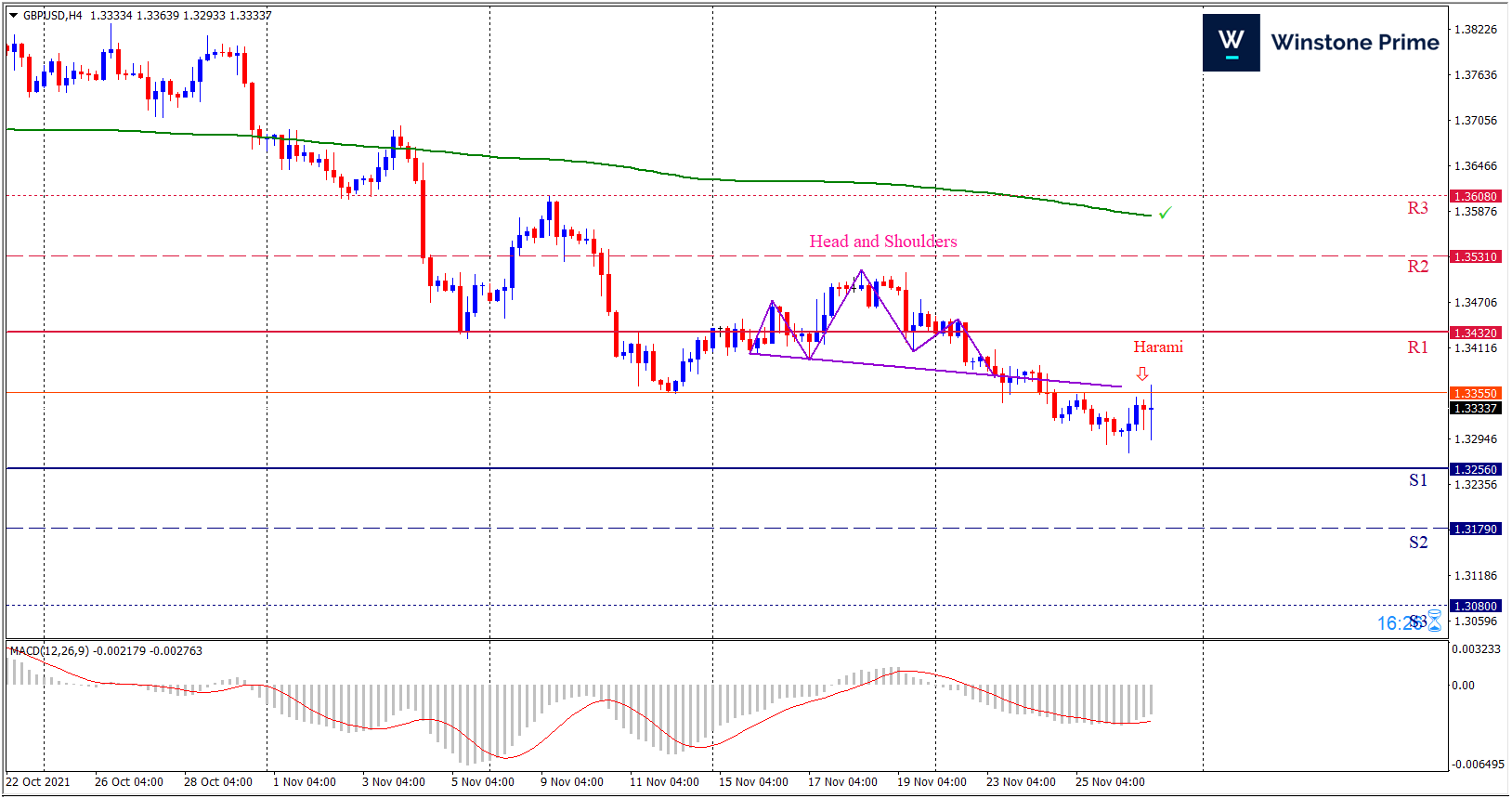

Last week’s high was 0.45% lower than the previous week. Maintaining high at 1.3453 and low at 1.3277 showed a movement of 176 pips.

In the upcoming week we expect GBP/USD to show a bearish trend. The currency pair is trading below the 200 Simple Moving Average and the MACD trades to the downside. A firm breakout below 1.3256 may make a fall to 1.3179 and then further fall to 1.3080. Should 1.3432 prove to be unreliable resistance, the GBPUSD may raise upwards 1.3531 and 1.3608 respectively. Chart formation of head and shoulders pattern breakout in H4 chart favors prospects of a bearish trend. Bearish harami pattern formation escalates the expectation for a bearish trend.

| Preference |

| Sell: 1.3333 target at 1.3180 and stop loss at 1.3437 |

| Alternate Scenario |

| Buy: 1.3437 target at 1.3607 and stop loss at 1.3333 |